Payroll Startup Rise Wins CoinDesk’s 2023 Pitchfest Contest

:format(jpg)/www.coindesk.com/resizer/Kp7K_kPq5E-t22ZbSPqw4PxH5hQ=/arc-photo-coindesk/arc2-prod/public/PG6NFPSFJVA5ZFDD46E343XSR4.png)

Anna Baydakova is an investigative reporter with a special focus on Eastern Europe and Russia. Anna owns BTC and an NFT.

Getting your paycheck in crypto? The younger the employees are, the more likely they are to favor this idea, research shows. Rise, a Ohio-based startup, targets companies that want to give their workers flexibility between fiat and crypto salary payouts. The project won CoinDesk’s PitchFest contest during the 2023 Consensus conference.

According to a 2021 survey by the financial advisor company deVere, over a third millennials and half of Gen Z employees would like to receive 50% of their paychecks in crypto. There is already a range of startups, like Bitwage, that help companies process their payroll in crypto, but Rise adds a new twist: it allows both companies and workers to choose whether they want to work with crypto or fiat and use smart contracts for instant payments.

More than 600 crypto, blockchain, and Web 3 startups applied to CoinDesk’s PitchFest. A selection team, made up of investors from Electric Capital, CapitalG and CoinFund and others picked 12 finalists, who flew to Consensus in Austin to duke it out on-stage. Through three semi-finals and a closely-contested final, the judges picked Rise as the winner.

Rise started as a marketplace for companies and contractors in crypto in Jan. 2021, but soon it was clear that this audience needs not a new LinkedIn but rather, tools for complaint crypto payments, Rise co-founder and CEO Hugo Finkelstein told CoinDesk in an interview.

“They already knew their workers and did not need new connections, they needed payment infrastructure and compliance component that would make their life easier,” he said.

Rise CEO Hugo Finkelstein pitching at Consensus 2023.

In June last year, Rise pivoted to a paycheck service, and in Oct. 2022, the company raised pre-seed funding with investors including JAM Fund by the Tinder co-founder Justin Mateen.

In April 2023, Rise launched the current version of its platform and closed a $3.8 million seed round led by Sino Global Capital and Polymorphic Capital, with participation from Draper Associates, Hashkey Capital, Paradigm Shift Capital, WW Ventures, P2P and Cosmo Capital, the company said in a press release.

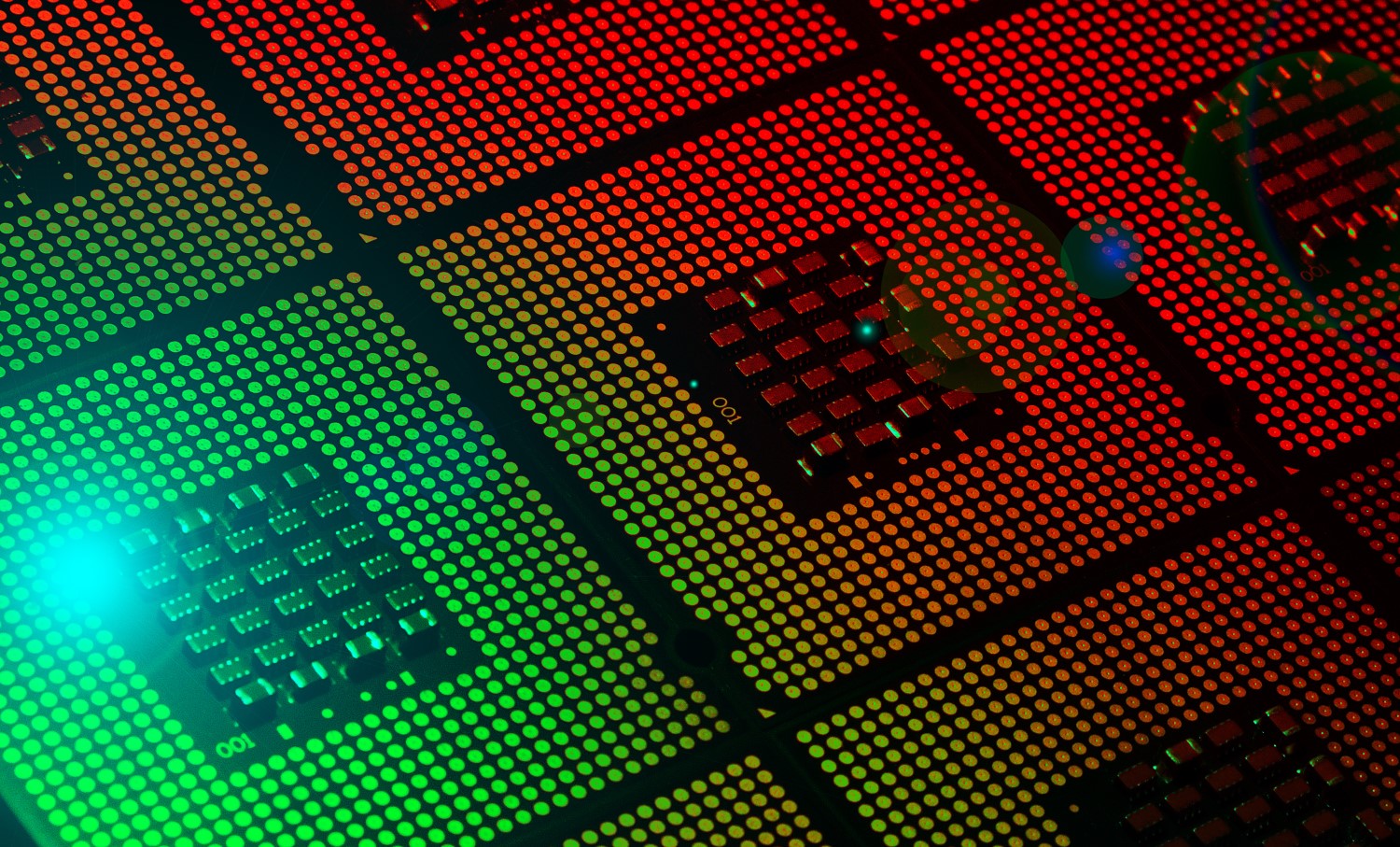

The company claims it can facilitate contractor fees payments in 90 fiat currencies and 100 cryptocurrencies on Ethereum and Ethereum compatible blockchains Arbitrum, Polygon, Optimism and Avalanche. The platform is built on the Arbitrum blockchain and currently supports 50 smart contracts that interact with each other and facilitate processes like approving new users, distributing payments, etc. Bitcoin is not currently supported but is on the roadmap, Finkelstein said.

It works this way: a company enrolls with Rise and funds an account with either fiat or crypto, whatever it prefers to use for payroll. The contractors it hires, in turn, can choose whether they want to receive a transfer to their bank account or some crypto to their account, or both, in a certain proportion.

For now, the service is only available for contractors, but in the coming months, Rise is planning to launch an employer of record service, which would allow companies to use for full-time staff salaries, by outsourcing their HR and payroll work to it.

Rise has already onboarded 500 contractors and 70 companies, which have sent over $10 million in payments via the platform so far. The project is aiming to grow tenfold by the end of this year, Finkelstein said. After registering as a money service business, the team of 30 people is now working on getting money transmitting licenses in some U.S. states, as well as local licenses in Europe, Finkelstein added.

At the moment, the service is available in 190 countries, he said. In the U.S., Rise also provides clients with tax documentation needed to report to the IRS, and similar functionality is being planned for other jurisdictions, too.

To be sure, there is a fair amount of competition in the field Rise is building its business in, with companies like Bitwage, DEEL, Request, Remote, ADP and Utopia, offering fiat and crypto payroll services through U.S.-based exchanges, mostly Coinbase (Rise is not disclosing their crypto broker for now). Some of these services have already onboarded thousands of users, but Finkelstein believes the market is big enough for everyone as more and more companies are getting interested in using crypto for payroll. Current clients of Rise include the Ethereum staking protocol Lido and the DAO governance platform Aragon.

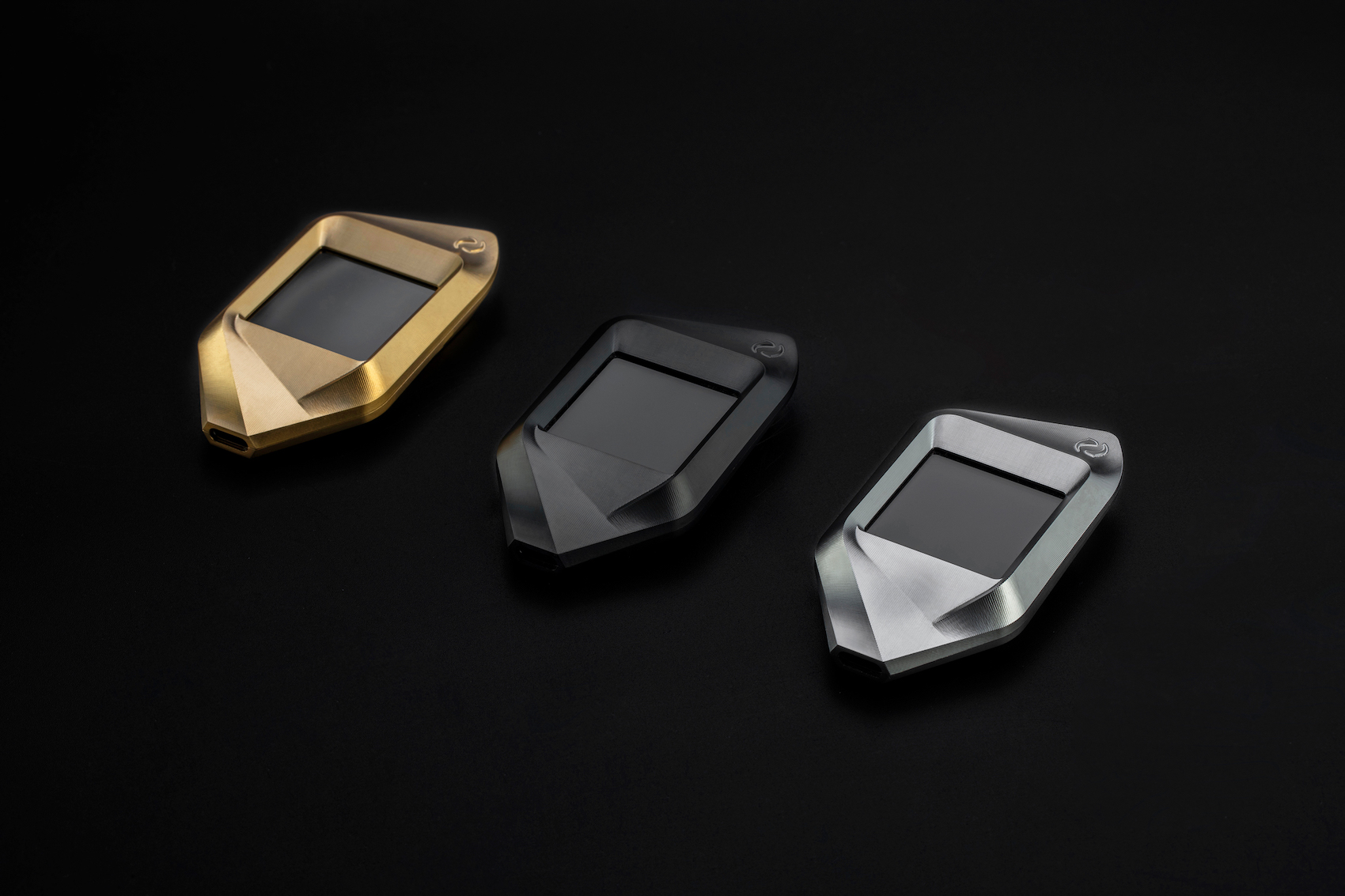

Rise hopes to compete by the breadth of cryptocurrency options and some other features designed to make it easier for companies to pay workers in crypto. For example, each contractor on Rise gets a Rise ID – an ERC-725 non-fungible token (NFT) containing information on this contractor’s KYC status, work and payments history. Users can authorize the use of this token with various crypto wallets and other services.

Rise is also planning to expand its services into the decentralized finance (DeFi) space, offering what it calls “High Yield” accounts to allow users take advantage of the DeFi interest-generating products. This feature is not live yet as the team has been focused on other tasks, Finkelstein said, admitting that the current regulatory environment also has not been conducive for yield generating products on blockchain.

Prior to co-founding Rise in 2019 with Andrew Maurer, Finkelstein worked as a head of marketing at the institutional crypto exchange LGO (before it was acquired by Voyager in 2020) and also as a venture growth analyst at SeedInvest.

CoinDesk plans to continue its PitchFest at Consensus 2024, spotlighting promising early-stage startups from across the global industry.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Kp7K_kPq5E-t22ZbSPqw4PxH5hQ=/arc-photo-coindesk/arc2-prod/public/PG6NFPSFJVA5ZFDD46E343XSR4.png)

Anna Baydakova is an investigative reporter with a special focus on Eastern Europe and Russia. Anna owns BTC and an NFT.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Kp7K_kPq5E-t22ZbSPqw4PxH5hQ=/arc-photo-coindesk/arc2-prod/public/PG6NFPSFJVA5ZFDD46E343XSR4.png)

Anna Baydakova is an investigative reporter with a special focus on Eastern Europe and Russia. Anna owns BTC and an NFT.