Possible Short-Term Correction for ETH Following Test of $2.1K? (Ethereum Price Analysis)

Ethereum’s price has been extremely bullish over the past few weeks, climbing higher each week. While there are numerous signs that the bear market is over, some worrying signs are emerging in the short term.

Technical Analysis

By: Edris

The Daily Chart

Looking at the daily timeframe, the price has been rallying aggressively after breaking the large symmetrical triangle to the upside. Currently, ETH is targeting the $2200 resistance level and is approaching it quickly. Yet, the RSI indicator is showing a clear overbought signal, rising above the 70% mark.

This signal could result in a decline or consolidation in the short term, either before testing the $2200 level or after. In this case, $1800 and the 50-day moving average, trending nearby, could be considered support levels to hold the market.

The 4-Hour Chart

On the 4-hour chart, the bullish trend is demonstrated clearly as higher highs and lows and a rising trendline are classic positive signatures. Yet, the market has been struggling to climb higher lately, as the RSI has also shown an overbought signal on this timeframe and dropped below the area, indicating that the momentum is fading and a potential pullback could be expected.

Therefore, the $1950 support level and the bullish trendline should be monitored as possible support areas. However, the market could still continue higher before correcting and eventually reaching the $2200 resistance area. So, while the RSI’s pattern is worrying, the market is still in an uptrend on this timeframe from a classical price action point of view.

Sentiment Analysis

By: Edris

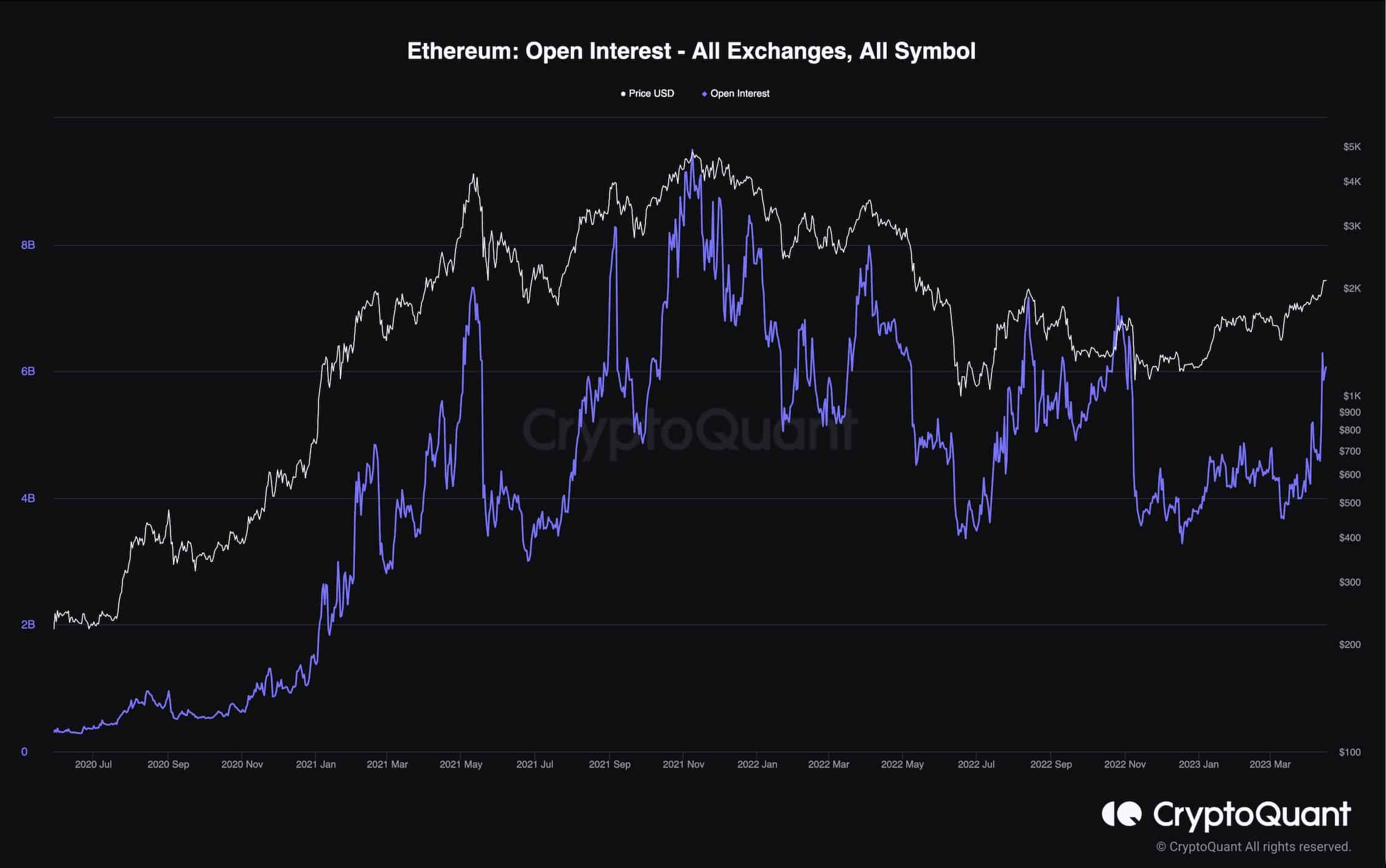

Ethereum Open Interest

Over the past few months, Ethereum’s price has been on the rise, attracting investors and speculators. While this is usually interpreted as a positive sign, too much speculation can become problematic, as it has in the past.

The chart below shows Ethereum’s open interest, which measures the number of open perpetual futures contracts. Higher values are usually associated with the bullish sentiment, while lower values indicate fear dominating the market.

Following the recent ETH price rally, the open interest has spiked massively, which points to a significant increase in speculation.

These spikes are usually followed by considerable volatility and sudden price corrections. Therefore, investors should be cautious as a pullback or even a bearish reversal could be expected in the short term due to a potential long liquidation cascade.

The post Possible Short-Term Correction for ETH Following Test of $2.1K? (Ethereum Price Analysis) appeared first on CryptoPotato.