Over $375 Million ETH Shorts Liquidated in a Day as Ethereum Tapped $3,450

Ethereum’s latest price pump to a fresh all-time high at $3,450 has caused substantial losses for bears. On-chain data reveals a new record in terms of liquidations of short position on all derivatives exchanges worth more than $375 million in the past day alone.

ETH Causes Mass Pain for Bears

The price of the second-largest cryptocurrency has been making headlines lately with consecutive all-time high records. The token has increased by roughly 350% since the start of the year, and its bull run only intensified as it entered May.

ETH traded at $2,750 at that point, but it broke above $3,000 for the first time in the following 48 hours. The cryptocurrency wasn’t satisfied with taking down this round-numbered milestone and continued upwards to its latest all-time high of over $3,450 marked hours ago.

The analytics resource CryptoQuant highlighted the pain ETH’s latest price surge caused to bears. The firm said that the number of short liquidations across all derivatives exchanges hit an all-time high. According to Bybt, liquidations in the past 24 hours stand at over $520 million, where the overwhelming majority of it were short positions.

It’s worth noting that CryptoQuant’s data only shows results from two perpetual futures contract pairs – ETH/USD and ETH/USDT.

Bybt shows that the liquidations were all across the cryptocurrency market following the enhanced volatility for most assets. Ultimately, over 140,000 traders were liquidated in the past 24 hours, and the total amount is close to $1.5 billion.

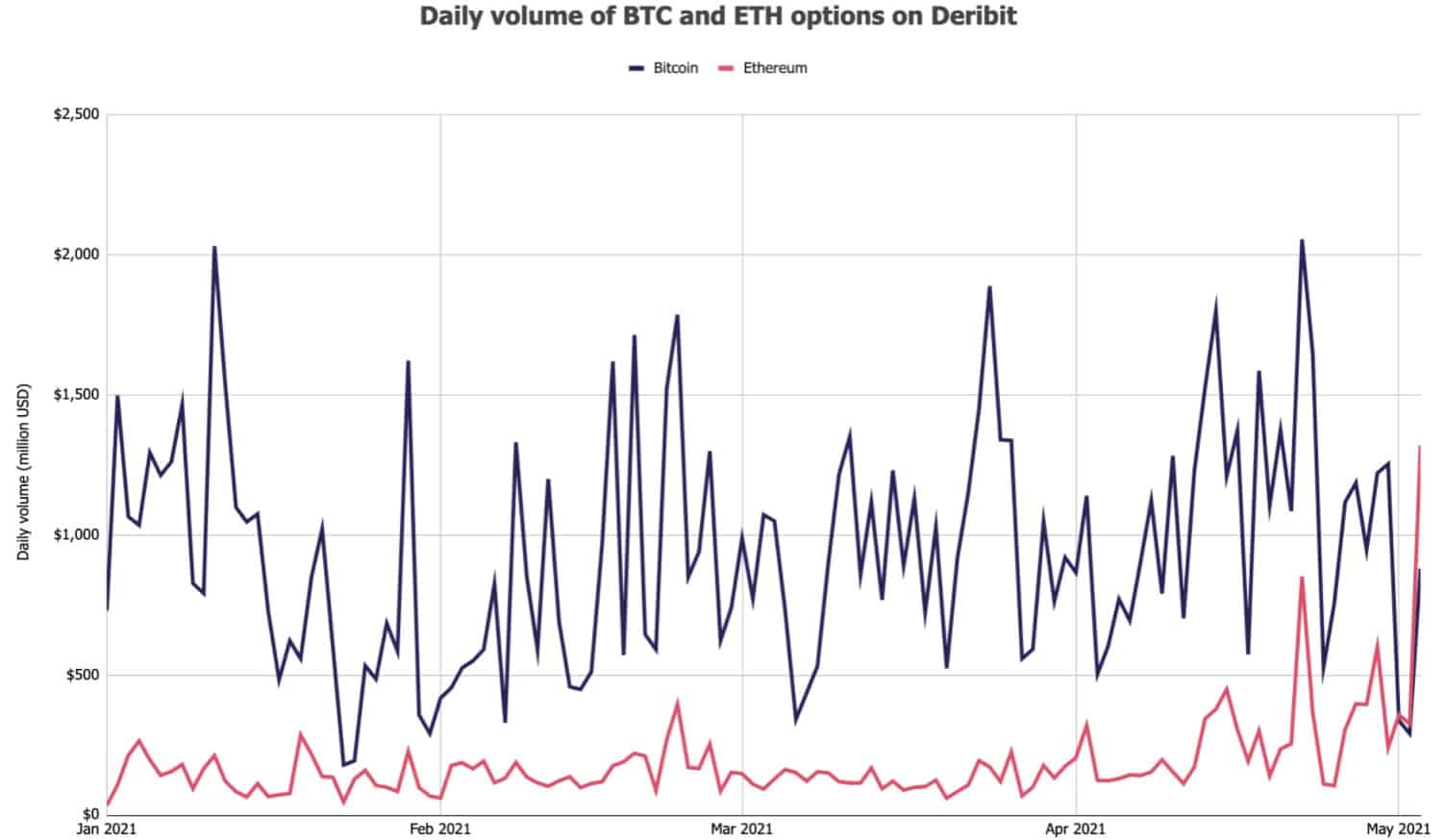

ETH Volume on Deribit Higher than BTC

According to further data from Skew, investors have become increasingly more interested in trading Ethereum than Bitcoin, at least on the crypto exchange Deribit. The ether (ETH) options trading volume surpassed that of BTC for the first time.

The Panama City-based cryptocurrency trading platform confirmed the flippening on Twitter but remained impartial on the development by saying, “we have no opinion.”