Public Bitcoin Miners Are Increasing Hash Rates, BTC Holdings

Last month, the top public bitcoin miners increased their hash rates and bitcoin holdings.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

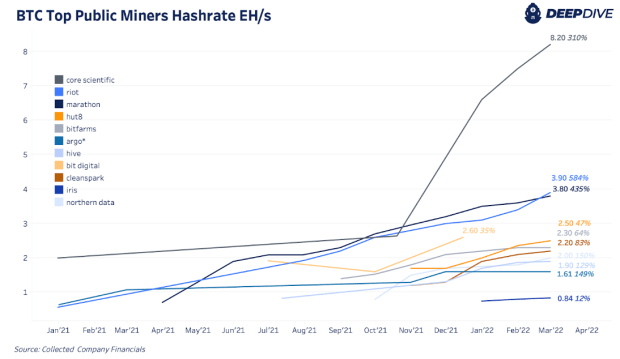

Although our focus has largely been on the current macro picture, bitcoin miners continue to operate like normal, producing blocks every 10 minutes. Over February 2022, the top public miners increased their hash rate and bitcoin holdings but produced less bitcoin compared to January.

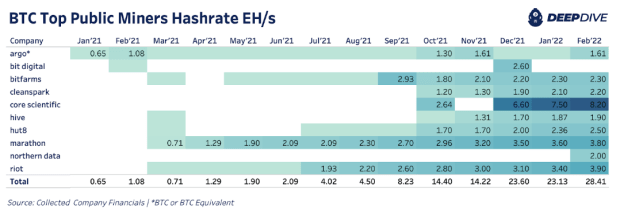

Almost all of the miners with available public data increased their hash rate last month with aggregate hash rate reaching 28.41 EH/s. If we include previous reporting numbers for Bit Digital, hash rate reached 31.01 EH/s across the below group of 11 public bitcoin miners. We’ve added CleanSpark, Northern Data and Iris Energy since our last miner update, The Daily Dive #145 – Public Miners January Update.

Core Scientific still makes up the lion’s share of hash rate with over 26% at 8.2 EH/s. That figure only includes their self-mining hash rate and doesn’t count their 7.7 EH/s in hosted hash rate capacity offered as a service to other miners. Across both their self-mining and hosting hash rate, they plan to reach 40–42 EH/s by the end of the year with Mike Levitt, CEO saying,

“We believe that we are well positioned to achieve 40 to 42 EH/s of total hashrate by year end 2022, distributed approximately evenly between our self-mining and hosting segments. Demand for our hosting capacity remains strong and continues to exceed our available supply. Our construction and power team is on pace to achieve 1.2 to 1.3 GW of operating infrastructure by year end to continue expanding our hosting and self-mining capacity.”

In this scenario, Core Scientific is implying their hash rate will grow another 164% this year.

Bitcoin holdings increased nearly 10% in February to 39,429 BTC just shy of 40,000. Marathon still holds the most bitcoin in their treasury across top miners. With Core Scientific, both miners have 16,291 BTC (roughly $635 million equivalent) and make up approximately 41% of all public miner bitcoin holdings.