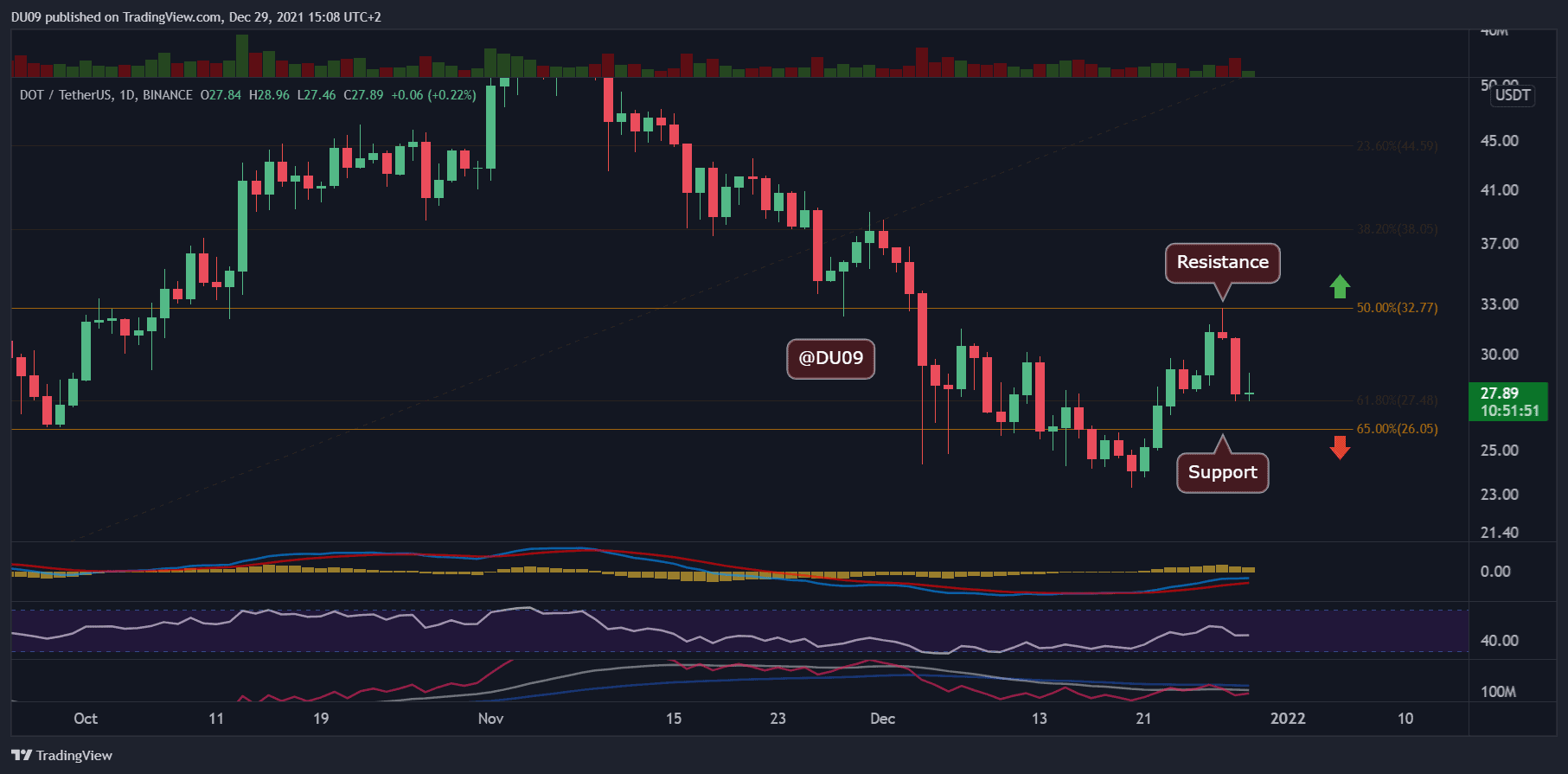

Polkadot Price Analysis: Following 8% Daily Drop, Here’s the Next Level to Consider for DOT

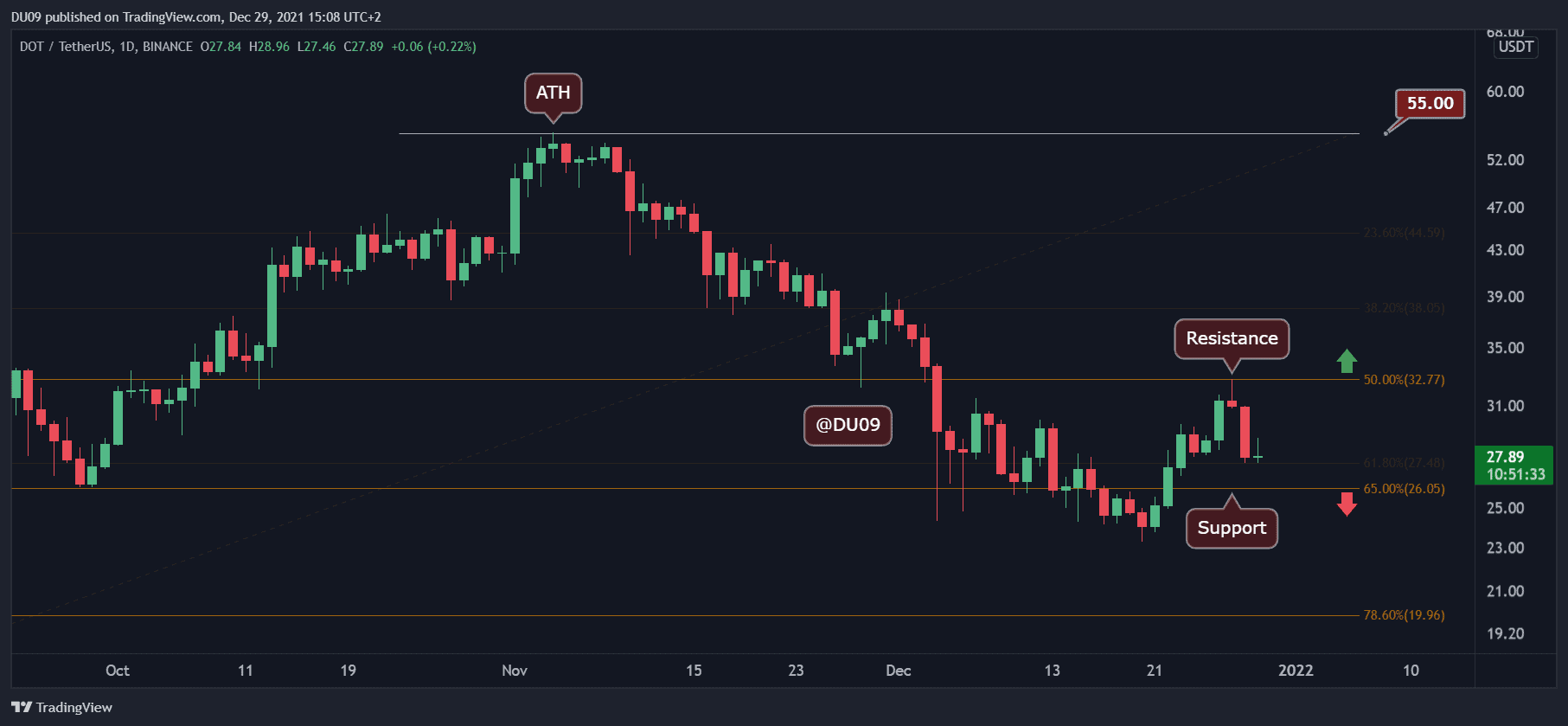

Key Support levels: $26

Key Resistance level: $33

DOT had a fantastic rally last week when the price increased by 40%. However, this week, DOT’s rally ended when the resistance at $33 rejected the price from moving higher. Today, the correction continued, and DOT has fallen under $30. The current support is found at $26.

Technical Indicators

Trading Volume: Sustained volume both during the uptrend and the current downtrend. This shows that market participants have taken quite an interest in DOT recently.

RSI: The daily RSI has made a higher high during the rally, which is a strong bullish signal. However, after the rejection at $33, the RSI is falling. This can quickly change as soon as DOT finds support.

MACD: The daily MACD is bullish, but the histogram is making lower highs after the rejection at $33. This is not concerning as long as the moving averages don’t do a bearish crossover.

Bias

The current DOT bias is neutral.

Short-Term Prediction for DOT Price

DOT had a very nice recovery last week after falling for over 40 days. It is important for the price to return to the uptrend after this correction, as otherwise, the top at $33 could be interpreted as a lower high within a larger bearish trend.