Polkadot Price Analysis: Here Are the Critical Liquidation Points for DOT

After breaking below the crucial 200-day moving average, Polkadot’s price has found support around the significant $6.5 mark. However, a sudden break below this pivotal support could trigger a notable cascade in the short term.

Technical Analysis

By Shayan

The Daily Chart

A detailed examination of the daily chart reveals a period of uncertainty and sideways consolidation near the critical $6.5 level. The recent price action led to a breach below the important 200-day moving average, currently standing at $7.1, signaling the dominance of sellers aiming to penetrate the $6.5 support.

In the event of a successful breach by the bears, a significant downtrend towards the crucial $5.5 support level becomes highly likely.

Conversely, should a sudden bullish shift occur, buyers will target the vital 200-day($7.1) and 100-day($8.1) moving averages in the medium term.

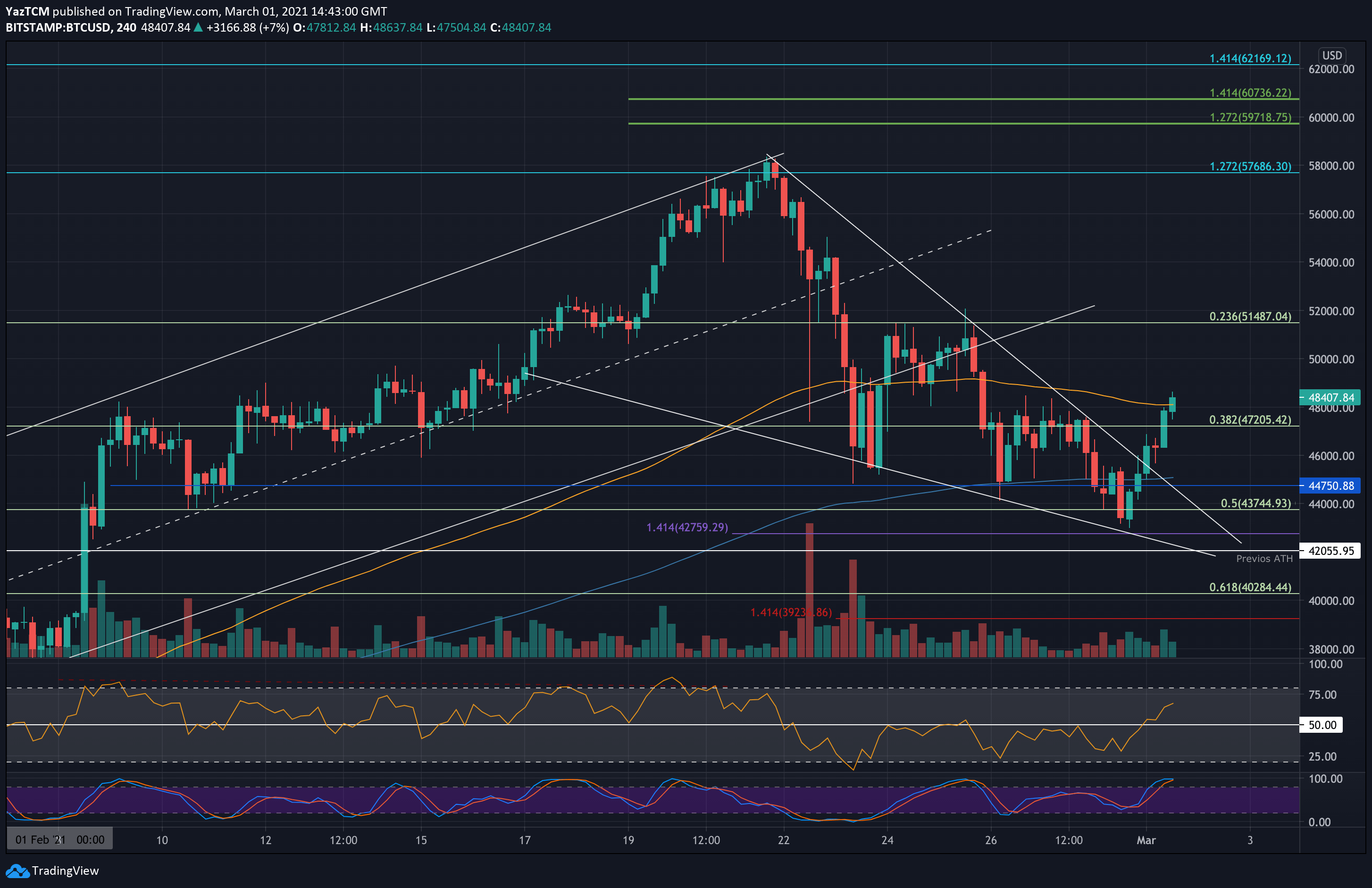

The 4-Hour Chart

Analyzing the 4-hour timeframe, it’s apparent that Polkadot’s recent uptrend encountered substantial selling pressure around the critical resistance zone defined by the 0.5 ($7.4) and 0.618 ($7.8) Fibonacci levels, resulting in a noticeable decline.

As a result, the price has embarked on a downtrend, indicating a prevailing bearish sentiment in the market.

This indicates the potential for a sustained downtrend towards the $6 support region, with price action in that area serving as the primary reference point for predicting the cryptocurrency’s future direction.

Sentiment Analysis

By Shayan

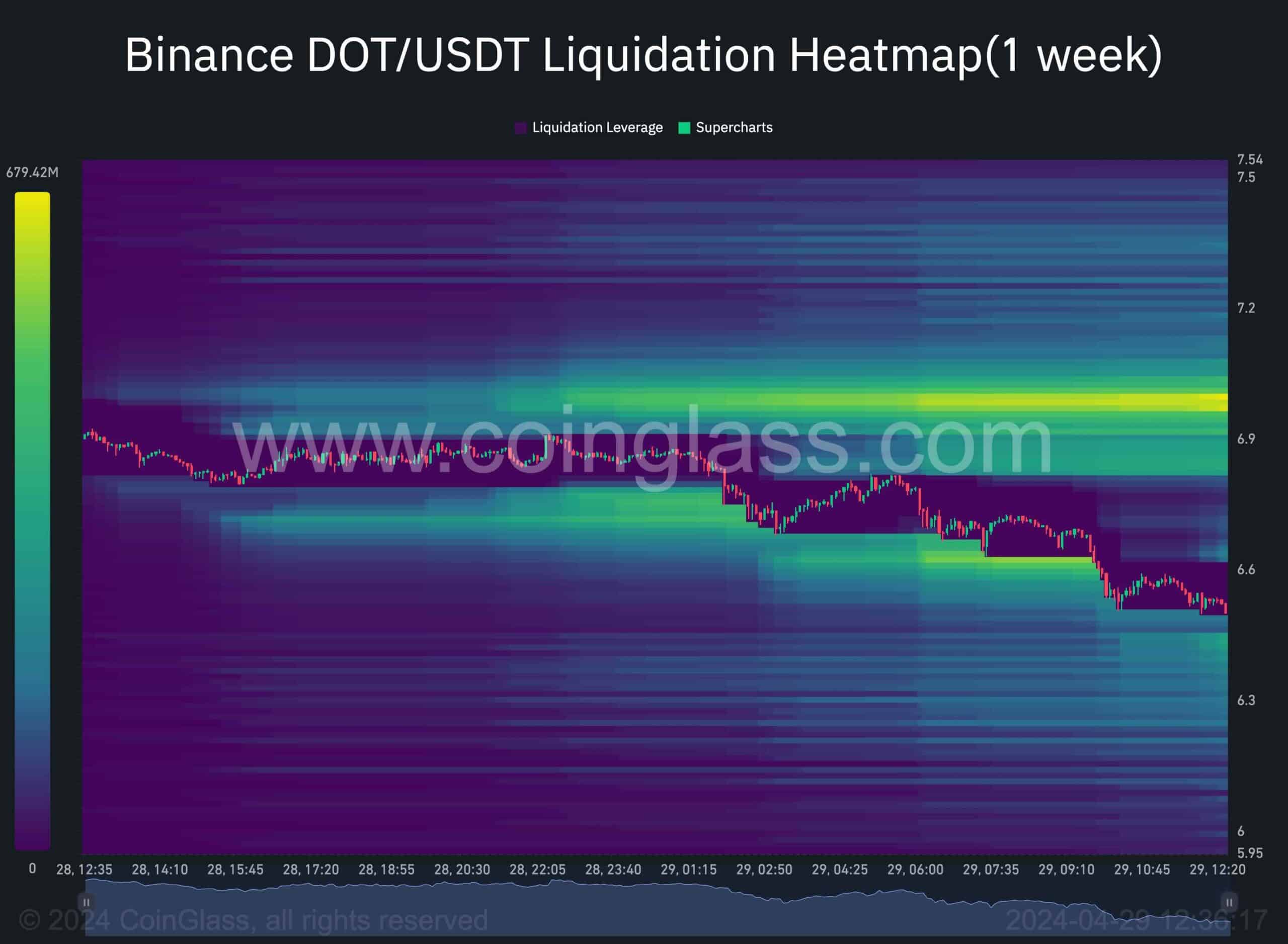

Given the recent significant downturn and the subsequent arrival at a substantial support area, traders may be eager to gauge potential future price destinations in the event of a bullish reversal. In this context, analyzing liquidity levels in the perpetual market could provide valuable insights.

The following chart illustrates the liquidation heatmap for the Binance DOT/USDT pair. This heatmap highlights price levels with notable liquidity that could potentially influence the direction of the price trend.

It’s worth noting that the recent significant plummet was largely driven by the aggressiveness of short positions. As depicted in the chart, the price region above the $6.9 threshold is accompanied by substantial liquidity in the form of buy-stop orders, rendering it a robust resistance area.

Therefore, should sufficient demand return to the market and trigger a bullish rebound, the next likely destination for Polkadot would be the price zone above the $6.9 mark.

The post Polkadot Price Analysis: Here Are the Critical Liquidation Points for DOT appeared first on CryptoPotato.