Over $160 Million in Liquidations as Bitcoin (BTC) Got Rejected at $65K

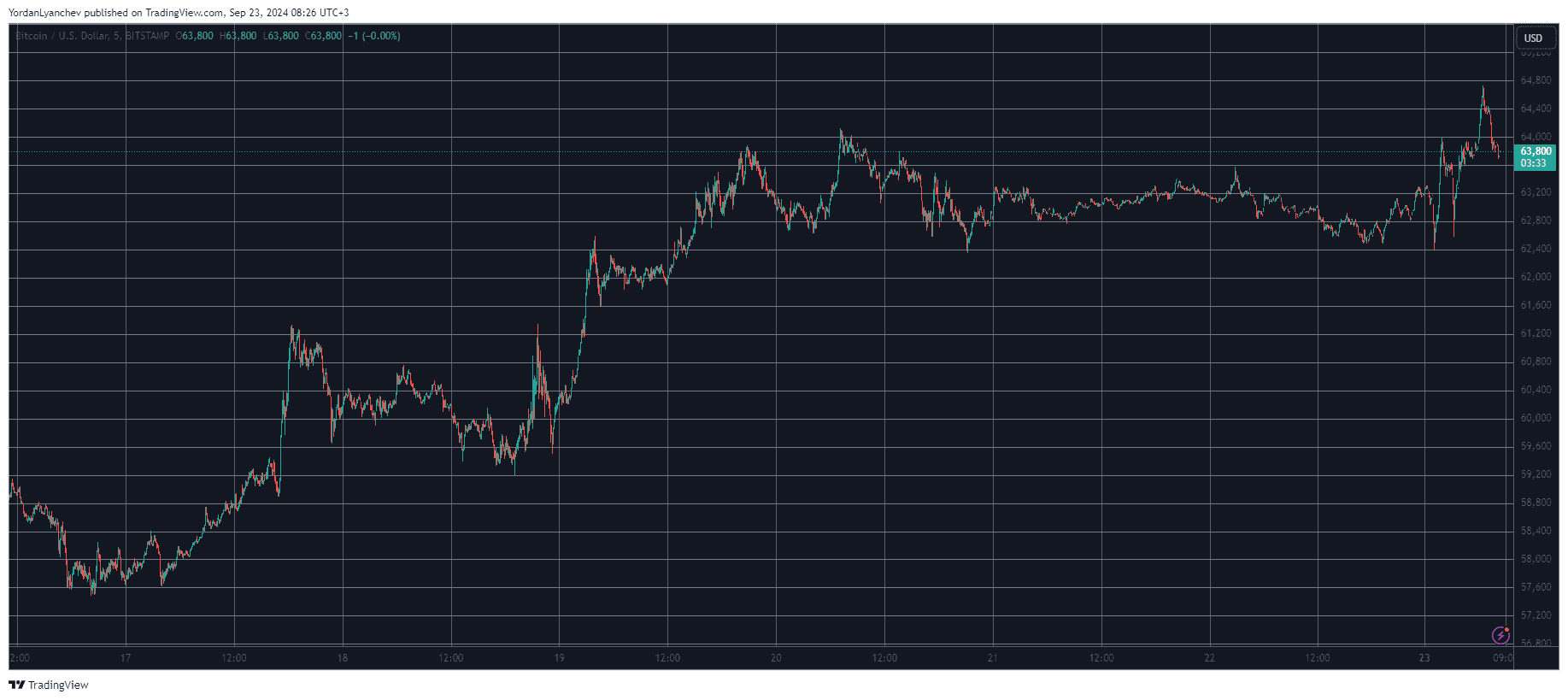

After a quiet weekend in which it stood primarily around $63,000, BTC went on the offensive during the Monday morning Asian trading session but was stopped at just under $65,000.

The subsequent rejection brought some more volatility to the market, which has liquidated over 60,000 traders on a daily scale.

Bitcoin’s price actions were quite positive in the past several days, especially since the US Federal Reserve cut the key interest rates in the country by 0.5% on Wednesday. BTC reacted with immediate price fluctuations but the bulls prevailed and drove the asset north, culminating in a price surge to over $64,000 on Friday morning.

The cryptocurrency failed to keep going up and lost some momentum during the weekend. As reported, it traded in a tight range of around $63,000 for the most part.

More volatility ensued on Sunday evening and Monday morning. First, BTC dropped to $62,400, shot up to $64,000, slipped by a grand and a half again, and initiated an impressive leg up hours ago.

This resulted in a price surge to a four-week high of $64,800 (on Bitstamp). Yet, the bears were quick to intercept and stop BTC’s rally. As of now, the asset trades about $1,000 lower.

Many altcoins mimicked BTC’s performance, but some, such as ETH and BNB, have gained more than 2% on a daily scale. ETH stands above $2,650, while BNB has neared $600.

This substantial volatility has harmed over-leveraged traders, with almost 62,000 such market participants being wrecked on a daily scale. The total value of liquidated positions is up to $165 million, according to CoinGlass.

The single-largest liquidated position actually involved ETH and was worth $2.73 million. It took place on Binance.

The post Over $160 Million in Liquidations as Bitcoin (BTC) Got Rejected at $65K appeared first on CryptoPotato.