Protocol Village: Civic to Verify Driver IDs for Web3 Car-Rental Platform Rentality, on Base Chain

Thursday, Sept. 19

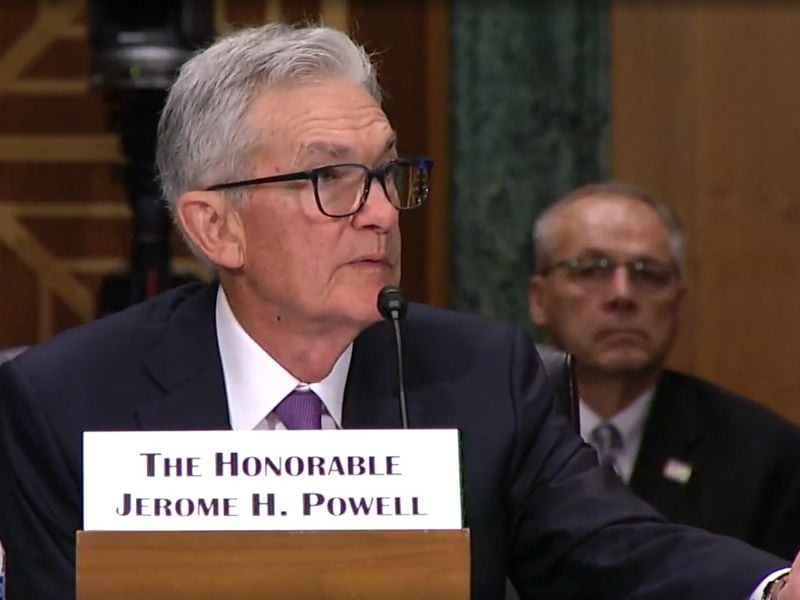

Civic’s ID Solution to Verify Drivers’ Licenses, Ages on Web3 Car-Rental Platform Rentality

Civic, developer of a tokenized identity solution on the verifiable web, has partnered with Rentality, described as the first Web3 car rental platform, “to securely verify drivers’ licenses and enforce age minimums on the Base network.” According to the team: “Using Civic’s ID Verification Pass, users can verify licenses virtually, streamlining the car rental process. This solution enhances security, trust and compliance in car rentals and peer-to-peer marketplaces by eliminating the need for physical verification and reducing friction in the transaction, setting a new standard for secure rentals.”

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OHZAS6LZD5FIPIEAPO7C6YZCQE.png)

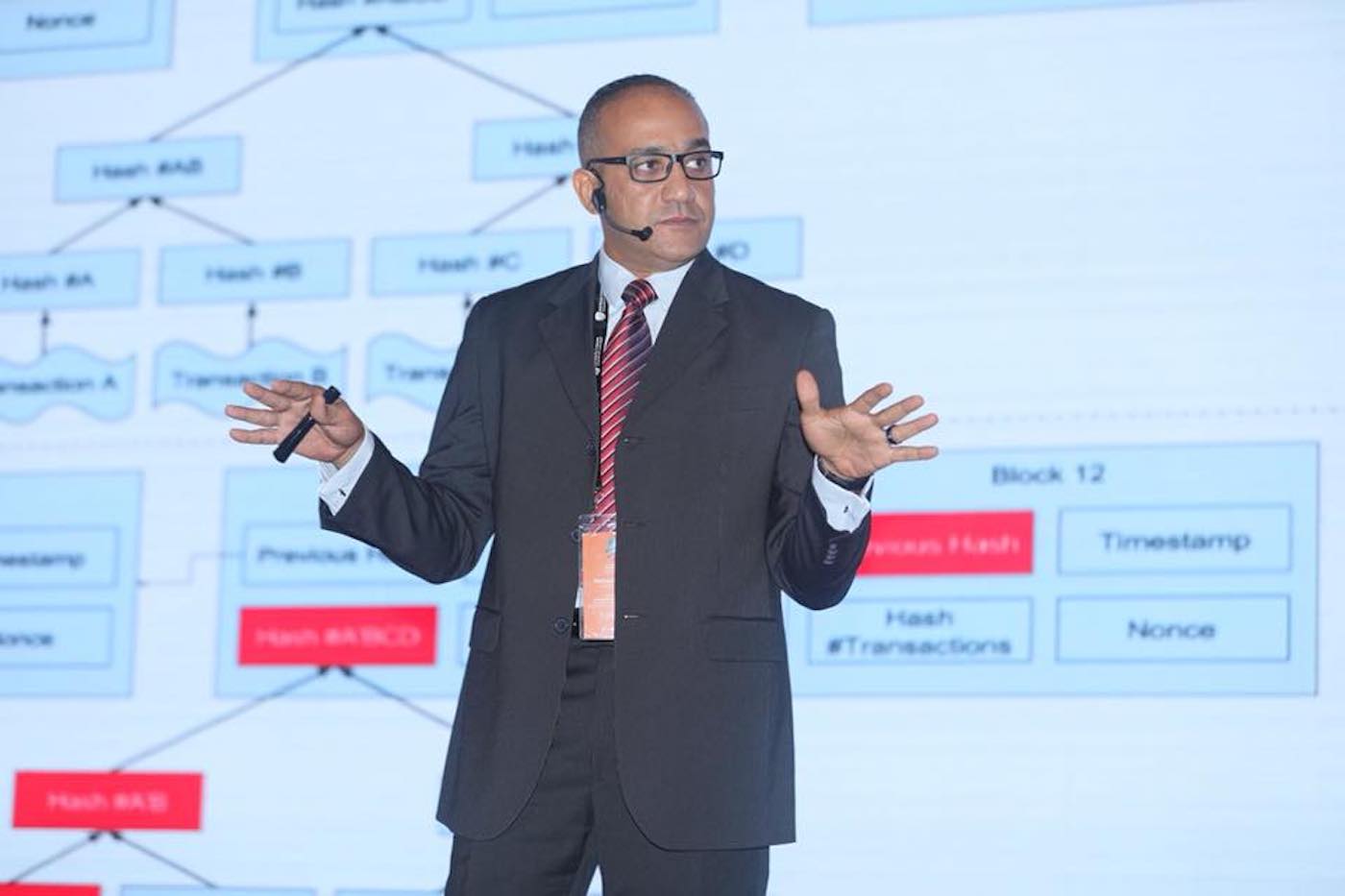

Chromia Blockchain Plans ‘Asgard’ Mainnet Upgrade for Customized Chains, Plans $20M Data and AI Ecosystem Fund

Chromia, a blockchain ecosystem that aims to avoid network congestion partly by giving every decentralized app (dapp) its own cluster of nodes and computational resources, announced the upcoming “Asgard” mainnet upgrade on the TOKEN2049 stage, along with a $20 million Data and AI Ecosystem Fund. According to the team: “The fund is aimed at supporting data-intensive projects and AI-enabled applications. Asgard, scheduled for Q4 2024, will introduce ‘Extensions’ – customized chains designed to bring new functionalities to the platform such as oracles, computation for AI models, support for data availability and ZK proofs.”

Oasis Network Launches Liquid Staking With Accumulated Finance

Oasis Network, designed to be a scalable, privacy-first and versatile layer-1 blockchain, has launched liquid staking in partnership with Accumulated Finance, according to the team: “ROSE token holders can now stake their assets while keeping them liquid for trading or use in DeFi applications. This new feature, powered by the Oasis Sapphire ecosystem, provides stROSE, a liquid staking token, allowing users to earn rewards and engage with decentralized apps. Improvements include boosted staking APR and a reduced unbonding period.” Users no longer have a 14-day unbonding period when converting staked ROSE to unstaked ROSE, a blog post reads.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/227Y5S7RKRFSFAVUHYK372HBLM.png)

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here.

Edited by Bradley Keoun.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/f22b7b33-3453-471b-9db5-9f17af90a499.png)

Bradley Keoun is the managing editor of CoinDesk’s Tech & Protocols team. He owns less than $1,000 each of several cryptocurrencies.

Follow @Liqquidity on Twitter