Prime Trust Unit Banq Files for Bankruptcy

Banq, a subsidiary of embattled crypto custodian Prime Trust, has filed for bankruptcy in a U.S. bankruptcy court in the district of Nevada.

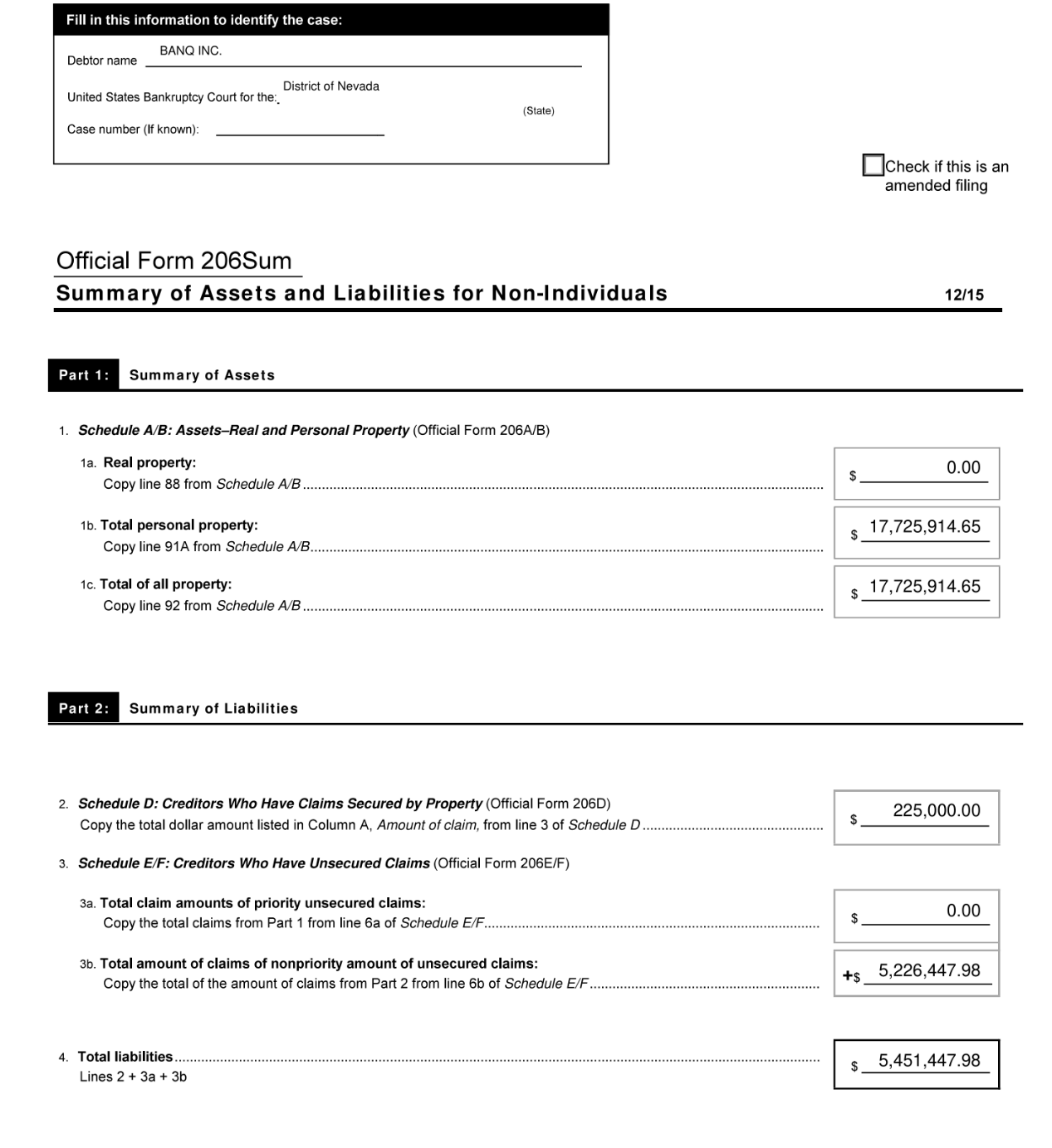

In the bankruptcy filing, the company cited approximately $17.72 million in assets against $5.4 million in liabilities.

This comes as Banq’s parent, Prime Trust, works to close an acquisition deal with BitGo after facing a financial crisis as a result of the Celsius bankruptcy.

Meanwhile, TrueUSD, which has a banking relationship with Banq’s parent Prime Trust, said that its pause in stablecoin mints and redemptions has to do with “Prime Trust’s bandwidth issues”.

South Korean crypto yield firm Haru Invest also engaged in an operational pause citing difficulties with an unnamed service provider, which is thought to be Banq or Prime Trust.

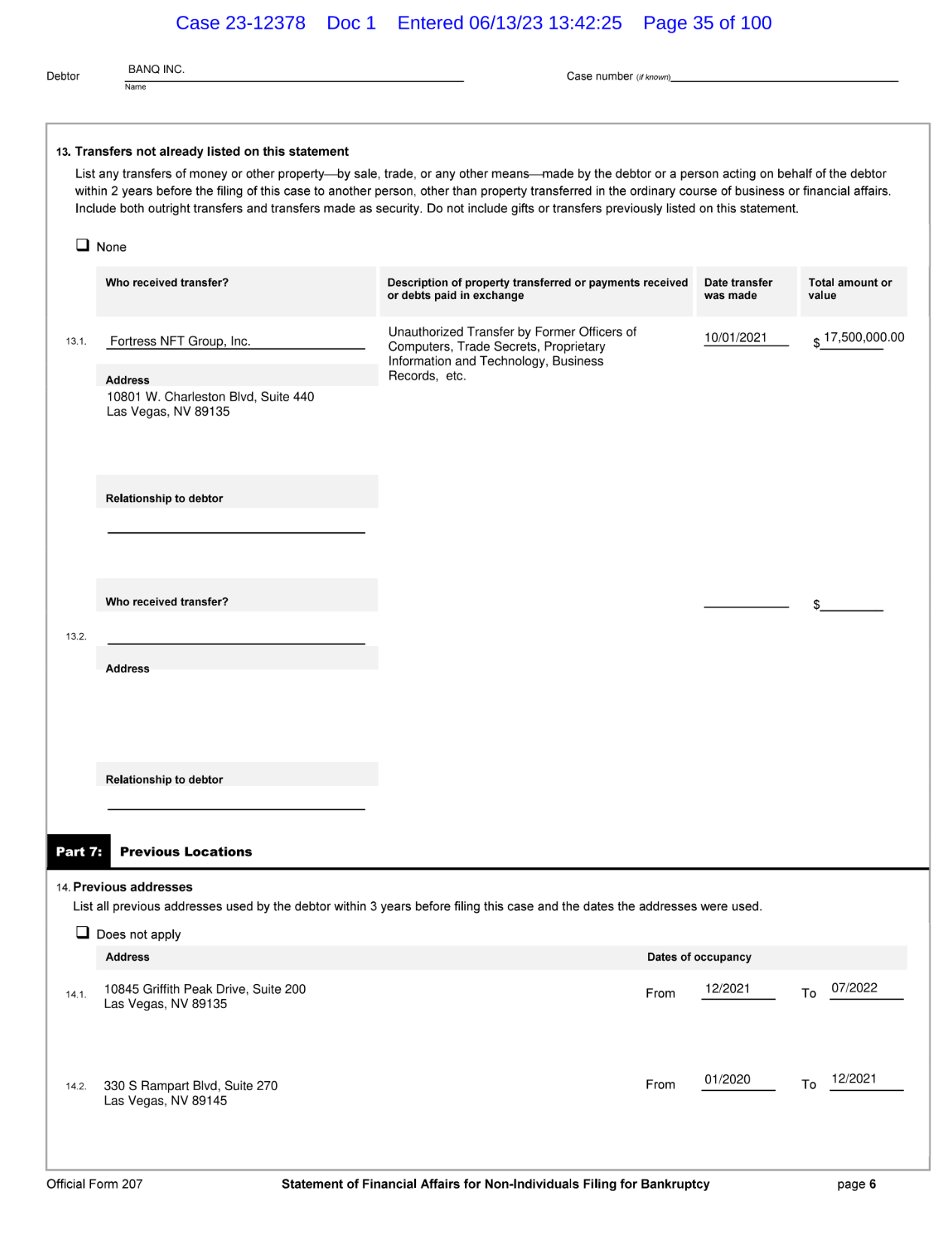

The company also notes in its filing that $17.5 million in assets were taken in an “unauthorized transfer” by former officers consisting of trade secrets, as well as proprietary information and technology, to Fortress NFT Group.

Fortress NFT Group was founded by Banq’s former CEO, CTO, and CPO. Banq has sued Fortress for allegedly stealing trade secret information to launch rival NFT platforms Fortress NFT and Planet NFT. It further alleges they engaged in fraudulent activities to cover up their misconduct.

Banq said in a suit against the trio that Scott Purcell, its former CEO, attempted to pivot Banq towards NFTs. Facing pushback from its board and shareholders, Purcell founded Fortress NFT and then sold Banq’s computers, intellectual property, and corporate infrastructure to the new company.

“Their theft of Banq’s corporate assets even included taking the company’s seat licenses for Las Vegas Raiders’ games at Allegiant Stadium, all without Board approval or knowledge. Specifically, Defendant Purcell transferred the seat licenses owned by Banq to himself,” the suit reads.

In early 2023 a Judge ordered the case to go to arbitration as Purcell and the other defendants in the case signed arbitration clauses.

Edited by Parikshit Mishra.