Protests In Hong Kong, Iran and Lebanon Worsen: Possible Impact On Bitcoin’s Price?

After months of protests in Hong Kong, politicians have reportedly decided to shut down a bank account related to the anti-extradition law movement. Additionally, a bank in Iran was recently set on fire, and people in Lebanon still have trouble accessing their savings. With raging protests around the globe, it’s interesting to see if Bitcoin’s price will be somewhat affected.

HSBC Bans a Bank Account Supporting Protests

Earlier this year, China proposed a new bill that would allow Hong Kong citizens to be extradited to the mainland. It sparked a wave of protests, and the law was finally placed “on hold.” However, demonstrations continue and they see serious support from different crowdfunding groups.

The reaction didn’t take long, and local news report shows that HSBC bank has banned a corporate account in their system, which is allegedly related to the protests. According to undisclosed sources, the bank has linked transactions to this account with crowdfunding activities associated with the demonstrations. As such, it has terminated the account, giving a 30-days notice set to expire this week. As per the notification, the actual use of the account didn’t match its original purpose from back when it was first opened.

The protests in Hong Kong may have started against the extradition bill, but they escalated and also touched upon a pressing issue in the country – surveillance and the lack of privacy. People avoided using their prepaid e-payment cards because they felt they were monitored. Consequently, 10% of all ATMs in Hong Kong were destroyed on a weekend, and 5% were out of cash.

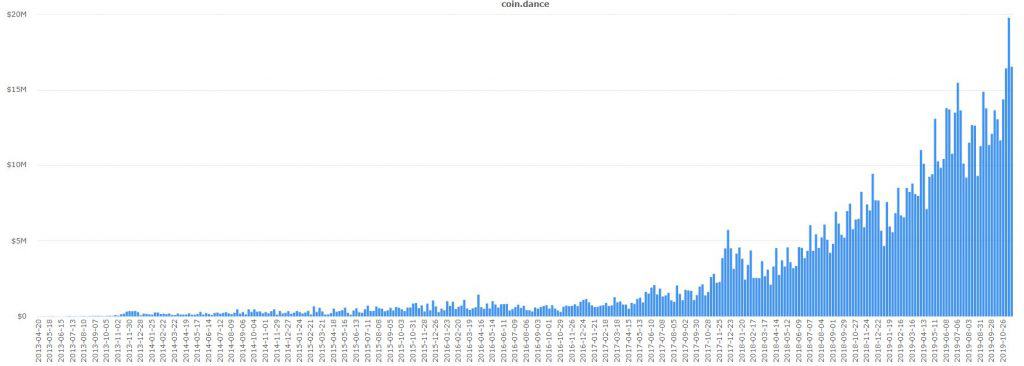

Amid all this, Bitcoin’s trading volume in the region surged to a new all-time high. Additionally, reports were circling and revealed that certain businesses are supposedly switching to use Bitcoin as a safe and anonymous alternative. However, it’s important to note that Bitcoin is pseudonymous, and it’s entirely possible to track the transactions to a certain entity, especially if cryptocurrency exchanges were used in the process.

Protests In Other Countries

Last Friday, the Iranian government increased the price of fuels by around 50%. Protesters were quick to come on the streets of the city of Behbahan. Things escalated quickly, and the local branch of the Central Bank of Iran was set on fire. Naturally, the Iranian Rial took a beating, losing over 20% of its value against the Euro since then.

Another country that is torn by turmoil is Lebanon. People demand a change in political leadership, and the protests resulted in banks shutting down. Most of the international, as well as USD withdrawals, were banned, leaving people without any access to their funds. The country’s Bank Association came up with a questionable solution, allowing citizens to withdraw a maximum of $1,000 per week. They can process international transactions under the “urgent personal expenses” category.

Other countries, such as Argentina, for instance, are also going through serious political and economic challenges. Amid all this, it’s important to note that Bitcoin surfaces as an alternative.

Its immutable and censorship-resistant nature takes care of the above issues as no central authority can control the amount a user can spend or send. Moreover, it’s impossible for someone to refrain a user from participating in the network, regardless of their current whereabouts, net worth, or political and economic views.

It remains interesting to see if these events will have an impact on Bitcoin’s price. The cryptocurrency has demonstrated a negative correlation with traditional financial markets. A recent example came from the US when President Trump announced new tariffs on goods imported from China. The news put global stocks in the red, while Bitcoin surged about $700 almost immediately after.

The post Protests In Hong Kong, Iran and Lebanon Worsen: Possible Impact On Bitcoin’s Price? appeared first on CryptoPotato.