Reason For Bitcoin’s Dump? Miners Realize Profits Since BTC Hit $42K

Bitcoin has been in somewhat of a slump over the past few days as the price doesn’t seem to be able to kick-off and reclaim the previous highs.

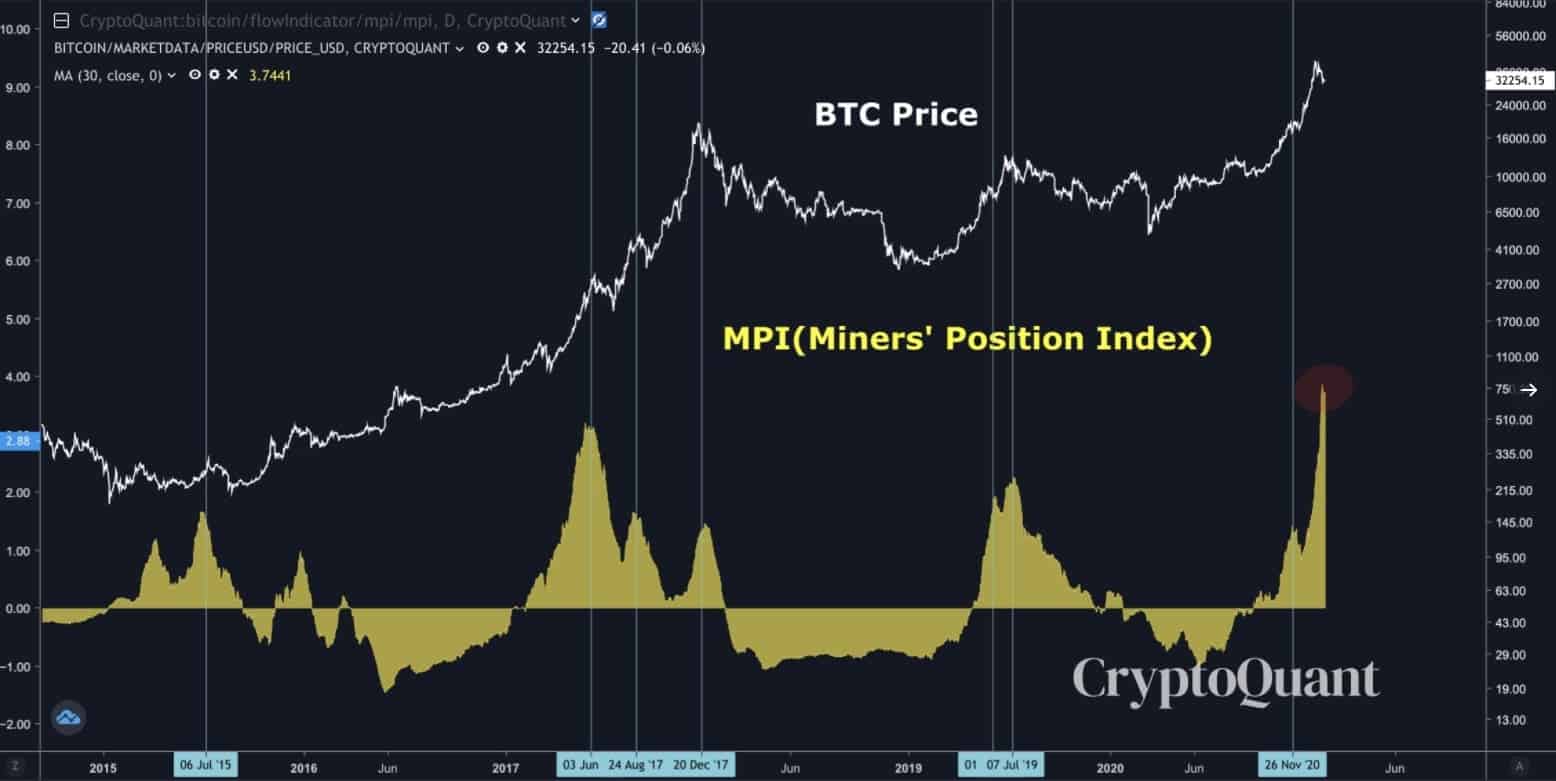

One possible reason for this could be the fact that bitcoin miners have been realizing profits since the price hit its all-time high at $42,000, according to the CEO of cryptocurrency analytics company CryptoQuant. Data also shows that there are many investors sitting on the sidelines, waiting for a clearer market direction.

Bitcoin in a Slump as Price Fails to Recover

Things are not looking very good for Bitcoin’s price at this point in time. It appears that its dollar value is unable to recover. The cryptocurrency crashed on January 21nd, dipping below $30K and even though it attempted to reclaim some of the previous resistance levels, it doesn’t seem able right now.

One possible reason for this could be the fact that BTC miners have been realizing profits ever since the cryptocurrency reached its ATH at $42,000. That’s according to the CEO of CryptoQuant – a crypto analytics company.

Speaking on the matter, Ki Young Ju said:

BTC Miners’ Position Index hit the 8-year high.

They’ve been moving an unusual amount of Bitcoins lately. It seems they’re continuously realizing profits since 42K.

This is one of the reasons why I keep my bearish bias.

Indeed, looking at the above chart, we can see that the index is at a high that we didn’t even see when Bitcoin had its parabolic run back in 2017.

People Sitting on the Sidelines

On another note, it also appears that the amount of stablecoins sitting on exchanges right now is at an all-time high. According to CryptoQuant, there’s around $4.16 billion in stablecoins that’s on the sidelines.

All #Stablecoins reserve for all exchanges just hit the all-time high.

Chart 👉 https://t.co/o6brPZy1eI pic.twitter.com/JsSygVyU8L

— CryptoQuant.com (@cryptoquant_com) January 26, 2021

As CryptoPotato reported earlier today, this was yet another black Monday on the cryptocurrency market as almost all large-cap coins are painted in red. When it comes to Bitcoin, the first level of resistance at the current rate lies at around $32,500, followed by the bearish .382 Fibonacci level of $33,100. On the other hand, if the price starts to trend towards the downside, the first level of support would be $31,000.