Philippines Crypto Adoption: 10% of Filipino Adults Hold Account On The Largest Local Exchange

Crypto adoption in the Philippines is undoubtedly on the rise. Coins.ph, a leading cryptocurrency exchange in the Philippines, has recently acquired over 5 million users onto its crypto platform. Founded in 2014, the digital wallet and payments application provides unbanked customers with much-needed financial services including paying bills and buying digital assets.

Coins.ph allow its customers to manage a myriad of online payments through its mobile app. In some cases, the platform even provides monetary rewards for utilizing its services. For example, users can load their SIM cards with credit via the app, earning a 10% rebate with every purchase. Similarly, Coins.ph customers can pay their bills—from utilities to insurance to tuition and more – using the app, earning instant rewards for every bill paid within the ecosystem.

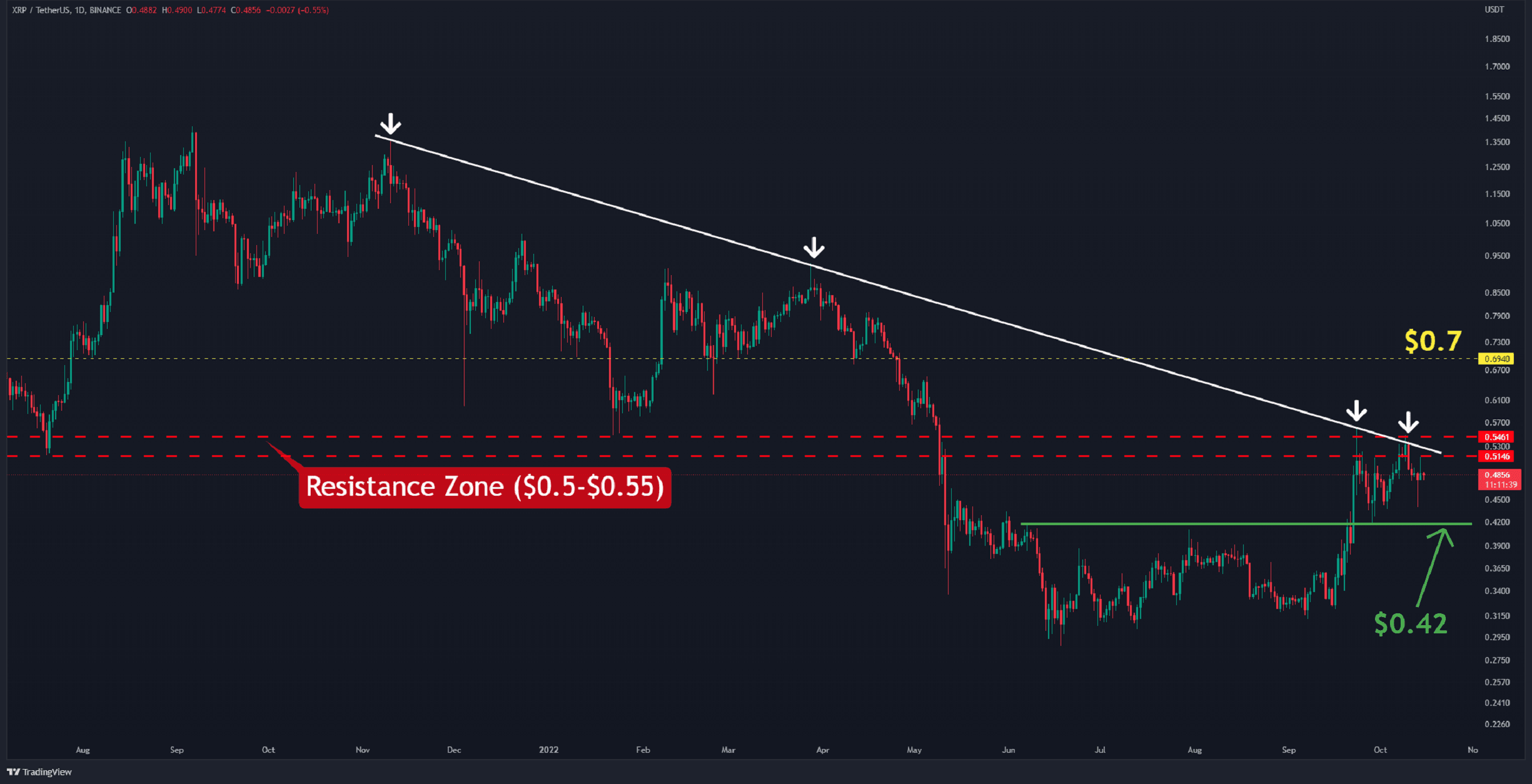

Speaking about the company’s vision, Ron Hose, CEO and founder of Coins.ph, emphasized that the focus of the app is to allow financial inclusion to Filipinos nationwide. Its users enjoy low-cost and speedy international payments thanks to the underlying blockchain technology. Currently, the platform supports Bitcoin, Ethereum, Bitcoin Cash, and XRP.

Validating a Practical Need for Cryptocurrencies Among the Filipinos Workers

This milestone of achieving five million users is significant due to the fact that it validates a commonly discussed use case for blockchain technology: Bringing financial services to the unbanked.

Given that about 77% of Filipinos do not have bank accounts, primarily due to reasons of inaccessibility such as a lack of necessary documentation or inadequate funds, it seems logical that 10% of Filipino adults are turning to cryptocurrency as a payments solution.

And the performance of Coins.ph is not the only indicator of cryptocurrency adoption in the Philippines. According to Joseph Lubin, co-founder of Ethereum, the Philippines and Chile are the leading adopters of Ether usage around the globe. Moreover, studies are being conducted to identify potential efficiencies in using cryptocurrencies versus traditional means like Western Union, to execute Overseas Filipino Workers (OFW) remittance transactions (the ongoing payments from Filipinos working abroad to their families in the Philippines).

As data continues to reinforce a rising cryptocurrency adoption rate in developing countries such as the Philippines, it reminds us that people are already finding practical uses for cryptocurrency today—despite the overarching speculation surrounding the digital currencies.

The post Philippines Crypto Adoption: 10% of Filipino Adults Hold Account On The Largest Local Exchange appeared first on CryptoPotato.