Prediction Markets Can Hedge Crypto Startups’ Regulatory Risk, Paradigm Says

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Paradigm, the venture capital firm led by Coinbase co-founder Fred Ehrsam, filed a legal brief supporting prediction market platform Kalshi in its suit against the Commodity Futures Trading Commission (CFTC).

In the case, filed in November, Kalshi asked the court to vacate the CFTC’s denial of its bid to list contracts on which party will control each house of the U.S. Congress after an election. The regulator concluded that Kalshi, based in New York, was pursuing unlawful gambling “contrary to the public interest.”

In a friend-of-the-court brief filed Thursday, Paradigm, which is not an investor in Kalshi, argued that such contracts could help businesses, including cryptocurrency startups, hedge their risks while producing positive spillover effects for the general public.

Paradigm is weighing in at a time of optimistic forecasts for long–languishing prediction markets, particularly those that run on crypto rails (unlike the CFTC-regulated Kalshi, which settles bets in U.S. dollars). In such markets, participants bet on the outcomes of real-world events, from the weather to military maneuvers.

Bullish outlook

Bitwise Asset Management, for example, forecasted in a December report that “more than $100 million will be staked in prediction markets, which will emerge as a new ‘killer app’ for crypto.” That figure would represent double the peak reached in late 2021, according to Bitwise’s analysis of data from The Block and DefiLlama.

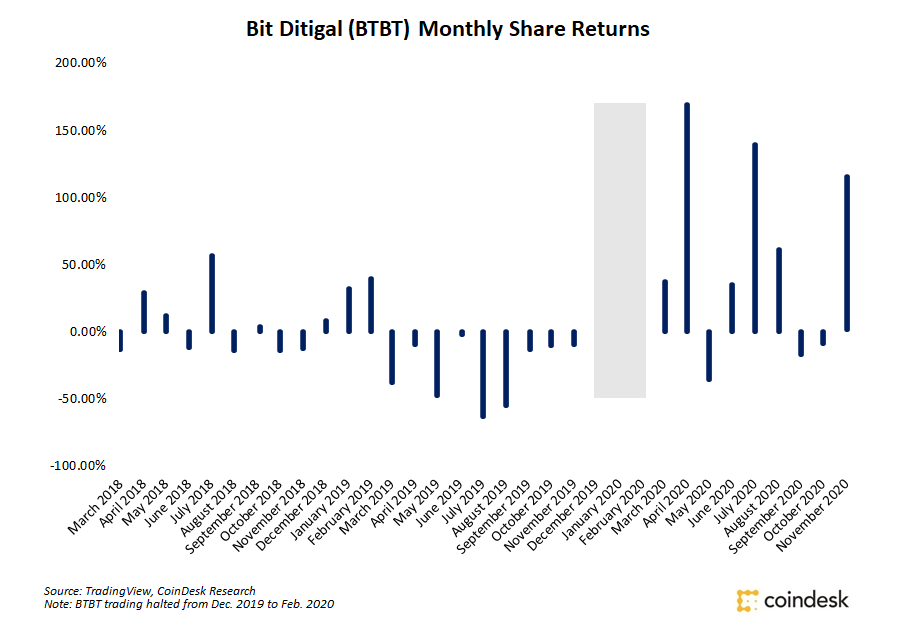

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3KNYJ3BGVBGOFPU2SHDWURXECY.png)

Polymarket, the leading crypto-based prediction market platform, logged its biggest volume month in January, according to Dune Analytics data shared on X (formerly Twitter) by Rob Hadick, a general partner at Dragonfly, another VC firm.

Hedging risk

“Paradigm has an interest in this case because prediction markets could be an impactful use case for crypto and related technologies in which Paradigm invests,” the firm said in the filing with the U.S. District Court for the District of Columbia.

For example, the brief described a hypothetical “entrepreneur who is building a crypto startup in the U.S. The likelihood that Congress will pass legislation that will impact the viability of U.S.-based crypto startups is directly affected by which party is in control of Congress. … The entrepreneur may therefore want to buy an event contract that pays out depending on which party takes control.”

Echoing a longstanding argument in favor of prediction markets, the brief went on, “when market participants hedge substantial sums on a particular event contract, members of the general public—even those who never join the market—get valuable real-time information.”

Such markets “might even be better predictors of electoral outcomes than public opinion polling—precisely because they require participants to put their own skin in the game,” Paradigm said.

Public benefit

Another friend-of-the-court brief filed Thursday supported Kalshi, this one by a prominent legal scholar.

Joseph A. Grundfest, a professor at Stanford Law School, made a similar appeal to the public good.

“In a world with miniscule poll response rates, sky-high polarization, and rampant fake news, prediction markets offer an objective indicator of the probability of particular election outcomes,” he wrote.

The CFTC has about a month to respond to Kalshi’s motion for summary judgment and present its own friend-of-the-court briefs. Kalshi would respond to those filings in March and the case may reach a conclusion in early April.