Previewing Congress’s Joint Crypto Regulation Hearing

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)

Nikhilesh De is CoinDesk’s managing editor for global policy and regulation. He owns marginal amounts of bitcoin and ether.

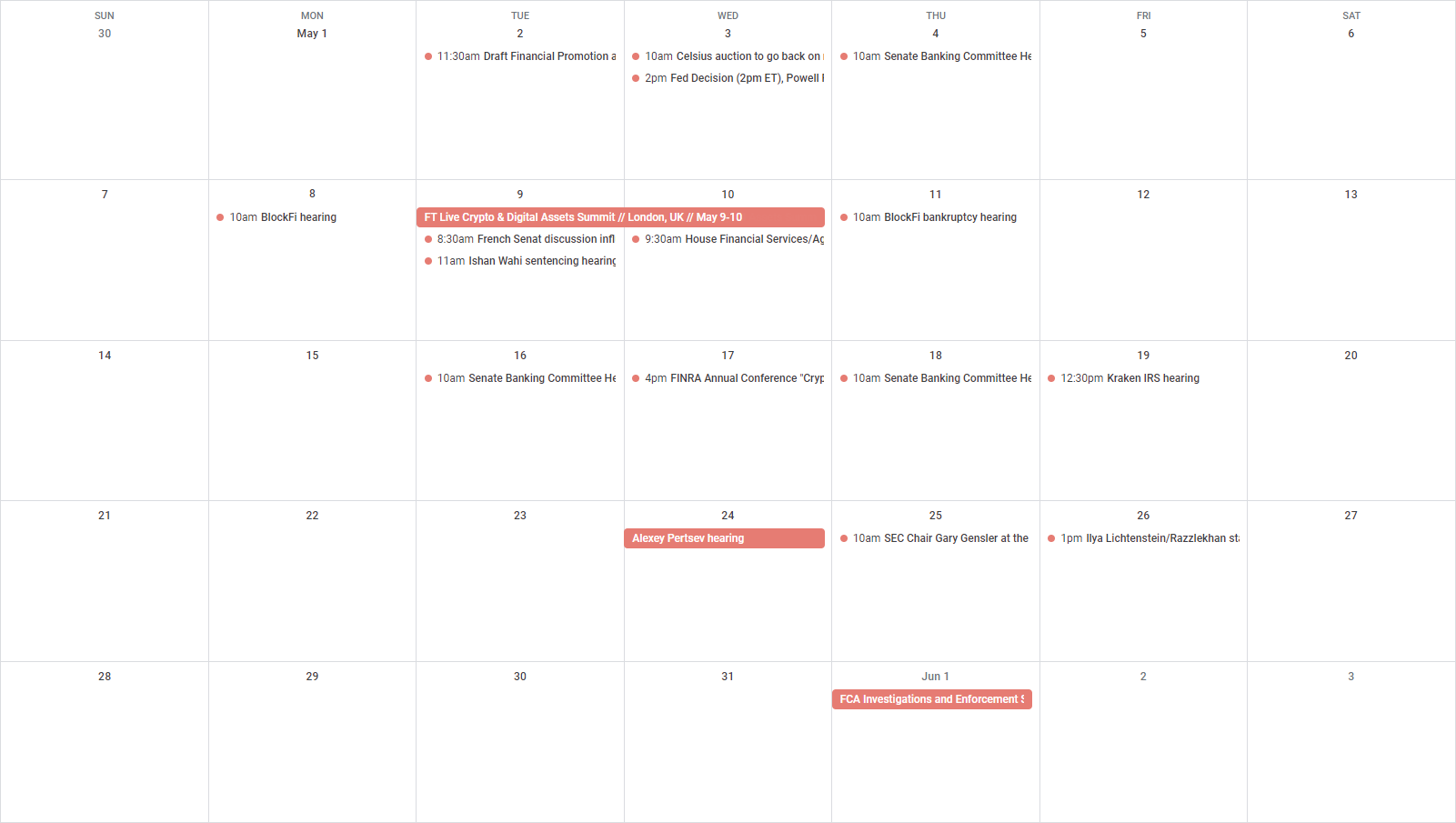

Over the past several weeks, Congress – particularly the House Financial Services Committee – has held a number of hearings on crypto and its role in the world. Even a hearing supposedly focused on overseeing the U.S. Securities and Exchange Commission instead mostly saw questions on crypto and climate issues. Tomorrow, we’ll see another hearing, held with the House Agriculture Committee, specifically discussing crypto regulation.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

“Regulatory clarity,” the way the crypto industry defines it, can come in one of two ways: Either a federal regulator provides formal guidance and rulemaking addressing one or another concern, or Congress passes a law defining those concerns. Regulators like the Securities and Exchange Commission (SEC) or Commodity Futures Trading Commission (CFTC) have issued some proposed rules (sparking backlash from the industry in some cases), but generally hopes were focused on Congress potentially taking action. We’re going to see another hearing kick off this week that hopes to address the crypto market.

Congress continues to grapple with the idea of crypto regulation. What fresh guidance would look like in practice is still up in the air, but lawmakers are taking another swing at the question on Wednesday.

We don’t know for sure if any actual legislation will move forward this year. The industry’s expectation was that a stablecoin bill would have the greatest chance of success in terms of becoming law. Those expectations were pretty well dashed during a hearing on stablecoins earlier this month when Congresswoman Maxine Waters (D-Calif.), the ranking member of the House Financial Services Committee, said that the bill reflected thinking from last October – and that, in her view, the committee needed to “start from scratch.”

Admittedly, it never looked like the Senate Banking Committee was publicly anywhere close to getting involved in the bill, but the fact the House had a bipartisan product suggested there was a chance. That’s dead now.

Despite this, lawmakers appear optimistic about the chances of a bill being signed into law over the next year.

At Consensus 2023 the other week, I asked Congressman Patrick McHenry (R-N.C.), the Chair of the Financial Services Committee, if he believed there was a path for legislation to become a law this year.

He said “Yes,” and added that a new bill addressing market structure issues would be introduced within two months.

Senator Cynthia Lummis (R-Wyo.), the other lawmaker on stage with me, seemed equally optimistic.

From the House perspective, the next step toward legislation is still Wednesday’s hearing, kicking off at 9:30 a.m. ET and featuring former Commodity Futures Trading Commission Chair and current Harvard Research Fellow Timothy Massad, Republic Crypto Head Andrew Durgee, Wilmer Cutler Pickering Hale and Dorr Partner Matthew Kulkin, Kraken Chief Legal Officer Marco Santori and Web3 Foundation Chief Legal Officer Daniel Schoenberger.

In his written testimony, Massad said one issue is the lack of a federal spot market regulator for non-securities cryptocurrencies, and the debate around how to even classify whether a given crypto is a security or not.

“Chair Gary Gensler of the SEC says most tokens are securities and the problem is a lack of compliance with existing legal requirements. Industry participants complain about a lack of clarity in the rules for resolving this issue and have called for regulators to create a new set of rules specifically for crypto,” he said. “Meanwhile trading and lending platforms claim they are only dealing in tokens that are not securities – thereby avoiding direct federal oversight. As a result, investor protection on crypto trading and lending platforms is woefully inadequate.”

Massad proposed Congress pass a law creating certain principles and standards by which every exchange would have to abide by, regardless of whether the token being listed is a security or a commodity.

Doing so, he argued, would negate the need to expand the definition of securities laws or create a new category system for digital assets while still encompassing the entire crypto market.

The hearing also features a joint proposed resolution saying Congress must provide further guidance for the U.S. Securities and Exchange Commission and Commodity Futures Trading Commission on how to bring existing regulatory protections to the crypto sector.

-

14:00 UTC (10:00 a.m. ET) There was a hearing in the ongoing Blockfi bankruptcy case, though any ruling has been deferred to Thursday.

-

12:30 UTC (2:30 p.m. CET) The French Senate will hold a hearing on influencers in crypto.

-

15:00 UTC (11:00 a.m. ET) A federal court will sentence Ishan Wahi, the former Coinbase employee who pleaded guilty to insider trading charges.

-

13:30 UTC (9:30 a.m. ET) The House Financial Services and Agriculture Committees will hold their first joint hearing on digital assets. House Financial Services Committee Chair Patrick McHenry (R-N.C.) announced the joint hearings at Consensus last month.

-

14:30 UTC (10:30 a.m. ET) Judge Lewis Kaplan of the New York Southern District Bankruptcy Court will make a ruling on certain types of withdrawals and whether they should be allowed in the ongoing Blockfi case.

-

(The Verge) I thought this was an interesting snapshot of the internet 25 years after Google’s launch.

-

(Bloomberg) Shaquille O’Neal attorneys say that process servers attempting to serve a lawsuit threw it at his car, which he was driving at the time (attorneys behind the suit previously said the basketball player had been “hiding” from the servers).

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

Edited by Henry Bond.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)

Nikhilesh De is CoinDesk’s managing editor for global policy and regulation. He owns marginal amounts of bitcoin and ether.