Progressivism And Bitcoin Are Not Opposed

While people often see the two as lying on different ends of the political spectrum, Bitcoin is actually an a-political technology designed to help everyone.

It’s time to set the record straight. Too many who write or pontificate about Bitcoin do not know what progressivism means in the political realm of American politics — looking at you Daniel Kuhn. In reality, many ideas among progressives and the left, are wholly aligned with Bitcoin’s mission.

“Progressive” is really an umbrella term that lumps together many left-leaning political ideologies under a set of demands that we deem to be inalienable rights of any human. These are education, healthcare, a living wage and housing. It is true that progressives do put demands on the government to protect and nurture these allegedly inalienable rights. However, you shouldn’t believe that progressives and the left are defenders of the state simply because they demand better of it.

In practice, progressives do their best work when they are not focused on electoral politics. At the local level, progressives focus on mutual aid, trade unions and grassroots organizing. These stem from the revolutionary anarchist tradition which came about due to horrific working conditions during the early centuries of capitalism.

The 19th century revolutionary anarchist’s goal was the absolute dissolution of the state by any means necessary. Anarchists despised the state with a passion that went beyond anything Murray Rothbard could have expressed. Anarchists of the time engaged in guerrilla warfare and many died trying to destroy the state (Rothbard lived out his life comfortably under the state, I might add). Progressives may not be trying to blow up the state these days, but they put major emphasis on providing for communities without help from the government.

Many assume that since Bitcoin inherently protects the right to property and individual ownership that it must be ideologically opposed to the beliefs of progressives. Actually, progressives aren’t opposed to owning things, in general. What it boils down to is rent, interest and democratic enterprises. What progressives really want are rent-free economies.

In fact, if you go back to the 19th century classical economic discussions of a free market, that’s what people like Adam Smith, John Stuart Mill, Karl Marx, Pierre-Joseph Proudhon, David Ricardo and others were trying to figure out. So, owning bitcoin is not in opposition to progressivism. Progressives are not inherently opposed to money, just opposed to how it is used as a means of control and power. Progressives and Bitcoiners are in opposition to neoliberalism because, among other problems that it created, neoliberalism is upheld through state violence.

As for exclusive individual ownership in Bitcoin, that is just a misunderstanding of Bitcoin. Bitcoiners are very proud of El Zonte, El Salvador’s Bitcoin Beach experiment. It’s hailed as a model for a successful circular economy based on Bitcoin. Here, the developers of the Bitcoin Beach wallet realized that locals would benefit from a community-based custodial option. In this case, the wallet makes it possible to designate a trusted member of the community to be the holder of the private keys for other people’s wallets. Here, responsibility is now coupled with community-based trust, not individual responsibility.

The idea of individual responsibility is one that is unique to the West and more so to the United States. Community identity is much more important in other parts of the world. Since Bitcoin has done so well in many developing nations where community is more valuable than individuality, it is hard to believe that Bitcoin is truly only for those concerned with strict individualism.

Another interesting community-owned idea in Bitcoin is the federated mint (FediMint). Here, a community with a certain amount of trust among its members, can effectively co-own the mint. This leads to a whole set of new ideas about community-based currencies that are backed by Bitcoin, that remind me a bit of Paul Grignon’s ideas about self-issued credit but also of Prodhoun’s concept of a People’s Bank, both coupled with John Nash’s work on ideal money. There is so much here that appeals to the progressive!

The only real part about Bitcoin that seems ideologically opposed to progressives at the moment is the 21 million bitcoin cap. The main reason is that there are economic leaders in the movement who are followers of John Maynard Keynes. This stems likely from the Keynesian critique of neoclassical economics and the argument that markets do not tend toward full employment, among other things.

Some of the desire for post-Keynesian approaches may be nostalgia for that long-dead constrained era of capitalism during the post-WWII period. Some of it is a seemingly pragmatic approach to softening boom-bust cycles, in which Keynes argued that deficit spending should occur during economic crises and be constrained during surpluses. Hyman Minsky, another pillar of economics for progressives, attempted to unite Joseph Schumpeter (Austrian school) and Keynes to understand how to stabilize an unstable economy. By the way, this unification (written in the early 1980s) provided a prophetic prediction of the Great Recession.

Even though there seems to be contradiction here between Keynesian ideas and Bitcoin’s monetary policy, some of the most progressively-aligned economists, like Michael Hudson and Steve Keen, regularly appear on Max Keiser’s “Keiser Report” for their sharp critiques of the banking system, dollar hegemony, quantitative easing, and neoclassical economics. Are you surprised? Progressive economists get it, they just aren’t convinced that the existing system can operate under a capped monetary policy. This is the problem in understanding, really. What Bitcoiners are really advocating for is a new system altogether.

Today, modern monetary theory (MMT) has taken hold of the progressive movement because it also centers the idea of a full employment guarantee where the government backstops the private sector employment with non-competitive jobs. MMT advocates also believe that they can control the money supply and inflation through fiscal and monetary policy. They argue that by bringing full productive forces online (no more, no less) that inflation can be properly managed. However, it has never been tried; the Federal Reserve Board does not practice real MMT at this time. To be clear, even MMT advocates are critical of quantitative easing.

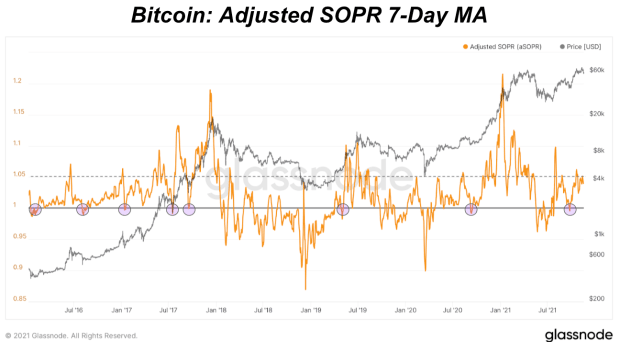

This is not to say that the left gives a full-throated endorsement of MMT, either. There are plenty of critiques of MMT from the left, all one has to do is look for them. Even so, Bitcoin is still appealing to a progressive even if they are MMT supporters simply because of the concerns over the goodness of their money over time. All one really needs to do is explain to the progressive how inflation decoupled from adjustments in living wage is a silent killer of their paycheck. What’s the alternative? Save some of that purchasing power over the long term by “hodling” bitcoin, of course.

Progressives are well aware of the damage the Federal Reserve and the government did during the Great Recession. Progressives supported Occupy Wall Street because many of them lost their homes to illegal foreclosures. Progressives need to be reminded, though, that the ivory towers of central banks are not any more our friends than the mega-corporation banks are. We can do better to educate our fellow progressives on money as a technology and on the idea that we can have a different economic system where a 21 million cap works.

To stimulate this idea of a different economic system, let’s pull from the degrowth movement. Degrowth encompasses a lot of ideas, but the main one is that our economic system should be tied to our planet’s ability to sustain life. Given the ease at which the banking system generates money (has anyone else compared the S&P 500 chart to the CO2 hockey puck chart?), and the obvious trends that as our Gross Domestic Product has gone up, so have our carbon emissions, it seems entirely logical that we should have a cap somewhere.

In the degrowth literature, there have been discussions about tying a currency to the amount of energy produced. Bitcoin’s network is backed by access to energy resources. Its mining protocol scales based on the price of electricity. It also has the ability to bring online wasted and stranded energy. This means that the network grows with a speed limit. We can plan whole economies around this prospect.

Furthermore, Bitcoin disintermediates the banking system and puts banking not only in the hands of the individual but of communities (something that Occupy Wall Street advocated for). Communities and/or cooperatives (like in the autonomous people’s economy in Rojava) can issue their own community-backed loans using bitcoin as the backing. There’s much to be explored here and progressives (and leftists more broadly) can really lead the way.

The reality is not that Bitcoin needs to be rebranded to fit a progressive narrative. It is that Bitcoiners – and non-Bitcoiners alike – need to realize that while the network’s genesis block was a political attack on the central banking system, that this sentiment is not exclusive to American libertarianism. This is why progressives are in the Bitcoin space, because we know that Bitcoin is for everyone, and we’re going to make sure that everyone, not just Libertarians, know that there is a way to exit the system and that Bitcoin can help us find the way out.

This is a guest post by Margot Paez. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.