PayPal and Square Are Buying Every New Mined Bitcoin… And More

When Bill Harris, former CEO of PayPal, described Bitcoin as “the greatest scam in history” in an article for Vox, the last thing that would come to his mind was the role his company would play in the global adoption of this cryptocurrency.

This was in 2018, just when Bitcoin was on a major bearish trend. The bubble —as Harris described it— exploded. But things changed, a new CEO replaced Harris and Bitcoin’s price slowly recovered. Well, slowly until PayPal jumped on the Bitcoin Wagon.

According to a report published by Pantera Capital, PayPal’s foray with Bitcoin has been crucial to its recent bullish rally.

PayPal Makes Bitcoin Simple

It all seems to come down to how PayPal adapts its philosophy to the crypto-verse, making crypto incredibly easy to adopt. According to Pantera Capital, the simplicity with which PayPal offers its crypto services has had a “huge impact” on the public perception of Bitcoin and on the adoption of other cryptocurrencies:

“Previously, the friction to buy bitcoin was pretty onerous: take a selfie with your passport, wait days to a week to get activated, daily limits. Three hundred million people just got instant access to Bitcoin, Ethereum, and other cryptocurrencies.

BOOM! the results are already apparent.”

PayPal’s user base also plays an essential role in favor. According to Pantera Capital, PayPal’s 300 million accounts are 3 to 1 higher than today’s number of Bitcoin addresses.

This makes it easy for many people to jump into Bitcoin. In fact, Pantera Capital believes this interest of large fintechs in crypto is a new phenomenon on its own. That’s why companies like PayPal, Cashapp, and Robinhood are so important for this bull run that many consider to be more stable than that of 2017.

Buy Them, Buy Them All!

Another cause of the rally could be PayPal’s current voracious appetite for Bitcoin and other tokens.

According to Pantera; PayPal and Cash App are buying so much Bitcoin that they could be causing a shortage in the market, directly contributing to pushing the prices up.

Pantera Capital’s estimations are impressive, and if valid, there would be less and less Bitcoin available to trade as time goes by:

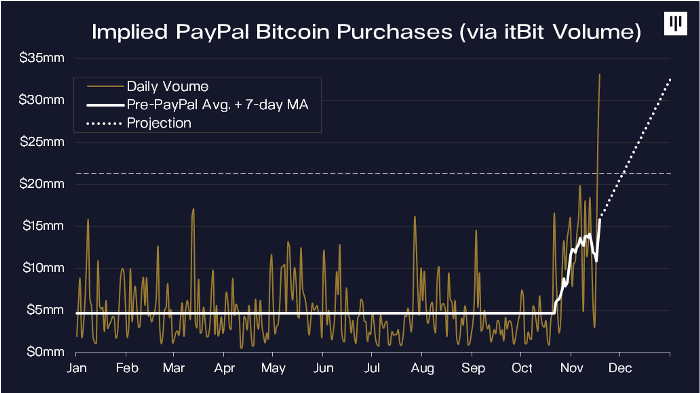

When PayPal went live, volume started exploding. The increase in itBit volume implies that within four weeks of going live, PayPal is already buying almost 70% of the new supply of bitcoins.

PayPal and Cash App are already buying more than 100% of all newly-issued bitcoins.

In a previous report, Pantera Capital estimated that Cash App was buying about 40% of all newly-issued bitcoins that miners put into circulation.

Adding this 40% bought by CashApp to the 70% that PayPal is buying reveals that both companies are getting 110% of all new Bitcoins, generating a shortage of 10% of all newly mined coins.

And although PayPal is already receiving criticism from prominent bitcoiners, it is still making them 62% richer thanks to the price movement.