Ordinals Upend Bitcoin Mining, Pushing Transaction Fees Above Mining Reward for First Time in Years

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.

For the first time since 2017, some bitcoin (BTC) miners are getting paid more to process transactions on the blockchain than they’re rewarded for creating new BTC, a potentially welcome development following the battering the industry has faced lately.

Bitcoin miners make money in two main ways: spawning new BTC by crunching numbers, and processing transactions on the network. Over time, the first has – by design – become less profitable; every so often, the reward gets cut in half. That payment stands at 6.25 BTC currently, and will go down again next year.

So, that creates a potential, existential threat to the profitability of mining over the long haul: eventually, the mining reward could become quite small, and will ultimately go away (likely more than 100 years from now) once all BTC have been mined.

The big recent jump in profits from processing transactions, therefore, could be a welcomed development, especially given the intense pain – including multiple bankruptcies – that has struck the mining industry during this crypto winter. The trend has picked up so much steam that on several occasions on Monday, mining pools such as Luxor Technologies and AntPool got paid higher transaction fees from newly added blocks than the 6.25 BTC mining reward.

Ordinals appear to at least partly explain the shift. This new project inscribes non-fungible tokens (NFTs) on Bitcoin’s blockchain.

Their emergence over the past few months is a “cool example of how, just when you think Bitcoin has become boring, there’s something waiting around the corner that surprises everyone,” said Colin Harper, head of content for mining pool Luxor Technologies who did not expect transaction fees to surpass the block reward between now and when the 6.25 BTC subsidy gets halved.

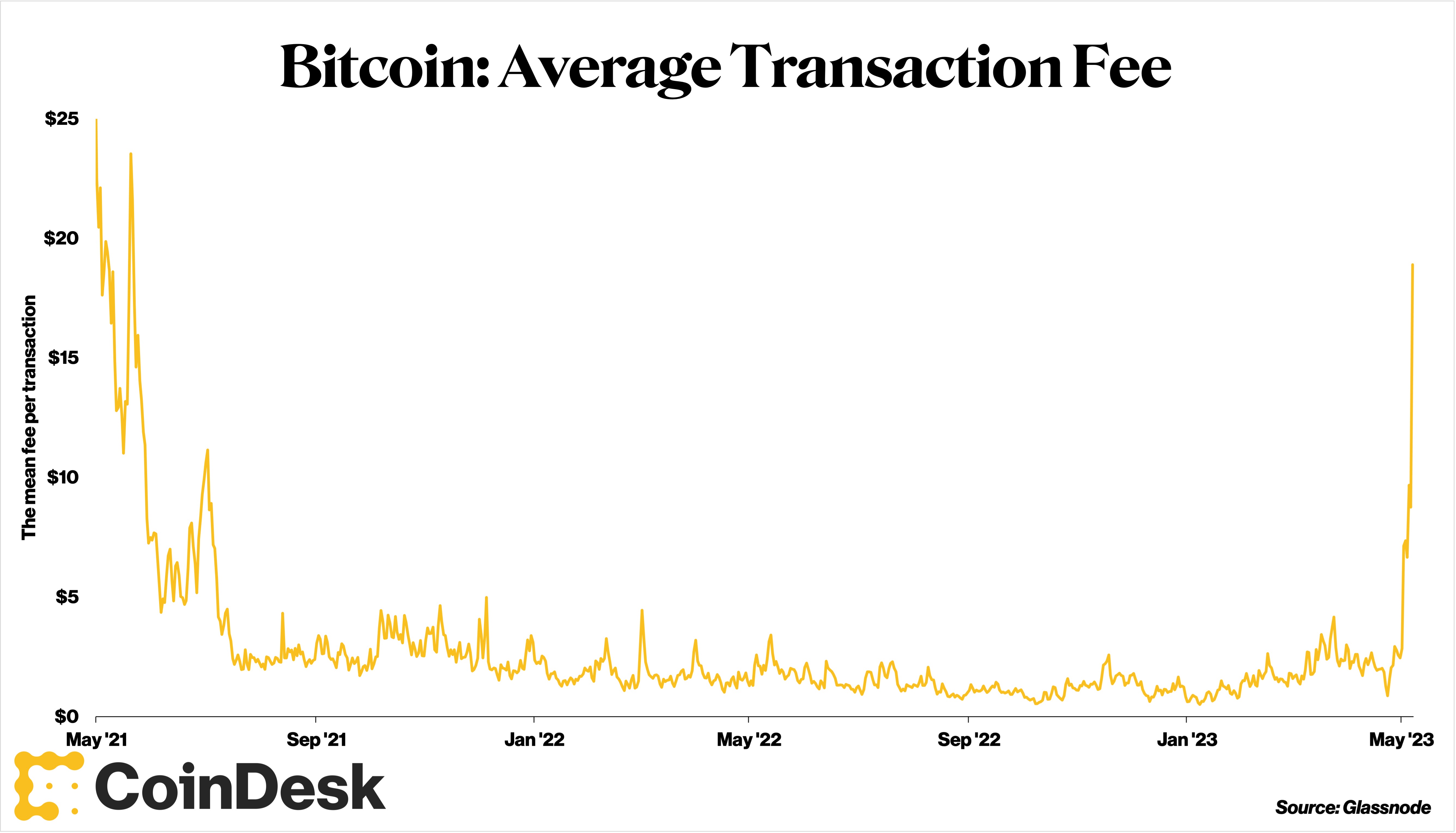

Average Transaction Fee on Bitcoin (Glassnode)

A lot of people, according to Harper, are thinking about whether they can “envision a future where we completely replace the subsidy with the transaction fees, and many people thought that was impossible before something like this.”

Harper added: “Some doubted whether or not Bitcoin blockspace can have use cases outside of settling value,” but now “there are new uses for blockspace and any use of blockspace where people are paying fees is good for Bitcoin in the long-term.” The question for Harper is whether or not inscriptions and Ordinals have staying power.

The average Bitcoin transaction fee has jumped more than 560% in May to $19.20, data from BitInfoCharts shows.

Edited by Nick Baker.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.