PrimeXBT Trading Platform Video Guide & Review

PrimeXBT is a Bitcoin-based crypto exchange, which was founded in 2018. It serves traders worldwide – in just over 150 countries, providing them with proper liquidity, a variety of trading tools and features, while also maintaining security and a safe trading environment.

PrimeXBT offers leveraged trading for the major cryptocurrencies, which include Bitcoin, Litecoin, Ethereum, and Ripple.

It’s worth noting that PrimeXBT sets out to provide their trading system for both professional and beginners in trading. The infrastructure is designed to facilitate a more significant number of orders per second, while still offering ultra-fast order execution and particularly low latency.

Additionally, the traders can design and customize the layout and the widgets to fit their overall trading style properly.

Margin Trading Benefits

As mentioned above, PrimeXBT provides margin trading options on a range of cryptocurrencies such as Bitcoin, Litecoin, Ripple, and Ethereum. Apart from cryptocurrencies, PrimeXBT also offers FX, Commodities, and stock indices margin trading, all from a single Bitcoin-funded account.

The main advantage of margin trading is that you can leverage a regular position without having to hold the required traded asset amount in your balance. What’s more, it allows you to open trading positions in both ways – long or short.

Another advantage of crypto margin trading is the fact that storage of a high amount of cryptocurrencies on an exchange is generally not recommended. By using leverage, you can trade on coins which are stored off the platform and hedge your portfolio during bear markets.

PrimeXBT Main Display

Once you land on the platform’s website, you’d be able to check out some of its main features, navigate between the available trading pairs, supported assets, as well as the leverage available for each one of them.

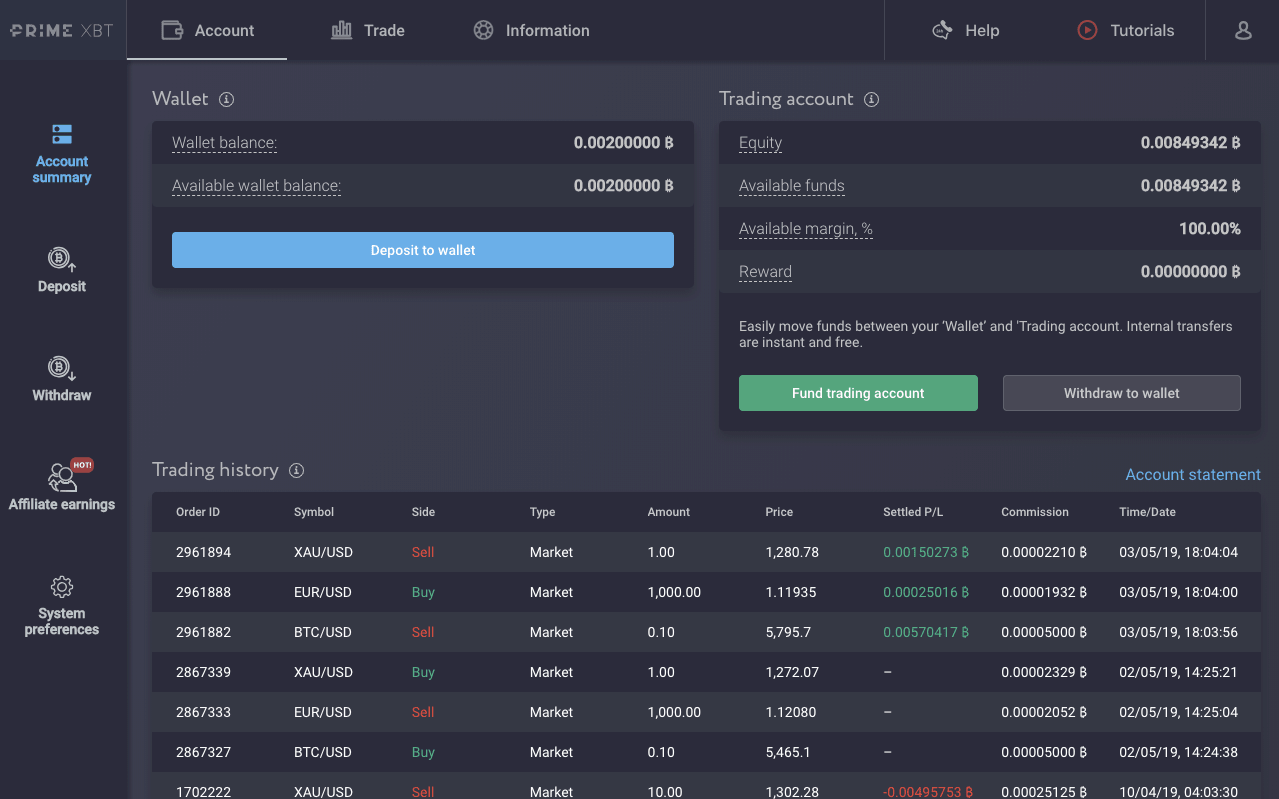

Registering an account is rather quick, and the platform touts that there is no KYC required, as of now. Once you have your account opened, you will also be able to access your personal dashboard and panel, which contains the account balance and the transaction history. From here you also deposit and withdrawal.

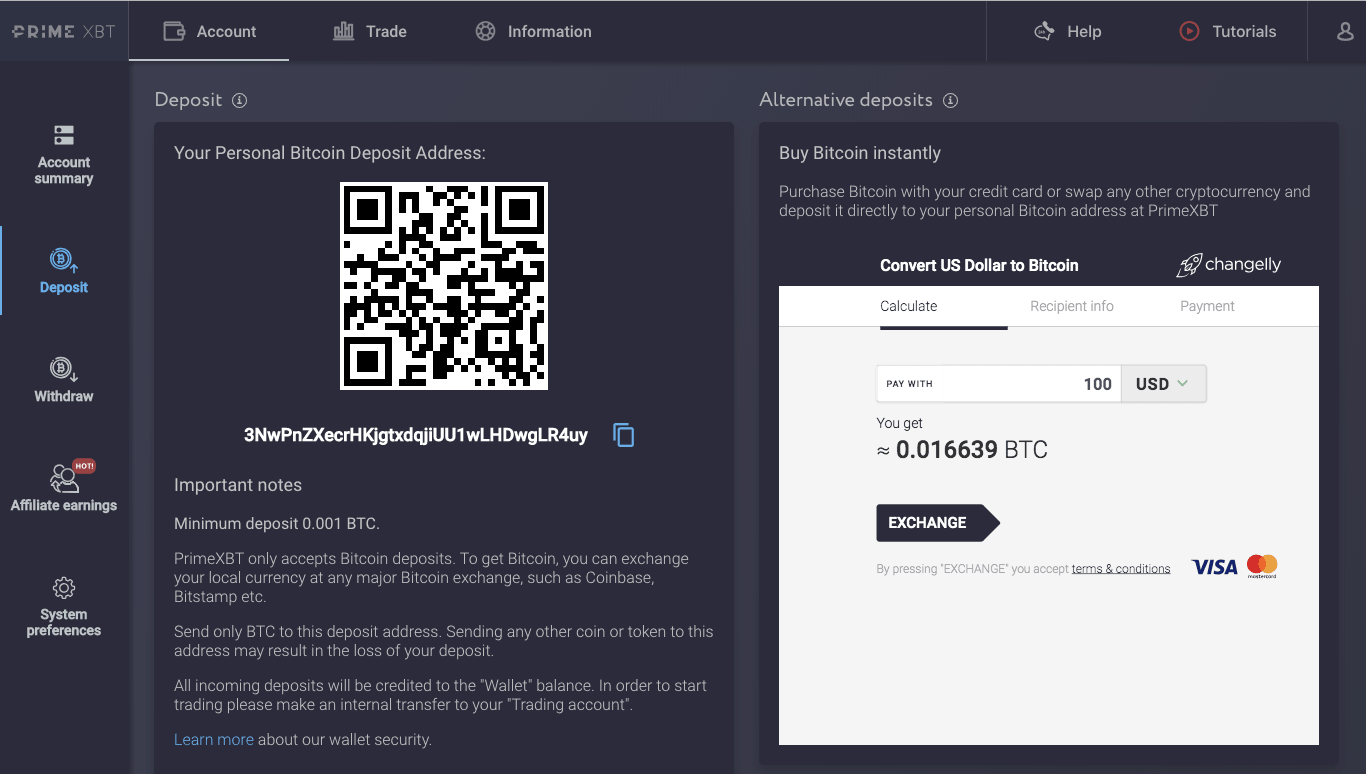

How to Deposit:

Under “Account” in the main menu, go to Deposit section, where you will be provided with a Bitcoin wallet address. After that, simply transfer your funds to the address.

It’s worth noting that PrimeXBT accepts only Bitcoin deposits. However, you will also find an integrated widget, which allows to instantly buy Bitcoin with your credit card or swap any other cryptocurrency. Then, deposit it directly to your Bitcoin address at PrimeXBT.

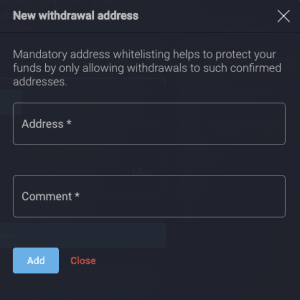

To withdraw funds from PrimeXBT platform, you can navigate to Withdraw section under the “Account” tab.

Before you can withdraw Bitcoin, you need to whitelist your wallet address. By doing so, withdrawals will be  restricted to addresses only included in the whitelist. In the unlikely event that your PrimeXBT account is compromised, an unauthorized user will not be able to withdraw Bitcoin to a non white-listed different address.

restricted to addresses only included in the whitelist. In the unlikely event that your PrimeXBT account is compromised, an unauthorized user will not be able to withdraw Bitcoin to a non white-listed different address.

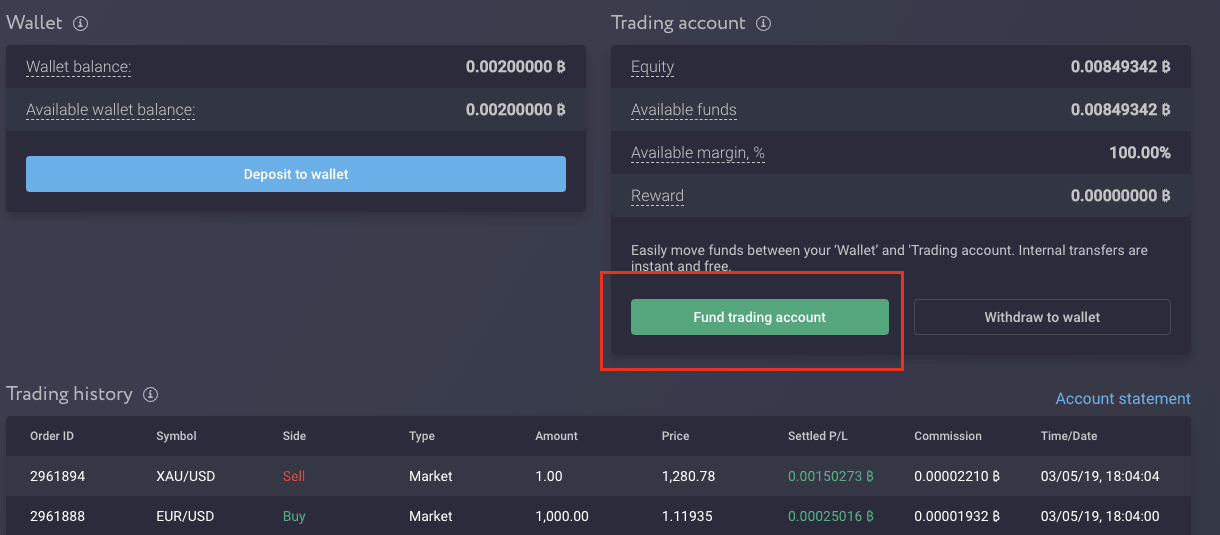

Once your account is funded, you will need to transfer your Bitcoins from your PrimeXBT Wallet to your Trading account. This can be done via an Internal transfer menu in the ‘Account’ section.

In our wallet, we have 1 Bitcoin.

Let’s fund the account with 0.2 Bitcoin – We click Fund trading account and just type the amount and click Transfer. That’s it.

Trading on PrimeXBT is somewhat simplified: On the top menu bar, select the “Trade” tab.

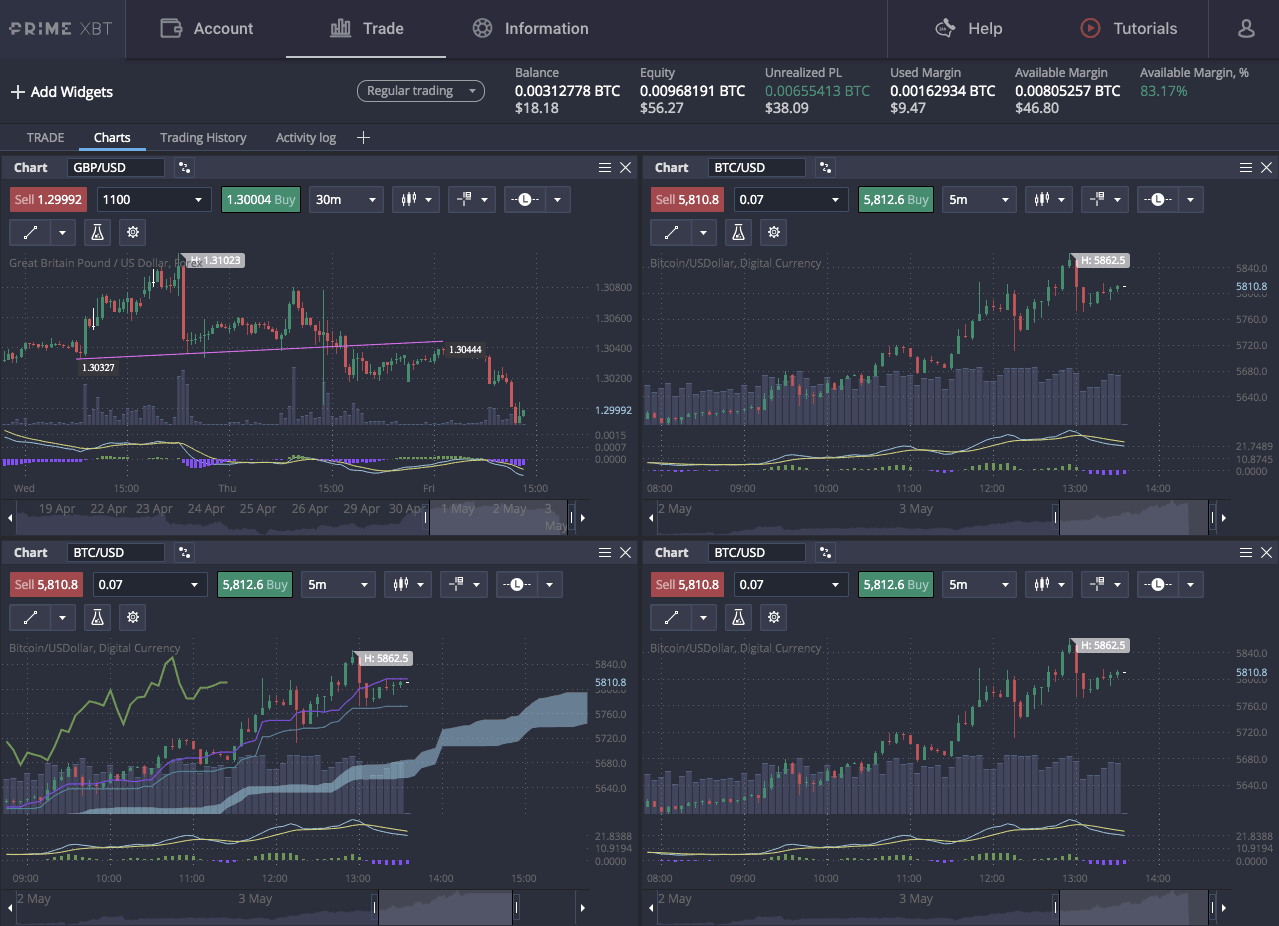

As you can see, on the left there’s a list with the available trading pairs, which include a wide variety not limited to crypto. In the middle, you can see the chart for the selected trading pair. Right on top, you’ll be able to monitor your current balance, equity, and other essential metrics.

As mentioned before, PrimeXBT allows you to trade both long and short positions. If you think the market will decrease, you should short it by opening a “sell” order. If you believe the market will increase, you should long it by opening a “buy” order.

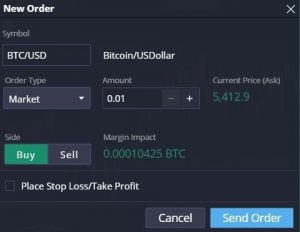

In this window, the first thing to do is to determine the order type. There are a few options. These include:

- Market Order – it means that the position will get filled by the best available price on the market.

- Limit Order – it means that you will set an order price manually using the Limit Price ticker.

- Stop Order – it will fill the position only when the stop price is reached.

- OCO Orders – this is a very cool feature which allows you to place two orders simultaneously. OCO stands for One Cancels Other – it will enable you to ultimately minimize the risk when trading by placing another order which will cancel the previous one once the set price is reached.

There’s also the option to place Stop Loss and Take Profit commands. This is not mandatory, but you can always use it in order to apply risk management.

After setting up the size of the position (in BTC), just press Send Order, Confirm, and that’s it.

Once the order is placed, you will see it on the bottom left side of the trading platform. As the order gets filled – in this case, it does immediately since we chose a Market order, it will move to the “Positions” section where you will be able to see the size, the actual execution price, current price, profit/loss, and of course, the option to close the position.

If we want to close our position: we just click on this button, confirm and that’s it.

Trading Customization

By customizing widgets and your platform layout, you can create a workspace that meets your needs. This is done using the “Add Widget” button.

The platform has provided the option to add a range of different widgets for trades:

- Chart Widget – you can open a trading chart on your workspace and use it to monitor by using technical indicators.

- Watchlist Widget – this will allow you to monitor other trading pairs with the latest market data.

- Dashboard widget – you will get direct access to order forms for the specific pairs that you have selected on your own.

- Positions widget – this option will show you all the current active positions that you have; you can modify them from here.

There are other widgets that you can add, such as order history, order books, alerts, symbol library, account widgets, statement widgets, and many others.

Those are just a few examples of how your workspace could look like:

Another thing to note is that PrimeXBT supports a multi-screen setup which is mostly required by professional traders.

A word about PrimeXBT Margin Trading

The easiest way to picture margin trading is by using division. So, for example, if you have selected leverage that is times 10, then you can expect the cost of the position to be reduced by a factor of 10. In other words, it will be divided by 10. This allows you to trade the selected pair by borrowing from the platform. Of course, the higher the margin is, the more funds you have to borrow, and that’s why fees will also cost more, and the liquidation price will be closer.

PrimeXBT offers 1:100 leverage on all of the digital assets available on its platform.

The core thing to understand is that users are automatically provided with buying or selling power, which is equal to 100x times of their balance. However, users control the leverage by adjusting the position size rather than adjusting the leverage level itself like other margin trading exchanges, such as BitMEX. For example, a user can open a 5 BTC position while having a 1 BTC deposit on a trading account, that will result in an effective 5x leverage.

PrimeXBT offers a set of available trading pairs and markets, which include Cryptocurrencies, Forex, and CFDs. The cryptocurrency section consists of the following trading pairs:

- BTC/USD

- ETH/USD

- EOS/USD

- LTC/USD

- XRP/USD

Users can also trade different traditional currencies in the Forex trading section, which provides a broad range of trading pairs, including EUR/AUD, GBP/JPY, USD/CAD, and many many more.

Regarding CFDs, users can find stock indices and commodity CFDs such as NASDAQ, the UK100 index, BRENT, Crude oil, natural gas, and others.

PrimeXBT Fees

The platform charges two types of fees: trading fees and overnight financing. Trading fees are standardized and flat, while the financing fees vary and will be based on the amount of funds you have borrowed for your margin trading positions.

The chart below displays it clearly:

Primexbt Referral Program

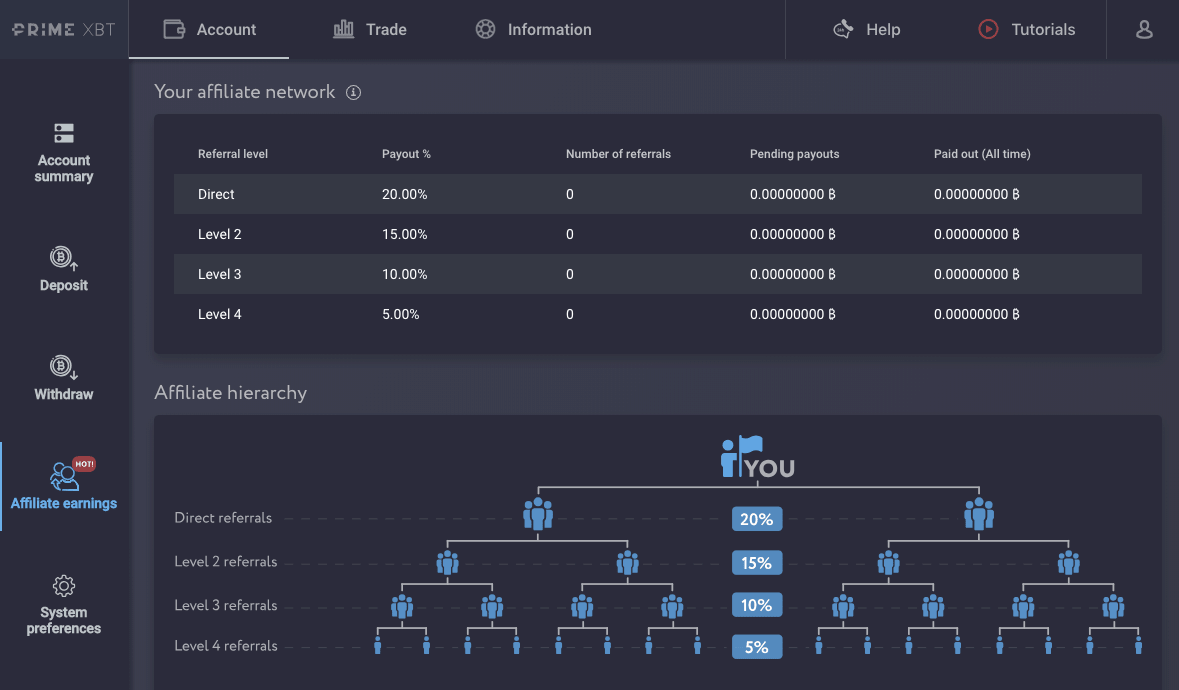

PrimeXBT offers a 4-level payout scheme, which means that you receive rewards not only for direct referrals register with your link, but also for their referrals as well.

Final Words

In general, the PrimeXBT trading platform is a very well-made and simplified infrastructure with great options for leveraged trading. It has some of the major cryptocurrencies listed, and it allows traders to both long and short them, which can be seen as an advantage. Of course, it’s always important to do your research and be particularly careful, especially when it comes to margin trading.

PrimeXBT

7.7

Pros

- Not limited only to crypto: FX, Commodities, indices and more with Bitcoin

- High latency, very quick response

- Low competitive trading fees

Cons

- Variety of cryptocurrencies is minimal, only to the major coins

- The exchange is relatively new (2018), and unregulated

The post PrimeXBT Trading Platform Video Guide & Review appeared first on CryptoPotato.