Polymarket Trader Betting on Donald Trump Win Ends Up Getting 99% Odds

-

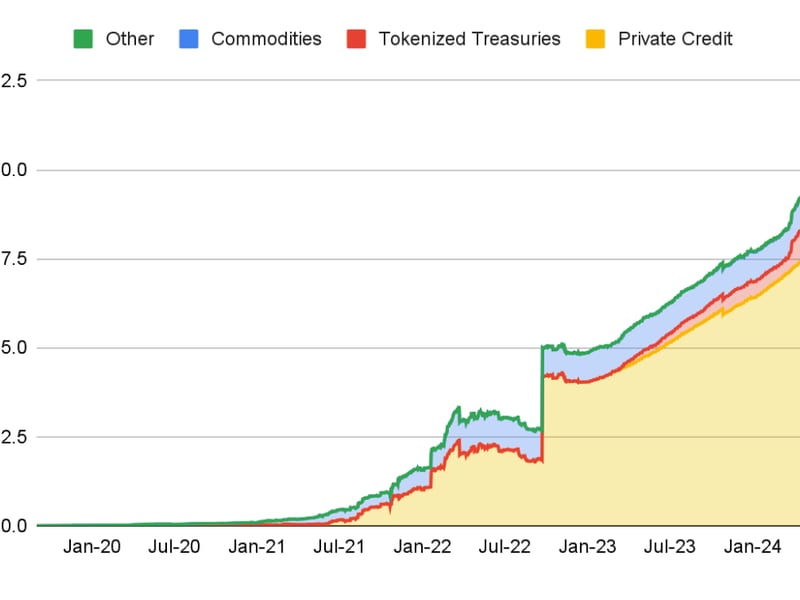

An individual or entity caused a brief mispricing on Polymarket by buying over 4.5 million Trump contracts for the 2024 Presidential Election, pushing the odds to 99% for a portion of the purchase due to the mechanics of the order book.

-

This anomaly occurred despite the actual market odds being around 63% at the time, highlighting how large trades can temporarily skew betting odds on prediction platforms.

02:28

Trump Pumps DeFi Token Sale; Bitcoin Price Jumps Above $65K

02:01

Trump-Endorsed Crypto Project Confirms Plan for a Token; Bhutan Holds Over $780M in Bitcoin

02:15

“Inside Trump’s Crypto Project; Ripple’s Upcoming Stablecoin To Launch in ‘Weeks’: Garlinghouse “

02:15

“Inside Trump’s Crypto Project; Ripple’s Upcoming Stablecoin To Launch in ‘Weeks’: Garlinghouse “

Republican Donald Trump’s presidential victory odds on Polymarket spiked to 99% for one entity briefly earlier Friday, data shows, as their constant buying led to a temporary mispricing in the order book.

The “GCorttell93” account purchased over 4.5 million Trump contracts in the “Presidential Election Winner 2024” market spending over $3 million in a short period. However, due to how the orderbook works, a tranche of $275,000 was filled at 99% odds – a leap from the actual 63% offered odds at the time.

The rest of their bets were placed at varying prices, such as a $129,000 tranche at 65.9 cents and a $102,000 tranche at 62.7 cents.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/5TY2JOGYKRH4NLFYRYJBX26DUQ.png)

How did the slippage occur?

On Polymarket, the price of shares in any outcome reflects the market’s current belief in the likelihood of that outcome. If a ‘Yes’ share for an event costs $0.60, the market interprets this as a 60% chance of that event occurring.

However, these odds are dynamic and change with each trade as Polymarket works on a blockchain-based order book that lists all the buy (bids) and sell (asks) orders for shares in an outcome.

Bids represent the highest price someone is willing to pay for a share, while asks are the lowest price at which someone is willing to sell.

This system allows for price discovery and provides liquidity. Users can place limit orders, where they specify the price they’re willing to buy or sell, which might not execute immediately if there’s no match.

However, a market buy may lead to someone’s bids getting filled at much higher prices.

As such, the order book allows everyone to see the depth of market interest at different price points, showing where other traders are willing to transact. This helps determine any bet’s true market price (compared to a centralized betting marketplace where brokers handle odds).

The election winner bet is the largest Polymarket by traded volume as of Friday, with over $2.2 billion in transactions. Trump leads the odds at 63%, while traders have given Democrat Kamala Harris a 36% chance of winning.

Edited by Parikshit Mishra.