Orange-Pilling Secrets From An Ad Copywriter

This is an opinion editorial by SV, the editor-in-chief of BitcoinMaxiNews.com and a former professional advertising copywriter.

After getting seriously into Bitcoin a while back, I decided to approach the subject of orange-pilling — which basically means to “sell” newbies on Bitcoin — as I would any given copywriting gig.

The first thing a professional ad copywriter will identify is the prospect’s main conscious and unconscious “objections” and fears. In other words, whatever is most likely standing in the way of this person being converted.

Let’s therefore start with the main orange-pilling obstacles, before a solution is presented.

Why ‘Selling’ Something As Great As Bitcoin Is So Hard

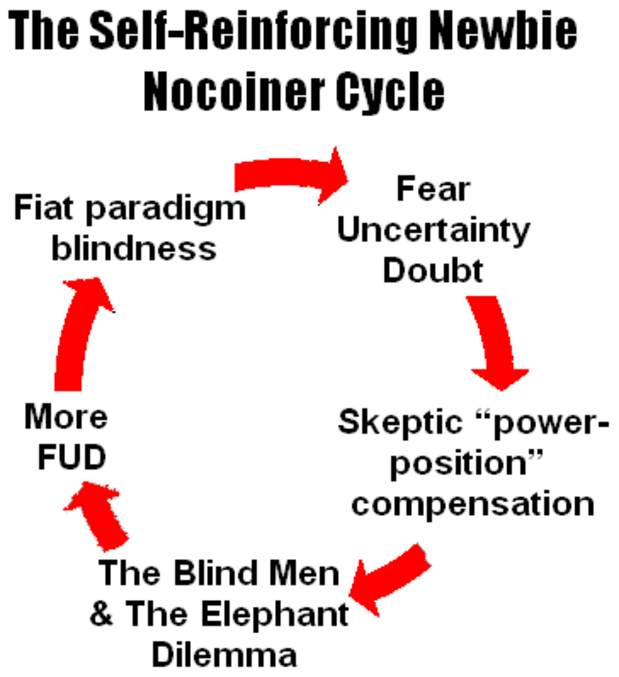

The challenge of orange-pilling newbies boils down to three things, and all three mutually reinforce each other to make it even harder:

1. Fiat paradigm blindness mixed with fear, uncertainty and doubt (FUD)

When I prompted it, OpenAI defined “paradigm blindness” as the “inability to recognize or fully understand the assumptions and frameworks that shape one’s beliefs, values and actions.”

Bitcoin is a paradigm-breaking innovation, and it’s therefore hard to truly grasp its value without breaking out of the “comfort zone” of the indoctrinated fiat paradigm.

A lot of the FUD is generated by this “fear of the unknown,” in addition to the fear of losing money.

2. The skeptic “power-position” compensation (resistance to being “lectured”).

Nobody likes being in the “submissive” position of being “lectured,” and few are humble enough to admit that they “don’t know” something.

Any orange-pilling attempt thus creates an equal and opposite force of resistance in them, and this is especially true if you try to convince them in person.

Remaining “skeptical” gives them the perceived “power position” and “upper hand,” which is why people love to proclaim how “skeptical” they are.

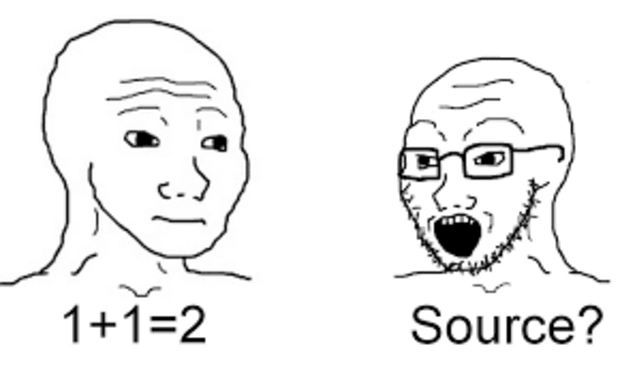

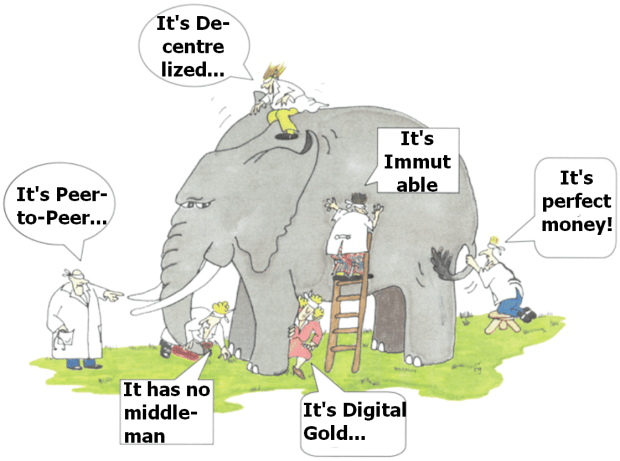

3. The blind men and the elephant dilemma (the “holistic-understanding killer”).

If you try to capture the “full elephant” of Bitcoin in your orange-pilling attempt, you will most likely come across as the guy in the meme below:

As all sales people know, logic and arguments are there to retrospectively rationalize decisions (or reinforce ingrained positions). A true change of mind is always a paradigm shift (small or big), and leaving the comfort zone of the old, ingrained paradigm is always a “leap of faith.”

Logic alone is seldom a strong enough catalyst and motivator for that to happen. This is why the purely-educational approach seldom is enough to break a newbie’s self-reinforcing, fiat-paradigm-blindness, FUD loop.

In addition, the educational approach takes too long, and it’s too boring/technical for the “instant gratification” fiat mindset.

What is needed is another semi-conscious force that’s equally powerful to FUD; namely fear of missing out (FOMO). If the level of FOMO eclipses and exceeds the level of FUD, people will convert. Simple as that.

Making Bitcoin Irresistible To The Fiat-Minded Nocoiner

This was always the first question I would ask myself when starting a new sales page copywriting gig:

“How do I present this offer in a way that’s absolutely, mouthwateringly irresistible to the target audience?”

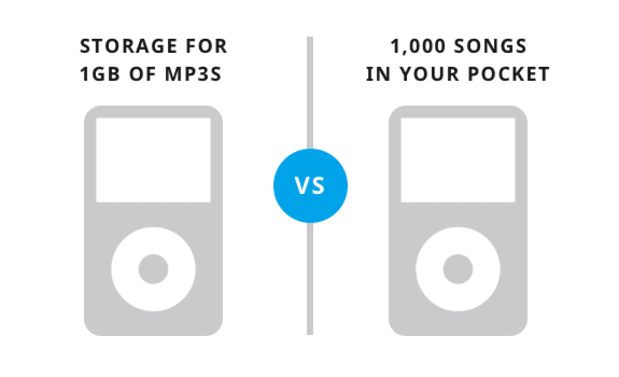

The example below clearly illustrates the difference between feature-oriented “education” and “sexy,” benefit-oriented persuasion:

Do you see the massive difference in perceived value?

Boring, educational, feature focus is a classic “rookie mistake” in the world of ad copywriting, and it’s an epidemic in the world of orange pilling.

It’s easy to believe that people need to “understand” Bitcoin before they would “invest” their hard-earned fiat into it.

The truth is, however, that Mr. Normie Nocoiner is less likely to “invest” the more you try to make him understand Bitcoin.

It’s hard to “sell” people on Bitcoin when you focus on the features.

Paradoxically, Bitcoin sells itself to anyone who does understand it, and the reason why is simple: Bitcoin is the best deal in town. It’s an absolutely, 100% irresistible offer.

This is why every Bitcoiner is doing everything they can to get their hands on as much bitcoin as humanly possible. The key takeaway here is the “irresistible offer” part.

There is a massive difference between trying to “educate” normies about Bitcoin, and in presenting Bitcoin as the irresistible offer that it is.

With that in mind, let’s forget about “peer-to-peer,” “permissionless” and “decentralized” for a moment. Let’s instead dive into:

Bitcoin: The Irresistible Offer

Normies do not need to be confused by the technical monster that is Bitcoin (repeat that sentence a few times for yourself, and sense the sigh of relief it gives you).

Nor do they need to understand the history of money, what “sound money” is, or why proof of work is such a big deal.

Mr. Normie Nocoiner only needs one single thing to “click” in his mind to be orange pilled on the spot, and that is to see a deal that’s irresistible.

In essence: What will push Mr. Normie Nocoiner to take the “leap of faith” into Bitcoin boils down to three things:

- A clear vision of the deal that a bitcoin “investment” represents (not what Bitcoin “is” or even what it “does”).

- A justified sense of urgency and FOMO.

- A clear understanding of why the deal is so irresistibly good (and why holding zero bitcoin is a far bigger risk than getting off zero).

Without further ado, here is my ultra-simple orange-pilling formula. It opens with the following question:

“So, what do you think will happen to the price of bitcoin once a critical mass realizes that Bitcoin mining not only solves global warming, but also the global energy crisis?”

This flies right in the face of what they’ve most likely been programmed by the media to believe, so it will definitely get their attention and make them curious.

I then follow up by reminding them that bitcoin has absolute scarcity, and that most of the supply is already in the hands of long-term holders who already understand where this is going.

You will most likely get tons of resistance when making the above claim about Bitcoin mining, which is good. It clears the space for you to present irrefutable proof elements to back it up.

You must have these proof elements ready up front, of course, and it’s a good idea to store them on your phone. You will find plenty of ammo in the orange-pilling rabbit hole that I have created over at Bitcoin Maxi News.

Once they see the proof elements of how Bitcoin mining is already being used to mitigate methane emissions (which is far worse than CO2 when it comes to the “greenhouse effect”), and how it balances the grid and incentivizes the buildout of renewable energy, well, at the very least, you’ve given them something to think about.

You can then repeat the initial question, and remind them that this early-bird opportunity will not last forever. This starts a “ticking FOMO clock” in their mind, as nobody wants to miss out on a great deal.

Explain that they don’t have to go “all in,” and that owning as little as 0.2 to 0.5 BTC can turn into generational wealth for their family when all this goes mainstream.

Close by saying that owning zero BTC is the biggest financial risk they can take, and that knowing these things is akin to having fully-legal “insider knowledge” that 98% of the population doesn’t know about — yet.

With this approach, you avoid all of the technical, confusing and boring stuff, and you present Bitcoin as the sexy and irresistible offer that it is, all within a few minutes’ time.

This is a guest post by SV. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.