Peer-To-Peer Bitcoin Trading Rising Across Africa

The conditions for growth are ripe as the continent embraces the freedom of Bitcoin.

Bitcoin was developed with the intent of putting financial control back in the hands of the people. In the years since its inception, Bitcoin adoption has grown worldwide. Recently, there has been a sharp increase in peer-to-peer bitcoin trading across Africa.

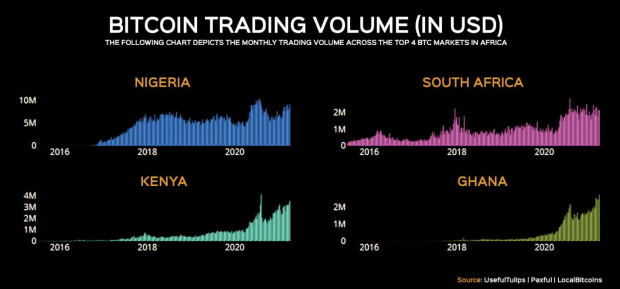

According to data from UsefulTulips, Ghana and Kenya have seen a steady increase in bitcoin trading, overtaking South Africa to become the second- and third-leading cryptocurrency markets in Africa during the first quarter of 2021. Nigeria, which recently saw a government crackdown on bitcoin, still leads the continent in bitcoin trading volume.

Trading volume in Nigeria surpassed $99.1 million between January and March 2021, followed by Kenya with $38.4 million, Ghana with $27.4 million and South Africa with $25.8 million. In 2020, Nigeria had a record-breaking $309 million in bitcoin trading volume, more than three times that of South Africa’s $98.4 million for the year.

The rise in volume in Ghana and Kenya can be attributed to favorable regulatory environments. Ghana’s Central Bank introduced regulations benefitting Bitcoin companies and startups, and the Central Bank of Kenya is reportedly considering adopting bitcoin as its reserve currency, likely fuelled by recent large investments in bitcoin by companies such as MicroStrategy and Tesla, which solidified its use as a store of value.

Meanwhile, the Nigerian government has instituted a nationwide crackdown on cryptocurrencies in recent months, as the Central Bank of Nigeria banned banks from processing bitcoin-related transactions. The South African government has also criticised Bitcoin after the recent collapse of the global Mirror Trading International Ponzi scheme, which was based in the country.

African citizens’ appetite for bitcoin has grown in recent years as financial uncertainty, rising poverty, government corruption and depreciating currencies have pushed individuals across the continent to look for more stable investments. The current global pandemic and recent surge in bitcoin’s value may have been factors as well.

This is a guest post by Dion Giullaume. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.