Open Positions on Bitcoin Options Pass $1B for First Time

Open contracts on bitcoin options rose to record highs on Thursday as the cryptocurrency’s price rose into five figures.

Data from major exchanges – Deribit, LedgerX, Bakkt, OKEx, and CME – shows that open interest on options rose above $1 billion, surpassing the previous all-time high of $70 million registered on Feb. 14, according to crypto derivatives research firm Skew.

The metric has increased sharply from the low of $410 million observed in March when the bitcoin market crashed on so-called “Black Thursday.”

Deribit, the world’s biggest crypto options exchange by volume, contributed nearly 90% of the total on Thursday as open positions on the Panama-based exchange reached a record high of $903 million.

Global options trading volume also jumped to $213.7 million yesterday, the highest level since the March 12 crash, while bitcoin itself clocked a two-month high of $10,062 on CoinDesk’s Bitcoin Price index. At press time, bitcoin had dropped back to near $9,830, representing a 1.5% drop on the day, but an over 10% gain on a week-to-date basis.

Options are derivative contracts that give the buyer the right, but not the obligation to buy or sell the underlying asset at a predetermined price on or before a specific date. A call option gives the purchaser the right to buy, while the put option gives the buyer the right to sell.

Open interest refers to the number of options contracts that have

been traded but not yet liquidated by an offsetting trade or an exercise or

assignment. While open interest represents the number of contracts open at a

given point of time, trading volume refers to the number of contracts traded

during a specific period.

The surge in open interest looks to have been caused by increased demand for put options, or bearish bets.

“Post-March crash, put options have been bought for downside protection primarily. As the market has rallied, more interest has entered via increased put accumulation,” said Tony Stewart, a derivatives trader and analyst in Deribit’s Market Insights channel.

Validating Stewart’s argument is the one-month put-call skew’s recent rise from -3% to 9.1%. The positive figure indicates that put options are costlier due to drawing greater demand than calls. Similar sentiments are being echoed by the put-call ratio, which rose to a 10-month high of 0.81 on Monday, according to Skew data.

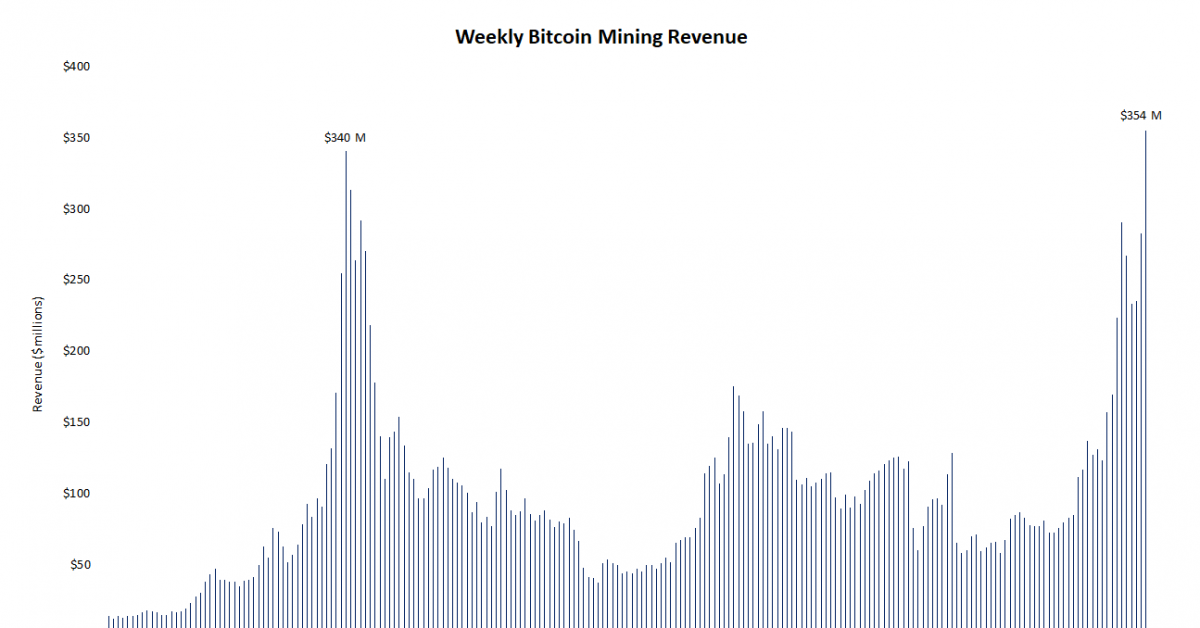

The put bias seen in the options market suggests investors may be hedging for a potential post-halving price drop. Bitcoin is set to undergo its third mining reward halving on Tuesday, following which the reward per block mined will drop to 12.5 BTC to 6.25 BTC.

That the supply-altering event is a long-term bullish development has been extensively discussed by the analyst community for many months. Bitcoin’s price has rallied by nearly 160% since bottoming out at $3,867 in March and has recently decoupled from traditional markets as hype over the event mounts.

Such strong rallies ahead of major events are often followed by price pullbacks. Historical data shows the cryptocurrency suffered a 30% drop in the four weeks following its second reward halving, which took place on July 9, 2016.

“We may see the market drop by 25%-35% from the peak, but we expect it to be followed by a period of range-bound trading over a number of months and then a gradual move back up. The longer-term horizon for bitcoin is extremely bullish but in the short-to-medium term, we think we’ll see a lot of disappointed players out there,” said Ed Hindi, CIO of Tyr Capital Arbitrage SP, which focuses on liquidity provision and arbitrage within the cryptocurrency markets.

Hence, it’s not surprising that trades are buying hedges (puts)

against long positions in the spot or futures market.

Bitcoin is widely expected to remain bid over the weekend due to “FOMO” buying from retail investors. FOMO, or fear of missing out, refers to panic buying in a rising market.

Until the halving has passed, more price rises look likely. “$10,000 has already been breached and the psychological resistance of that has been overcome. We are keeping our eye on $10,500 as the next key level,” said Matthew Dibb, co-founder of Stack, a provider of cryptocurrency trackers and index funds.

Disclosure: The author holds no cryptocurrency at the time of writing.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.