Pionex Grid Trading Bot: Crypto Exchange With Automated Trading Tools

[Featured Content]

Cryptocurrency trading is growing in popularity as the interest in digital assets, especially in Bitcoin, has skyrocketed over the past few months.

This doesn’t come as a surprise, given its parabolic increase. After all, Bitcoin’s price reached almost as high as $60,000. Moreover, various institutional funds started considering the opportunity behind BTC while major public companies already jumped on the bandwagon.

The latest to do so was Elon Musk’s Tesla. The company revealed a $1.5 billion investment in Bitcoin this January. According to the SEC filing, it even plans to potentially begin accepting BTC for its products.

With this, however, comes severe volatility, making it very challenging for regular users to benefit from the highly fluctuating price. This led to some of the major exchanges, including Huobi and KuCoin, creating their own automated trading bots.

Pionex is a pioneer in the field, and other exchanges have quickly followed their lead.

Pionex and Their Grid Trading Bots

First things first, Pionex is a cryptocurrency exchange backed by some notable investors such as Banyan Capital, BitUniverse, Shunwei Capital, and Zhenge Capital.

It has been operating for more than a year and a half and provides comprehensive trading experience, security, and a variety of different trading pairs for users to engage with.

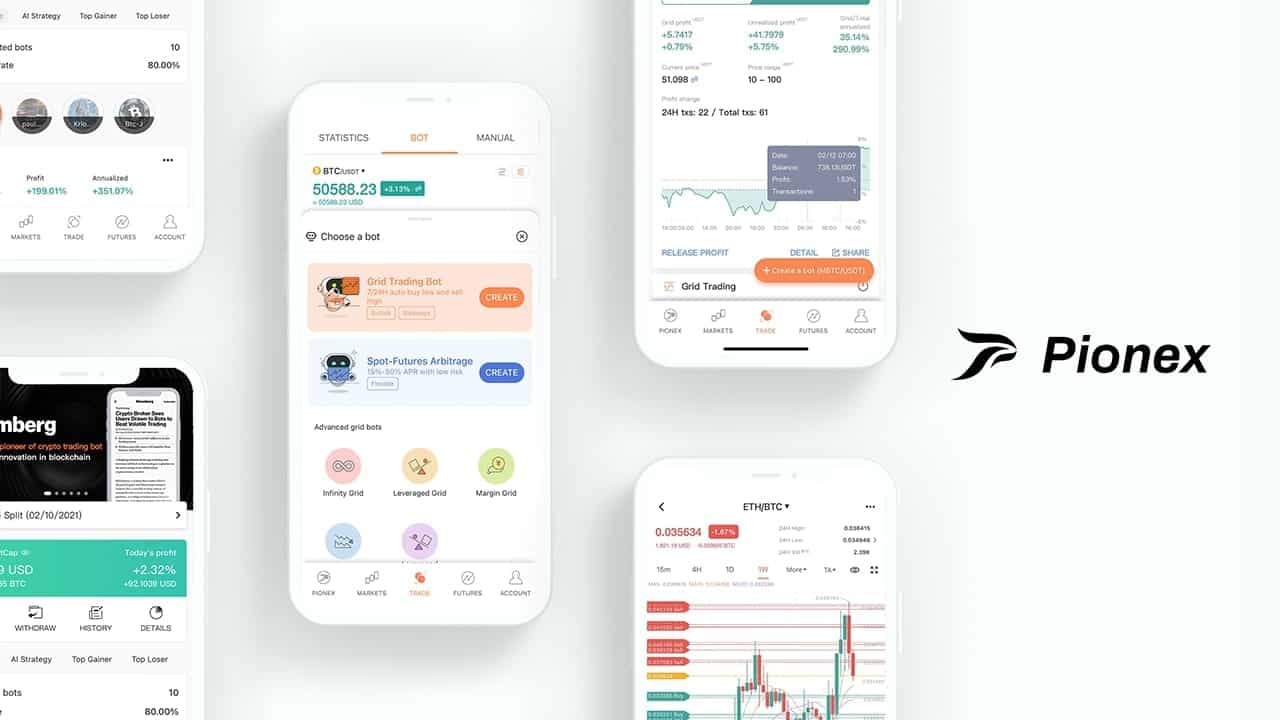

More interestingly, however, Pionex has created a number of trading bots that follow certain algorithms to make it easier for users to benefit from the volatility of the market that we’re currently seeing. This allows a semi hands-off approach where predetermined settings dictate the way the bot will function.

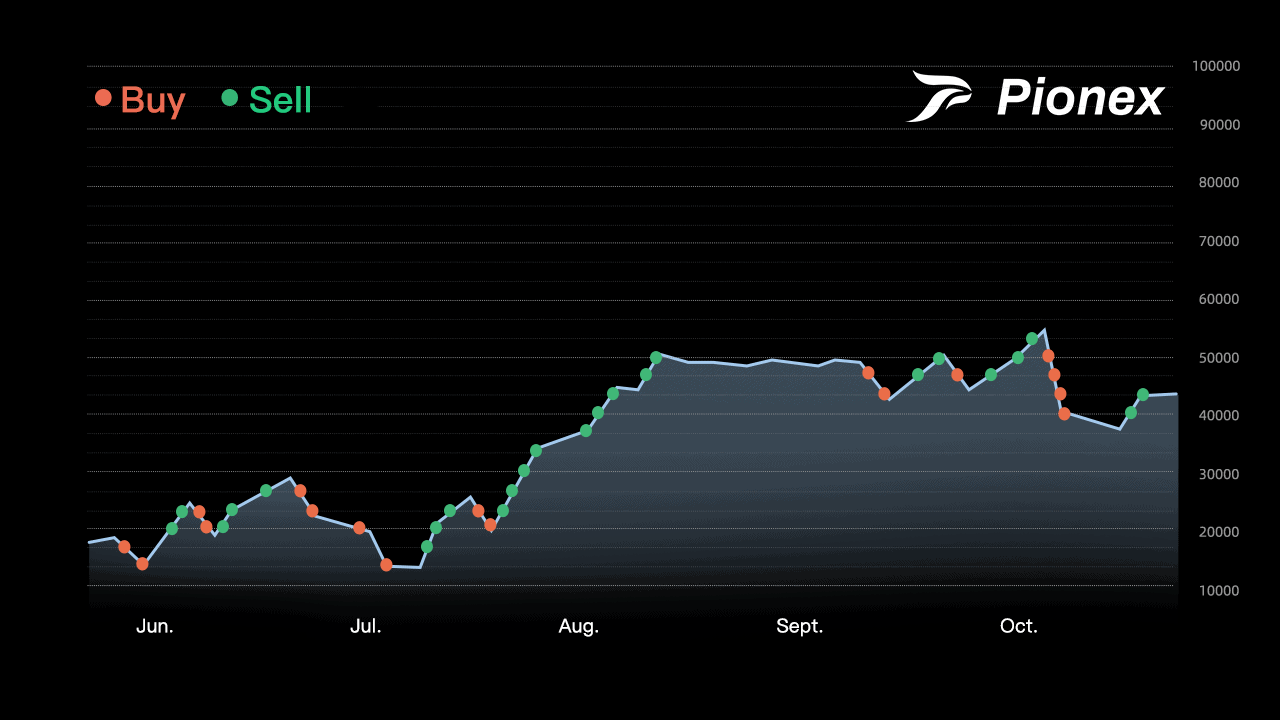

One of its flagship products is the Grid Trading Bot. The concept is that grid trading profits from the ups and the downs of the market. Users are able to set a price range for the bot and adjust how many Grids they want as long as the price stays within a certain range. The bot will always sell a portion when the price goes a bit up or buy a portion when the price goes a bit down. This is a good option to use when the market is moving sideways in a consolidation pattern.

In a sense, Grid Trading allows users to generate a stable and semi-passive income with relatively low risk in an otherwise very volatile market. It also takes the emotions out of trading, which is a very serious consideration.

A Sample Use Case

Grid trading bots are a good option for traders who want to HODL their bitcoins. They can set up a wide price range and not get shaken out by the volatility that we are observing, especially in the last few months.

It’s also worth noting that users can take advantage of 12 smart trading bots on the platform that is suitable for different situations. For instance, they can set up short-term trading bots, which means they don’t need to screen the markets and the charts all the time – the bots will take profit or stop the losses once the price hits their predetermined settings.

Pionex shared a story with CryptoPotato where a user created a grid trading bot and used it to maximize his earning potential in a way that doesn’t require constant market monitoring.

With the Grid Trading Bot, in particular, users can also opt to choose an AI Strategy or to set the bot themselves. With the former, they would be provided with a set of parameters that are calculated from backtesting the performance of the bot over the past week. This will provide them with recommended price ranges and profits per grid as a preview, and all they need to do is to choose how much of their funds they want to allocate to it.

Pionex – a Secure Environment

The team told CryptoPotato that one of the things to consider is that Pionex is a Binance broker, and most of the funds are deposited right into the Binance broker account. This is because Pionex aggregates the liquidity from Binance and Huobi.

It’s also worth noting that Pionex is amongst the first exchange venues that have a total of 12 trading bots that are free to use. Traders are able to automate their strategies 24/7 without having to check the markets constantly.