ProShares’ Bitcoin Futures ETF Racks Up Biggest Weekly Inflow in a Year

A flurry of Bitcoin ETF filings in the U.S. has almost instantly spurred interest in the asset from institutional investment circles.

ProShares’ Bitcoin Strategy ETF (BITO) – a Bitcoin futures fund offered in the U.S. – last week recorded the highest weekly inflow in over a year as bitcoin (BTC) prices breached the $30,000 level, data cited by Bloomberg senior ETF analyst Eric Balchunas shows.

BITO allows investors to gain exposure to bitcoin-linked returns with a regulated product and holds over $1 billion worth of CME Bitcoin Futures, holdings data shows.

Investors poured in $65 million to BITO in the past week, the data shows, breaking a previous 2023 high of just over $40 million in April. As such, the product did not see meaningful inflows in May and most of June as demand for bitcoin lulled.

BITO has closely tracked spot bitcoin prices which has likely added to its allure among traders. “It pretty much has tracked bitcoin perfectly. It lagged spot by 1.05% (annually), but its fee is 0.95%,” Balchunas tweeted.

The BITO buying pressure likely indicates interest in bitcoin exposure among institutional investors closely on the back of a bitcoin ETF frenzy in the U.S.

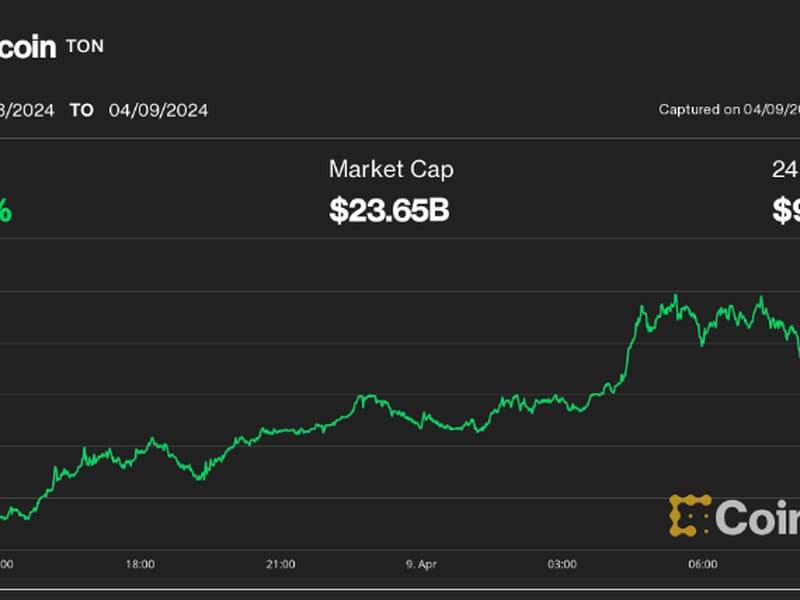

Bitcoin prices rallied in the past two weeks as investment giant BlackRock (BLK) filed for a spot bitcoin ETF in the U.S.

The world’s largest cryptocurrency by market capitalization touched $31,000 over the weekend to extend monthly gains to 14%, as per CoinGecko data.

The U.S. Securities and Exchange Commission (SEC) has consistently blocked spot products from launching, but BlackRock’s stature and history of ETF approvals have spurred a bullish outlook for bitcoin among some traders.

Edited by Parikshit Mishra.