Over $700 Million Liquidated as Terra (LUNA) Crashes Below $1

Terra continues to lead the market-wide correction as LUNA has plummeted below $1, meaning a weekly drop of almost 99%. Bitcoin and the altcoins are also in the red, with the total liquidations exceeding $700 million on a daily scale.

- CryptoPotato reported earlier today that the cumulative market capitalization of all cryptocurrency assets had lost over $400 billion in less than a week, dropping to a 10-month low of $1.350 trillion.

- The landscape has only worsened since then as BTC failed at $31,000 and started dumping once more. Minutes ago, the primary cryptocurrency charted its latest low since July 2021 of $29,000 (on Bitstamp).

- As it typically happens, the altcoins are in no better shape. Just the opposite, Ethereum is down by 10% to below $2,200, BNB is beneath $300 (-15%), While Solana, Avalanche, Polkadot, Dogecoin, and many others have lost over 20% on a daily scale.

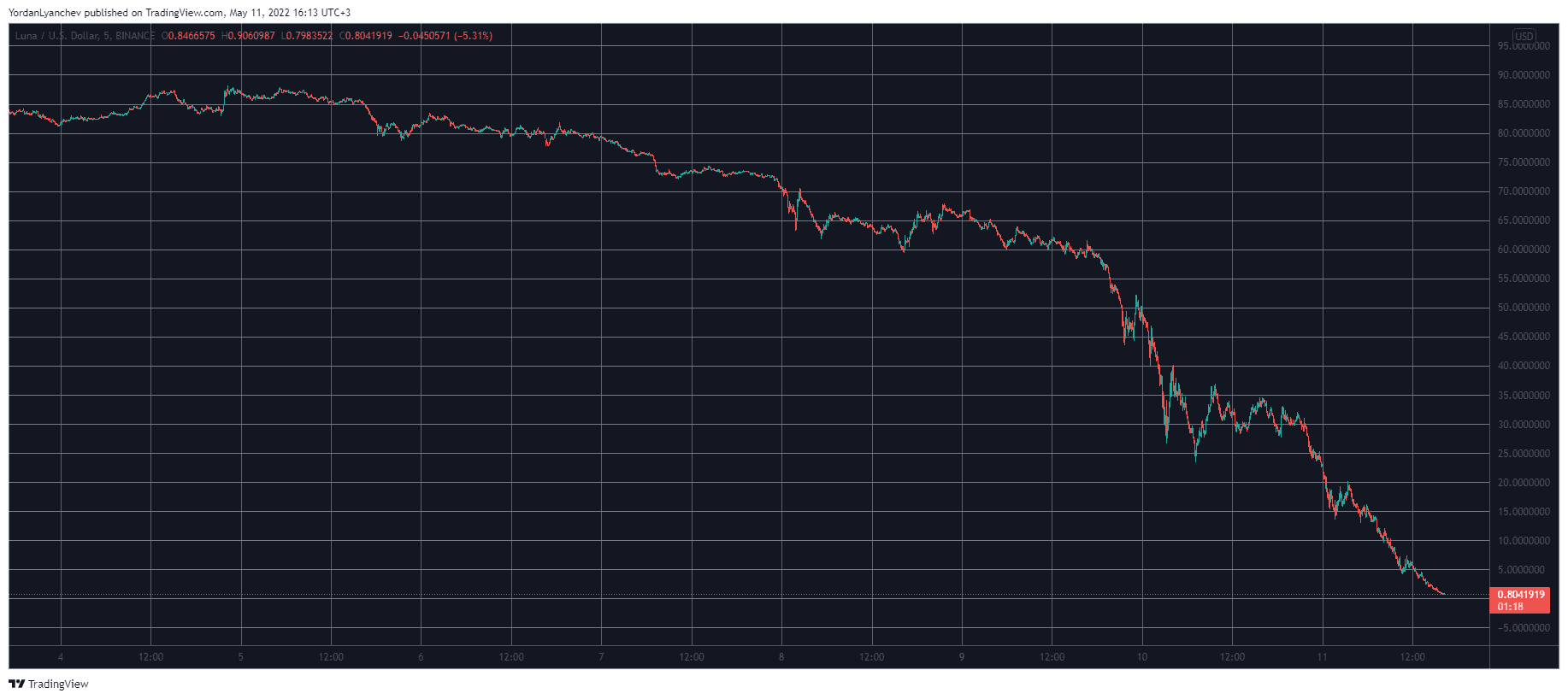

- Yet, no other coin has suffered as much as Terra’s native cryptocurrency – LUNA. The saga that unfolded in the past week or so, leading to UST de-pegging from its supposed price of $1, meant that users could profit by arbitraging LUNA.

- Thus, the selling pressure propelled a massive price slump for LUNA, which dumped below $1 earlier today. Just for reference, the asset traded at $90 six days ago. This means it has lost about 99% of its value in less than a week.

- Naturally, this enhanced volatility caused mass pain for over-leveraged crypto traders, with the total liquidations skyrocketing to over $700 million on a 24-hour scale. The number of liquidated trades is close to 300,000, and the largest single liquidated order transpired on Binance worth $20 million (ETH-USDT).