Pi Network Sinks 18% as Some Traders Rotate Into Solaxy Presale

Pi Network (PI) just took an 18% hit, and some traders aren’t sticking around to see if it recovers.

Instead, they’re rotating into the Solaxy (SOLX) presale, drawn in by its promise of faster transactions and lower fees on Solana.

But is this a smart move or just another case of chasing hype?

Pi Network Slides to $1.12 – Is There Any Hope for a Rebound?

Pi Network is currently facing some big challenges.

The token is now hovering around $1.12 – its lowest price since February 22.

It’s also broken below key support at $1.25, a level that had held up on two previous occasions, suggesting that sellers are firmly in control.

With PI now down 62% from its all-time high on February 26, its market cap has shrunk to $7.7 billion, and there’s little sign of a reversal.

Spot trading volumes remain high, but that’s likely due to traders offloading rather than buying the dip.

Plus, PI’s technicals remain weak.

PI is stuck in a descending channel on the 4-hour chart, reinforcing the bearish trend.

Open interest is also down 9% in the past day, meaning that even leveraged traders are pulling back.

All of these factors point to bears having the upper hand, and unless buyers step in soon, the downtrend could drag on into April.

Why Pi Network Is Crashing – The Key Factors Driving the Sell-Off

Pi Network’s sell-off isn’t random – it’s driven by several factors that have traders heading for the exits.

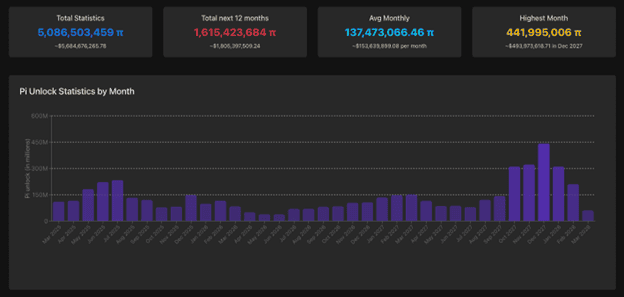

One of the biggest drivers is the recent wave of token unlocks, which have flooded the market with new supply.

More tokens in circulation usually means lower prices, especially if demand isn’t strong enough to absorb the extra selling pressure.

And right now, demand doesn’t seem to be keeping up.

The recent KYC deadline on March 14 has only added to the uncertainty.

Miners who failed to complete verification may have lost access to their tokens or been locked out of the mainnet migration, triggering panic selling.

Meanwhile, Pi Network’s failure to secure a Binance listing – despite strong support – has further shaken confidence.

And let’s not forget the early adopters who mined PI for years; many are likely choosing to take profits now.

With selling pressure ramping up and no immediate catalysts for a rebound, traders are understandably pessimistic about Pi Network’s prospects.

It’s another example of how even a project with a passionate community can stumble under the weight of supply shocks and unmet expectations.

Solaxy Layer-2 Gains Momentum as Traders Hunt for the Next Big Opportunity

For traders rotating out of Pi Network, Solaxy presents a different kind of opportunity – one rooted in solving real issues in the blockchain space.

As Solana’s first Layer-2 scaling solution, Solaxy aims to fix the network congestion and transaction failures that have hampered Solana users, especially during meme coin frenzies.

The project is gaining traction quickly, having already raised $26.8 million in its presale, which shows strong investor confidence.

Solaxy’s setup is relatively simple.

It processes transactions off-chain and settles them back onto Solana in batches, similar to how Ethereum’s Arbitrum and Optimism operate.

This approach reduces strain on Solana’s mainnet, improving speed and lowering fees – two things traders and developers are looking for.

On top of that, Solaxy has a staking app for its native SOL token, offering APYs of 152%.

So far, over 7.5 billion SOLX tokens have been locked up.

The experts at 99Bitcoins, known for their sharp crypto analysis, have praised Solaxy’s potential – claiming it could explode after it lists on a DEX.

They also highlighted Solaxy’s growing presence on X (Twitter) and Telegram.

While Pi Network struggles with confidence issues, it seems investors are choosing to grab SOLX tokens instead.

The question now is whether Solaxy can deliver on its promises and transform Solana’s ecosystem for good.

Visit Solaxy Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post Pi Network Sinks 18% as Some Traders Rotate Into Solaxy Presale appeared first on CryptoPotato.