Radix’s XRD Token Beats Wider Crypto Market With 176% Surge in a Month

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Decentralized finance (DeFi)-focused distributed ledger Radix’s XRD token has more than doubled in the past 30 days, becoming the best-performing top 100 cryptocurrency.

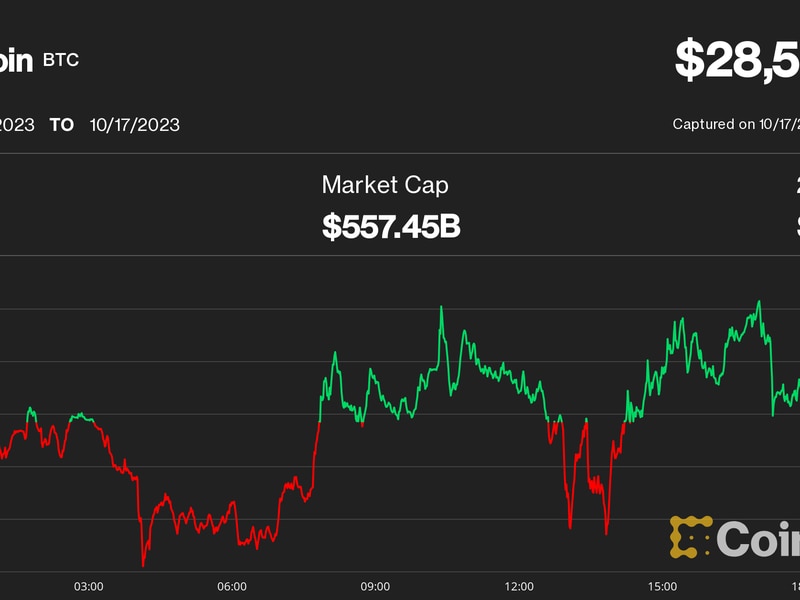

XRD has rallied by 176% to $0.114, with the price reaching a 12-month high of $0.15 at one point, Messari data show. The rally has lifted the cryptocurrency’s market capitalization to $1.16 billion, making it the 46th largest coin in the market. In four weeks, market leaders bitcoin (BTC) and ether (ETH) have gained 2.6% and 8.2%, respectively, while the total crypto market capitalization has increased 5% to $1.18 trillion.

Radix’s March fundraising, led by market maker and investment firm DWF Labs, and optimism about an impending upgrade seem to have galvanized investor interest in the token, according to Markus Thielen, head of research and strategy at Matrixport. The financing round gave Radix a valuation of $400 million.

“Radix raised $10m in funding ahead of the launch of its Babylon mainnet scheduled for July 31, which will introduce smart-contract functionality on the network,” Thielen said in an email.

XRD rallied over 15% March 23, when the fundraising was announced, and began a near-vertical rise a week later after Radix rolled out the “Release Candidate” network (RCNet), bringing the highly-anticipated upgrade from Olympia to Babylon a step closer.

The upgrade will introduce smart-contract capabilities to Radix, allowing developers to create powerful decentralized applications. As of last month, Radix had over 50 projects developing applications and tools for gaming, trading, lending, NFTs, and wallets.

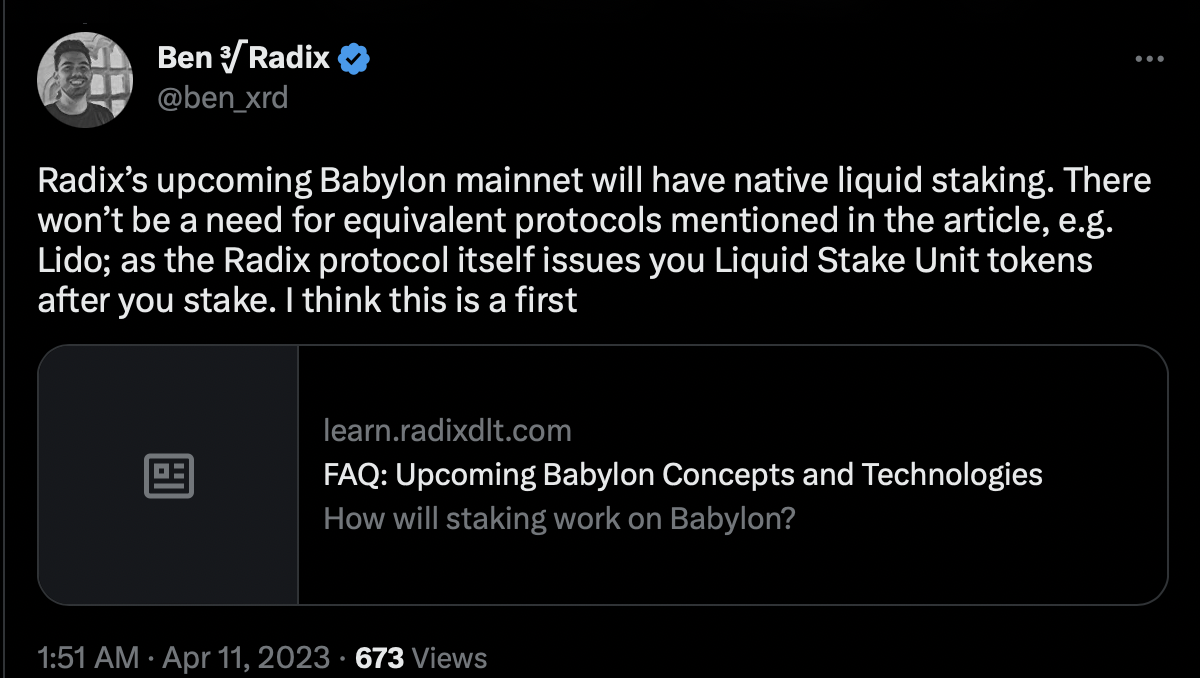

Babylon will natively support liquid staking of XRD, eliminating the need for separate protocols like Lido, which help ether stakers retain the liquidity of their coins by issuing staked ether tokens. Staking refers to locking coins in the blockchain to boost network security in return for rewards.

(Twitter)

“The Radix Public Network upgrade from Olympia to Babylon will occur on or about July 31st, 2023, paving the way for global Web3 and DeFi to finally exit the ‘tech demo’ stage with a mainstream-capable user and developer experience,” Radix said in an official announcement.

Edited by Sheldon Reback.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.