Over $26M Worth of Bitcoin Associated With 2016 Bitfinex Hack Is on the Move

Over $26 million worth of bitcoin (BTC) associated with the massive 2016 hack of crypto exchange Bitfinex was moved around across seven transactions on Wednesday, according to Twitter-based blockchain tracker bot Whale Alert.

- The security breach at Bitfinex in August 2016 led to the theft of over 120,000 BTC (worth approximately $1.2 billion today). Similar movements of stolen funds were also reported in July.

- Six of the transactions flagged by Whale Alert ranged between $4.1 million and $4.8 million, with one for a relatively small amount of $12,000.

Related Posts

Defi Giant Aave Rakes in $6M in Revenue as Crypto Market Plunges

$350 million worth of DeFi positions were liquidated during the market sell-off. Aave secured $6 million in revenue from processing on-chain liquidations. One $7.4 million WETH position was liquidated, providing Aave with $802,000 in revenue. 11:52 Bitcoin ETFs Are Still 'Wildly Successful': Kraken Head of Strategy 11:52 Bitcoin ETFs Are Still 'Wildly Successful': Kraken Head

$9,650: Bitcoin Price Dips Below Key Long-Term Support

news View Bitcoin has dipped beneath the 100-day moving average, potentially opening the doors to support near $8,500 if the bulls can’t keep prices above the MA. Total weekly volume for the bears is lower than expected, offering a small hope for a bullish rebound. Price would need a firm close above the 100-day MA…

Coinbase Is Down, Experiencing ‘Connectivity Issues’

LatestOpinionFeaturesVideosMarketsGet the Latest from CoinDeskSign up for our newsletterMoney ReimaginedFirst MoverCrypto Long & ShortBlockchain BitesBy signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policyPlease enter a valid email addressTechBusinessPolicy & RegulationPeopleBitcoinDogecoinEtherEthereumJPMorganMarketsNewslettersOpinionStellarXRPBitcoin 101Blockchain 101Ethereum 101Trading 101All 101 Guides0x (ZRX)CosmosGemini DollarZcashGrinSee allVision HillCryptoCompareGDA CapitalFundstratThe TIESee allAnthony…

Central Banks Are Privacy Providers of Last Resort

Jul 30, 2020 at 14:31 UTCCentral Banks Are Privacy Providers of Last ResortJ.P. Koning, a CoinDesk columnist, worked as an equity researcher at a Canadian brokerage firm and is a financial writer at a large Canadian bank. He runs the popular Moneyness blog. Have central banks quietly pivoted to becoming consumer privacy advocates? It certainly seems like…

Have the Hedge Funds Infiltrated Reddit’s WallStreetBets?

The media keeps saying WallStreetBets is going after silver; WallStreetBets members say it’s a campaign to co-opt and divide them. This episode is sponsored by Nexo.io.Today on the Brief:Elon Musk talks bitcoin on ClubhouseIndia trying to ban crypto?DEXs have best month ever in January Our main discussion: Has WallStreetBets been infiltrated by hedge funds? Reddit…

Apparently It’s Very Difficult to Custody Crypto

With the infamous Mt. Gox, less-infamous Quadriga and a handful of other times crypto companies have entered mainstream awareness for losing millions of dollars of customer funds, we have years of evidence that custodying crypto is apparently quite difficult. And yesterday, we got even more.On the morning June 22 crypto custody giant BitGo terminated its…

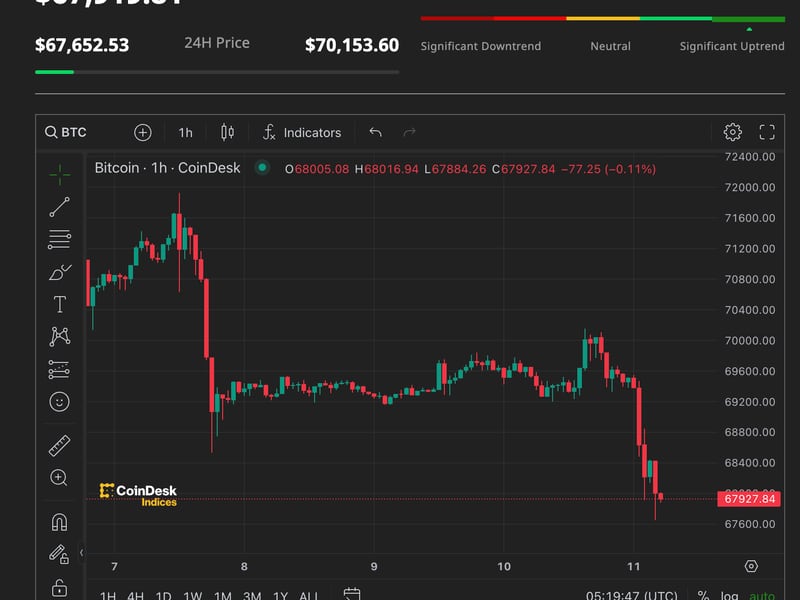

Bitcoin Slips Below $68K as ETFs Bleed $64M, Asian Stocks Decline

BTC, Asian stocks traded lower Tuesday as prices for the safe haven Treasuries rose.The U.S.-listed spot BTC ETFs registered a cumulative outflow of over $64 million on Monday.It was a risk-off day in Asia.01:57Bitcoin Breaks Past $44K; Elon Musk Says His AI Startup Is 'Not Raising Money Right Now'08:42Bitcoin Ecosystem Developments in 2023 as BTC

U.S. Judge Rebuffs SEC Request for Binance.US Asset Freeze for Now

WASHINGTON, D.C. — The federal judge overseeing the U.S. Securities and Exchange Commission's case against Binance and Binance.US declined to order a temporary restraining order freezing the U.S. trading platform's assets.That would allow the U.S. arm of the company to continue doing business while hashing out restrictions with the regulator.If the two sides can agree…