Over $230M Liquidated as BTC Soars Past $45K After Latest ETF Developments

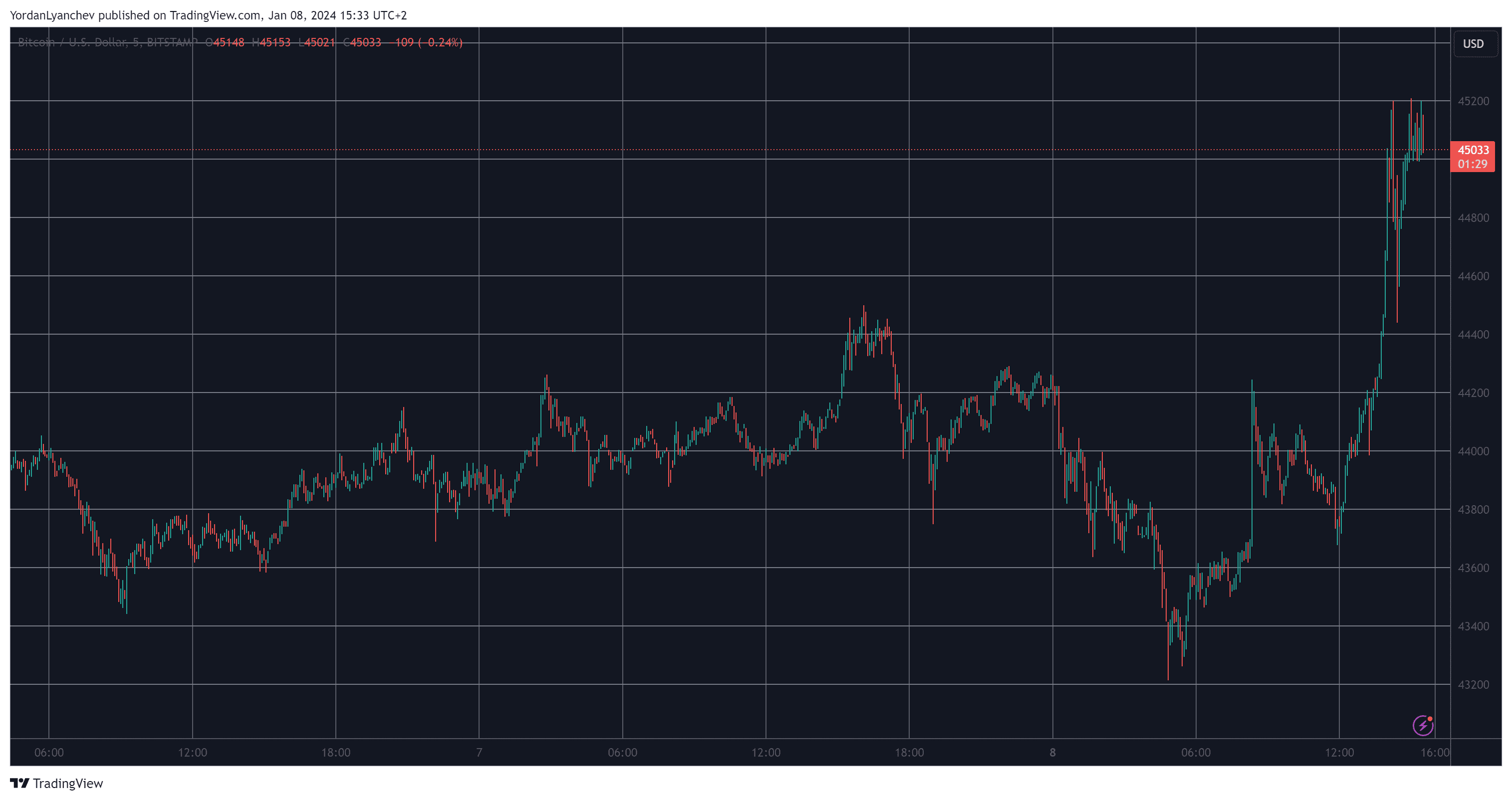

After days and days of trading sideways at around and below $44,000, BTC went on the offensive in the past few hours and flew past $45,000 for the first time since the crash last Wednesday.

This comes as BlackRock, among other financial behemoths that have filed for Bitcoin ETFs, announced the fees they will charge should their products reach the markets.

Bitcoin’s year began with a bang as the asset skyrocketed to almost $46,000, which became its highest price tag in nearly two years.

A day later, though, the cryptocurrency plummeted by over $4,000 as reports emerged that the SEC plans to reject all ETF applications in the next few weeks.

Once these rumors were refuted by ETF experts, BTC recovered most losses and returned to $44,000 where it spent the next several days.

More developments on the ETF front from earlier today resumed Bitcoin’s bull run. As many financial giants, such as BlackRock, announced the fees their ETFs will charge customers, BTC shot up by over a grand.

This resulted in reclaiming $45,000 for the first time in nearly a week. Additionally, this enhanced volatility meant a large number of liquidations. According to CoinGlass, the total value of wrecked positions has increased to over $230 million on a daily scale.

In total, more than 125,000 traders have been liquidated, with the single-largest order taking place on OKX – worth $2 million.

The post Over $230M Liquidated as BTC Soars Past $45K After Latest ETF Developments appeared first on CryptoPotato.