Optimism From Ethereum’s Shapella Upgrade Is Fading, Crypto Options Show

Risk reversals track the spread between implied volatility for OTM puts and calls, telling observers in which direction market volatility is more likely. An option is OTM when the underlying asset’s market price is below the set price (strike price), in the case of bullish calls, or above the set price, in the case of bearish puts.

Related Posts

TradFi aposta tudo nos cortes das taxas do Fed. O que isso significa para o Bitcoin

Os chamados “pontos” divulgados na quarta-feira como parte da decisão política da Reserva Federal dos EUA mostraram que os banqueiros centrais esperam 75 pontos base em cortes nas taxas em 2024. Isto representa um aumento substancial em relação aos apenas 25 pontos base esperados pelos decisores políticos há três meses.The Fed's dot plot (Federal Reserve)Já

3AC Founders’ OPNX Exchange Formally Reprimanded by Dubai Crypto Regulator

Jack Schickler is a CoinDesk reporter focused on crypto regulations, based in Brussels, Belgium. He doesn’t own any crypto.OPNX, a bankruptcy claims exchange set up by the founders of collapsed hedge fund Three Arrows Capital (3AC), has been formally reprimanded by Dubai's crypto regulator for operating an unregulated exchange, according to an official notice.The letter…

Ripple Excites XRP Army as Metaco Acquisition Brings Banks Closer

News that Metaco, the Swiss digital assets custody firm acquired by Ripple earlier this year, is working with HSBC, one of the world's largest banks, quickly became a reason to be cheerful for many supporters of the U.S. fintech’s ledger protocol, known collectively as the “XRP army.”Named after the cryptocurrency designed to move liquidity around

Blockchain Bites: JPM Coin Goes Live, Bitcoin Rallies, Stocks Falter

Oct 27, 2020 at 16:37 UTCUpdated Oct 27, 2020 at 16:38 UTCBlockchain Bites: JPM Coin Goes Live, Bitcoin Rallies, Stocks FalterJPM Coin will see its first commercial use, banking executives said. Southeast Asia’s largest bank by assets, DBS, is eyeing a digital assets exchange. And bitcoin’s recent rise shows a decoupling from traditional markets, like…

Why Eigenlayer’s Airdrop Is Controversial

Users of the Ethereum restaking pioneer Eigenlayer, many of whom are about to be rewarded with a massive airdrop of a new EIGEN token, are voting with their dollars. In response to what some have called Eigen Labs’ overly complicated white paper and relatively limited rewards, users have withdrawn about 150,000 ether (ETH), worth about

Bitcoin News Roundup for Feb. 20, 2020

Feb 20, 2020 at 17:00 UTCWith the price of bitcoin (BTC) diving nearly 7 percent in the last 24 hours, Markets Daily is back with another time-saving bitcoin news roundup.For early access before our regular noon Eastern time releases, subscribe with Apple Podcasts, Spotify, Pocketcasts, Google Podcasts, Castbox, Stitcher, RadioPublica or RSS.Today's news:For early access…

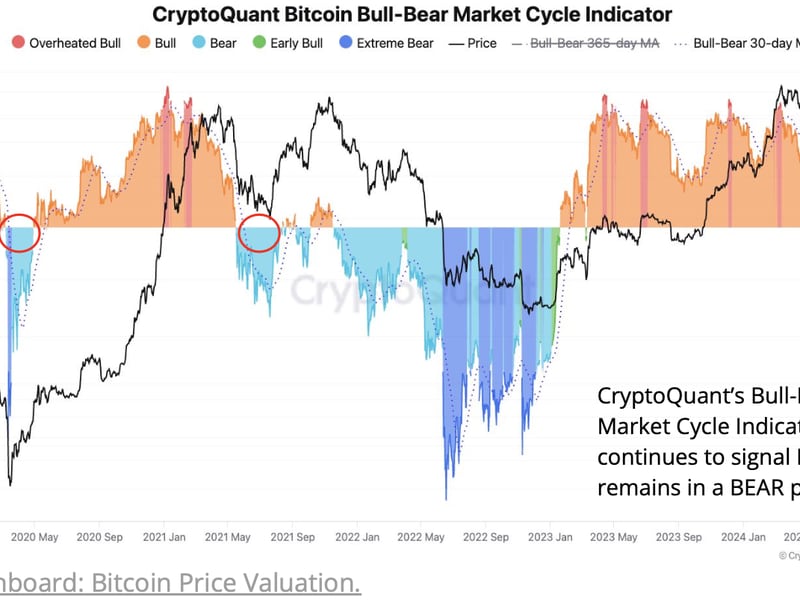

Bitcoin Decouples From Gold as Crypto Continues in Bearish Phase

Bitcoin has been in CryptoQuant's bearish phase since August 27. There's been a decoupling from gold, which has been making record highs, while bitcoin struggles more than 20% below its record level of a few months ago. BTC's MVRV ratio is below its 365-day moving average which suggests a further price correction may be on

Coinbase vs. the SEC Debates the Difference Between Beanie Babies and Securities

Five hours in court, and the fate of Coinbase as a going concern hangs in the balance. On Wednesday, Coinbase and the U.S. Securities and Exchange Commission (SEC) sounded off in the Southern District of New York, arguing over whether the top securities watchdog’s lawsuit against the largest U.S. crypto exchange is valid.This is an