Polymarket Whales Favor Trump as Election Betting Surges Past $400M

This week in prediction markets:

-

Polymarket whales favor Trump, despite Harris’ gains.

-

Mainland China will probably not unban Bitcoin in 2024.

-

Coinbase volume will likely half in Q2.

In the week since President Joe Biden stepped down as the Democratic party candidate, his running mate Kamala Harris has effectively doubled the chances of a Democrat taking the White House, moving the odds to 38% from 18%.

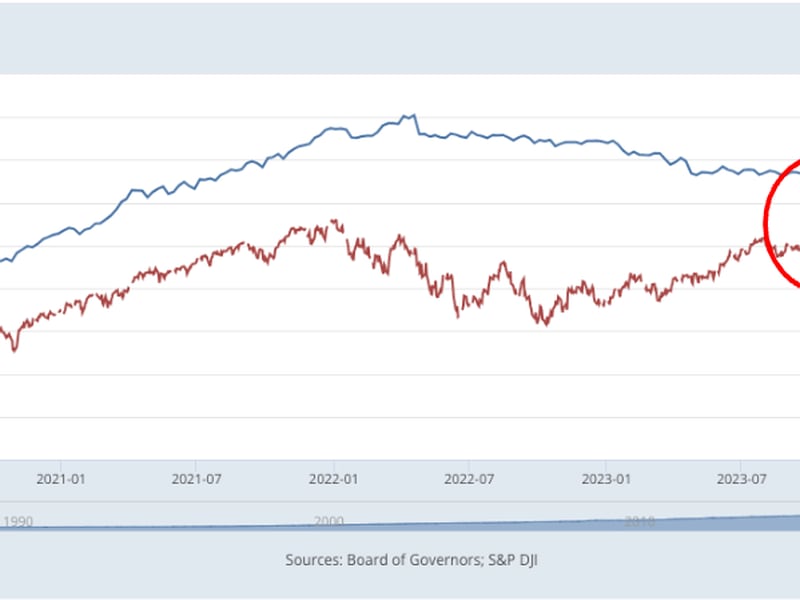

Harris’ gains in the Polymarket polls appear to be from small, individual bets entering the market.

Trump’s bettors, however, seem to have more conviction: the top five holders of the ‘Yes’ side of Trump’s contract hold a collective 9.1 million shares, which will resolve to a pot of $9.1 million if Trump wins. Meanwhile, the top five holders of the ‘Yes’ side of the Harris contract have a total of 4.7 million shares.

All-in-all bettors have staked $423 million on the outcome of the Presidential race.

The largest holder of the ‘Yes’ bet of the Trump contract is also the biggest holder of the ‘No’ side of the Harris contract.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/7XZC5PTJAZCL3GEI5CZFUAPA64.png)

This user, who goes by the handle ‘Larpas,’ is set to win $3.38 million should Trump, not Harris, win the election.

The betting market is set to heat up heading into November’s election as the crypto community leans more toward the idea that a vote for Harris is a vote against the digital asset industry while the democrats look for ways to side with the crypto industry.

Another point to note: leverage is coming soon to Polymarket, which may lead to traders opening up larger positions in order to reap more rewards.

Trading with leverage for much larger rewards already exists outside the betting market, which was one of the selling points of PoliFi tokens. But with many of these in the red, it’s questionable if the market has continued interest in this asset class.

Mainland China will keep bitcoin banned

China’s earlier stance in the digital industry helped bitcoin mature, with some of the earliest bitcoin exchanges like BTC China and Binance calling the country home.

But China’s relationship with bitcoin is complicated.

While crypto exchanges are banned in Mainland China and financial institutions are prohibited from interacting with virtual currencies, owning crypto and trading it peer-to-peer is not prohibited.

There’s now a growing belief that Mainland China will remove the crypto ban and allow exchanges to once again set up shop in the region while letting investors participate in the Hong Kong-listed crypto exchange-traded funds (ETFs).

The market, however, is skeptical.