PrivacySwap: Multiple BSC-Based Yield Farming Opportunities

[Featured Content]

It goes without a shred of doubt that the past year and a half have been outstanding for the field of decentralized finance (DeFi).

One of the best metrics to gauge its advance is the total value locked (TVL) in various protocols. Data from DeFi Pulse shows that back in January 2020, the number was somewhere around $600 million, whereas today it sits at almost $58 billion, having peaked at well over $88 billion earlier in May.

This is the direct result of increased interest in the field, as investors realize the potential of DeFi-based protocols as a growing alternative to traditional financial tools.

While this growth was largely fueled by the advance in automated market makers and decentralized exchanges like Uniswap, others came to light that promise better and more considerable benefits on the table.

One such protocol is PrivacySwap.

What is PrivacySwap?

PrivacySwap is a DeFi project and AMM with the main goal of allowing its users to stake cryptocurrencies quickly, safely, and securely. According to its main Medium page, the project is the brainchild of seasoned cybersecurity experts, which is quite important, given the generally risky field of DeFi where exploits tend to happen rather regularly.

To attest to its security, PrivacySwap had its smart contracts audited by TechRate, which can be publicly verified on their GitHub page. It’s worth noting, though, that investors should always approach DeFi protocols with a bit of caution – as Vitalik Buterin himself said it – there’s a non-zero chance of failure with each smart contract.

Nevertheless, the team’s intention is to bring together a community of passionate blockchain enthusiasts, traders, and hodlers from all over the world and create an environment that’s conducive for the betterment of the entire cryptocurrency industry.

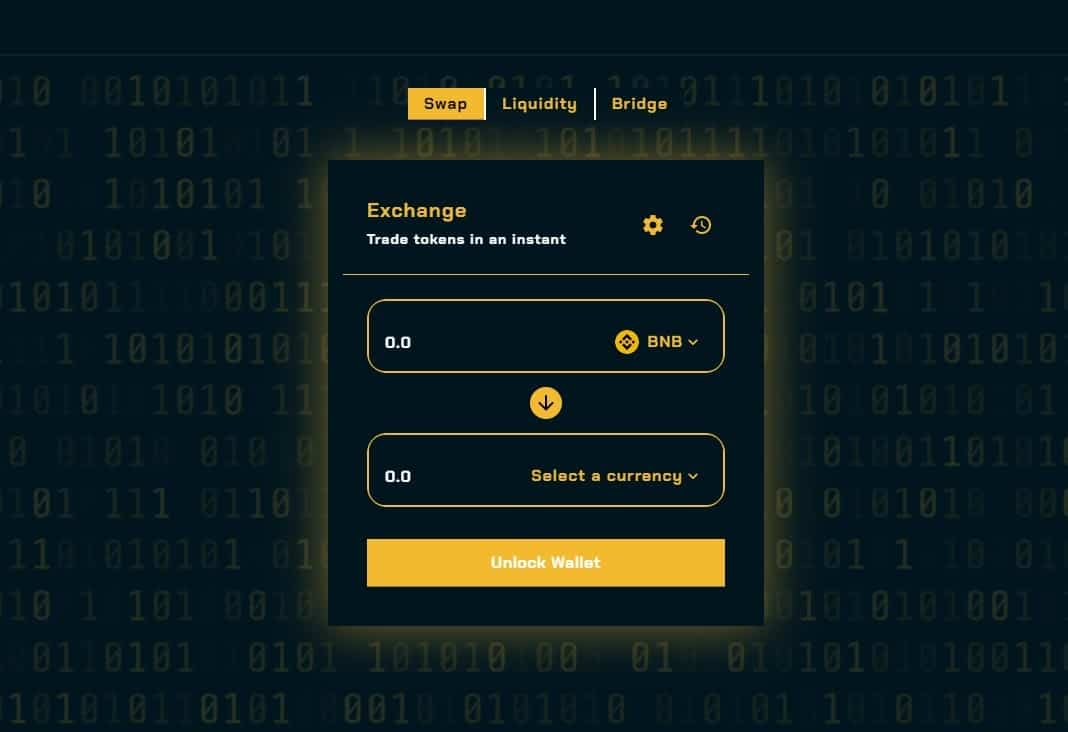

The protocol itself works on Binance’s Smart Chain and it’s quite similar in its interface to other DeFi projects.

All users need to do is unlock a BSC-compatible wallet (such as MetaMask) and they’d be able to start staking.

The ecosystem also has its native cryptocurrency, ticked PRV. At the time of this writing, it has a circulating supply of around 76,557 (out of 262,834 total supply) according to CoinGecko and it trades at around $14.

In terms of additional project features, the team has launched a referral system for its users and expects to launch a BNB and BUSD privacy mixer by August this year. Another interesting thing would be the crypto-accepting debit cards, which is also scheduled for 2021. The PrivacyCard can be loaded with both PRV and other stable coins.

Farming Yield Through PrivacySwap

Yield farming is also one of the hottest trends in the DeFi space. The difference between CeFi (centralized finance) and DeFi usually boils down to the interest rate, with DeFi offering substantially higher ones. Of course, this comes at increased risks of protocol exploits, rug pulls, and whatnot – something that each investor should be particularly wary of.

In any case, the process of yield farming usually requires the user to stake a certain amount of tokens in liquidity in a certain pool. In return for this service, they’re able to earn yield at a certain interest percentage.

For example, they have the PrivacyVaults, a yield optimization system that leverages the concept of compounding. The assets will be immediately staked into a ‘vault,’ and smart contracts will secure them. While it does not auto-harvest, the auto compounding feature alone is already beneficial as it will automatically stake the user’s remaining PRV.

Once again, it’s important to emphasize on the fact that DeFi staking is a lot riskier compared to staking your crypto in a centralized platform. While it’s true that you have complete control over your coins, it’s also true that DeFi protocols are a much more regular target of hackers, where many of them get exploited, causing serious challenges to investors. There’s also the risk of Impermanent Loss, so it’s important to be perfectly familiar and aware of what you’re doing when participating in such farms.

On the flip side, they offer massive returns and can be a source of additional income on your crypto holdings.

In any case, PrivacySwap seems like a reliable project with an interface that’s familiar to anyone with even brief experience in DeFi. Although, it appears that the team behind it is anonymous. This is not uncommon in the field of DeFi, but it should also be taken into consideration.