Polygon Co-Founder: Web3 Remains ‘Mega-Mega Bullish’ Despite Crypto Downturn

Bitcoin and the cryptocurrency market’s downturn have left industry experts anticipating an extended winter. But Polygon co-founder Sandeep Nailwal believes the big picture for Web 3 remains bullish. The exec asserted that the correction has more to do with “macro” than any fundamental weaknesses in the Web 3 sector.

What’s Next?

In the latest Twitter thread, Nailwal said Web 3 remains bullish despite the market-wide chaos.

“Long-term Web3 remains mega-mega bullish, so newbies keep learning and builders keep building!”

While predicting a long bear market, Nailwal noted that if the US Federal Reserve manages to “remove” the uncertainty plaguing the market, there might be a respite and suggested that “there is a lot of dry powder sitting on the sidelines to bring in aggressive bull rallies.” However, a possibility of such a scenario appears bleak, considering sticky inflation and stagflation concerns.

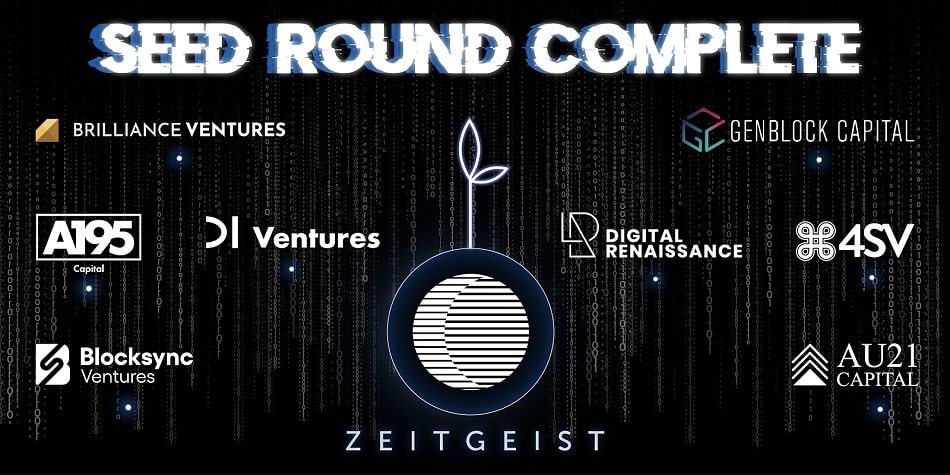

Several Venture capital funds have raised a significant amount of capital. Nailwal believes even though these entities will take a cautious approach in selecting their bets and acceptable valuations would be much lower but the exec expects the “thesis-based VCs to keep deploying.” He also added that most of them will also play in liquid markets.

The Polygon co-founder predicted that markets will eventually be able to find a bottom after inflation hits a peak in 3-6 months when Fed raises rates. Only then will “things become normal.”

Cutting Jobs

As global stocks slid, investors offloaded assets deemed risky, which inadvertently sparked a massive sell-off in crypto. The market saw trillions of dollars in value wiped out as a result. The ongoing volatility has destroyed both long and short positions.

Amid a weak global economic outlook, many established cryptocurrency platforms, including Coinbase, Gemini, BlockFi, and CryptoCom, have slashed their workforces, citing the dramatic shift in macroeconomic conditions. Crypto firms appear to be struggling to weather the storm.

Binance is among the handful of companies defying the current market sentiment of lay-offs and cost-cutting plans. The exchange’s chief executive recently boasted about having a “war-chest” to help the platform amid a falling crypto market. CZ even went on to say that crypto winter is a great time to hire people.

Featured Image Courtesy of Wild Digital