Opinion: Bitcoin Dominance Metric Should Exclude Stablecoins Like Tether. Here’s Why

Altcoins have always been around aside Bitcoin. The first altcoin, Namecoin, popped up somewhere in the middle of 2011. Since then, the total number of altcoins has reached 5 digits, and they have evolved from Proof-of-Work to Ethereum-based ERC-20 smart contracts to Initial Coin Offerings (ICOs).

2017 was the year of the ICO, and it was the year that the list of cryptocurrencies started taking up more than two pages. In 2017 and the first quarter of 2018, new coins were born on a daily basis.

Bitcoin’s dominance rate is a metric used to measure the share of Bitcoin of the total market cap. Not surprisingly, the lowest-ever Bitcoin dominance rate was recorded on January 8, 2018, at 33.4% (according to data from CoinMarketCap). Just recently, following the massive surge in Bitcoin’s price this year, the BTC dominance rate reached its highest level since May 2017, surpassing 70%.

There is variation in the way in which Bitcoin’s dominance rate is calculated: While a 68.2% dominance rate is displayed on both CoinGecko and CoinMarketCap, TradingView’s numbers are more in favor of Bitcoin, with a 70.5% dominance rate as of writing this.

However, one common mistake that the vast majority of websites are making is to include stablecoins when calculating market dominance.

Why Ignore Stablecoins?

Stablecoins, as the name makes clear, are stable coins that are generally pegged to fiat currencies like the US dollar. The reason why investors hold them is generally for hedging purposes, in order to stabilize their crypto holdings’ value without the need to convert them to fiat, eliminating the tremendous volatility of the crypto markets.

This has absolutely nothing to do with investing in altcoins. Yes, hedging one’s Bitcoin investment is a reason why one might invest in altcoins, but true altcoins are volatile – a lot more so than Bitcoin – and investors buy them for one reason – a high risk-to-reward ratio.

Bitcoin’s Dominance, Correctly Calculated

For that reason, stablecoins should definitely stay out of the Bitcoin dominance game. Hence, the BTC dominance equation should be:

Bitcoin Dominance Rate (%) = (Bitcoin market cap) / ((Total market cap) – (Stablecoin market cap))

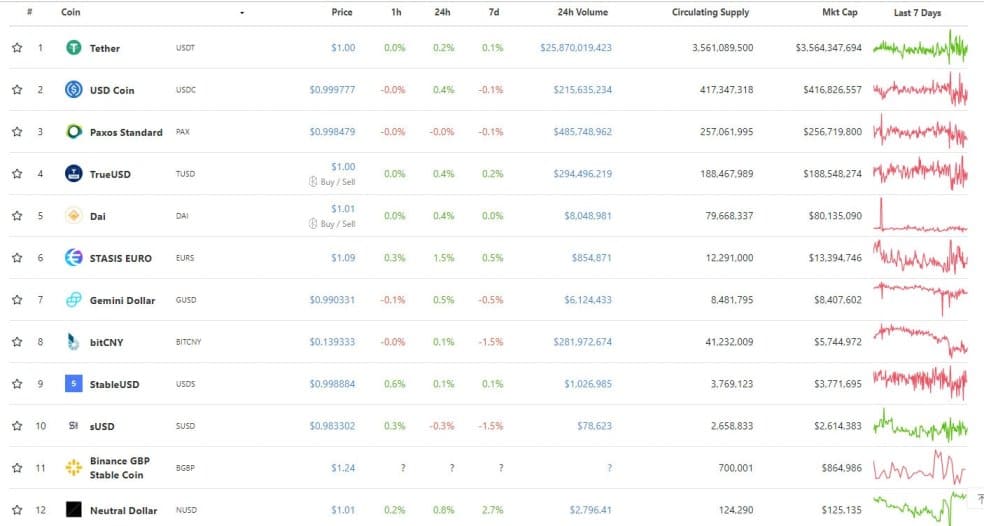

Here are the leading stablecoins, according to CoinGecko:

The combined market cap of the 12 leading stablecoins is $4.57 billion. CoinMarketCap shows an even higher value, and the leading stablecoin alone (Tether) possesses a current market cap of $4.1 billion.

With a total market cap of $221.4B and a Bitcoin market cap of $150.8B, Bitcoin’s dominance rate reverts to 70%. 2% isn’t a huge difference, but it’s significant as Tether is working its way up the list of the top cryptocurrencies by market cap, and the famous stablecoin is already in fourth place on CoinMarketCap.

Here is an interesting thought experiment: If all altcoin holders sold their altcoins for stablecoins like Tether, Bitcoin’s dominance rate would still be 68.2% as currently calculated, even though Bitcoin would comprise 100% of all actual cryptocurrencies. After all, stablecoins are not altcoins, but rather stable coins.

The post Opinion: Bitcoin Dominance Metric Should Exclude Stablecoins Like Tether. Here’s Why appeared first on CryptoPotato.