Overstock’s tZERO Patents Tech for Recording Trades on Public Blockchains

Security token trading platform tZERO has been awarded a patent for a way of recording trading data on public blockchains.

The company, a subsidiary of retail giant Overstock, announced Tuesday that the patent for its new tech, dubbed “Time Ordered Merkle Epoch (TOME) methodology,” had been awarded by the U.S. Patent and Trademark Office.

The firm explains:

“TOME is a base-layer technology that uses digital signatures to record and verify time-series data such as trades, executions and settlements. This technology enables low-latency systems, including traditional matching engines or private blockchain ledgers, to be anchored into immutable public blockchain ledgers,” the company’s announcement says.

The technology will allow tZERO to record trades as hashes anchored on a public blockchain, verify previous trades and keep an immutable record of the transactions on its platform, according to the announcement.

The method, tZERO CEO Saum Noursalehi said, “can be used in our suite of products, as well as licensed to companies across various industries that are seeking to maintain a tamper-proof and auditable record of time-series-based data.”

It can also link the settlement of tokenized securities on a public blockchain with legacy trading systems and anchor data about the resulting on-chain settlements into public blockchains, the company said.

“For example, off-chain trade data and on-chain settlement data occurring on an Ethereum mainnet can be combined and anchored into the Bitcoin blockchain for added resiliency, security and transparency,” tZERO explained.

TZERO, launched for trading in January, is designed as an alternative trading system (ATS), a limited version of a securities exchange to trading tokenized private equity. It started with its native equity token, tZERO Preferred (TZEROP), with ambitions to be an issuance platform for other companies that want to tokenize their securities.

So far, the second token that was made available on the platform is Overstock’s own digital stock, the Digital Voting Series A-1 Preferred Stock, previously known as Blockchain Voting Series A Preferred Stock, or OSTKP — an early blockchain experiment by Overstock issued back in 2016.

The platform has so far seen meager trading volumes, as only the accredited investors could register and only one token has been available to trade. However, this month, the lock-up period for TZEROP tokens (issued under Regulation D) expires, at which point retail investors will be allowed access to the asset.

Overstock CEO Patrick Byrne previously told CoinDesk he expected to see a boost in trading activity on tZERO after that point.

On August 8, Overstock will conduct a Q2 earnings call where the Overstock and tZERO leadership will share the company’s current state and future plans.

The company has previously won a similar patent outlining how it could merge legacy trading systems with cryptocurrencies and digital asset tech.

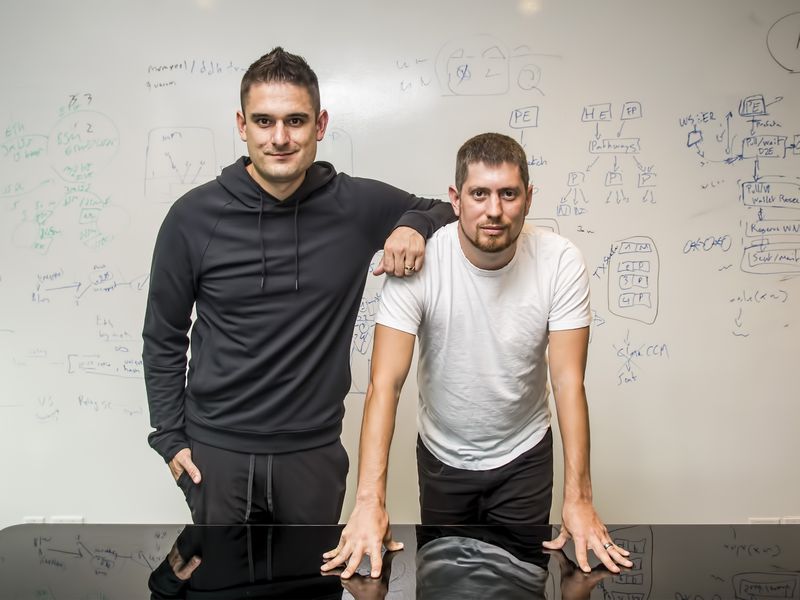

Overstock CEO Patrick Byrne image via CoinDesk archives