Bitcoin has inspired coast-to-coast interest in the United States. In the boardrooms of Wall Street, suited executives are planning ways to profit from it; in Silicon Valley’s tech campuses and studio apartments, hoodie-wearing programmers are creating apps, tweaking code and proposing protocol upgrades. And enthusiasts across the South, throughout the Midwest, in cold Alaska and warm Hawaii, are obtaining, holding and occasionally trading bitcoin.

The millions of American bitcoin enthusiasts are right to be excited about bitcoin’s potential to change the world, but most of them, if pressed, will admit that other emerging and unsettled markets hold the keys to mass bitcoin adoption. Upheaval and unrest in established markets, like change and evolution in emerging markets, makes a compelling case for cryptocurrency use.

Demand for Bitcoin in Hong Kong Is Rising

Data from the peer-to-peer site LocalBitcoins indicates that demand for bitcoin in Hong Kong has recently seen a conspicuous spike during the continuing pro-democracy protests. Many protesters have withdrawn their money from banks to demonstrate their anger with the Chinese government; Goldman says roughly $4 billion moved from Hong Kong to Singapore in August 2019 alone.

The movement of 173 bitcoin in Hong Kong over the course of one week may, in truth, represent just a couple of large transactions from whales or institutions; it’s likely we’ll never know for sure. Even with the uncertainty, the transfer’s timing is suggestive. Bitcoin was invented to take power from repressive or unjust central systems, and some people in Hong Kong believe Bitcoin offers hope for a more just future.

Bitcoin Adoption in Venezuela

Unfortunately, the people of Hong Kong are not alone in facing political and economic instability or government abuse. In Venezuela, to take just the most prominent example, hyperinflation has rendered the bolivar, the local currency, next to useless: The money is worth less than the paper it’s printed on. Some in Venezuela and similarly afflicted countries opt to trade in imported dollars or other stable currencies, but such trades involve their own hurdles, like obtaining the imported currency at scale and ensuring that it is widely usable across a country.

Mass adoption of digital currency is helping to solve this problem, and it’s clear that citizens are paying attention. More than $250 million worth of bitcoin has moved through Venezuela in 2019.

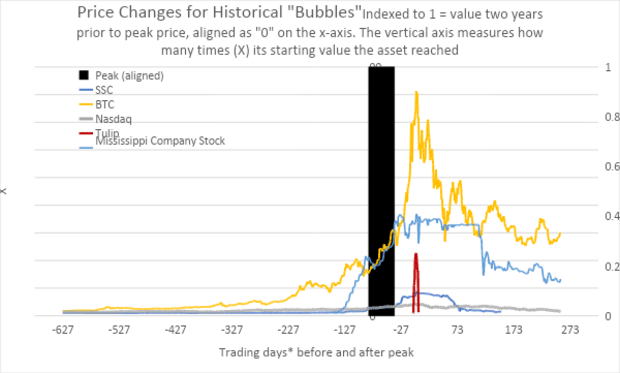

Both Stability and Volatility Add Impetus

Neither Wall Street nor Silicon Valley is incidental, of course. Those centers of tech and finance will continue to play vital roles in the Bitcoin story, though perhaps not always in the way enthusiasts hope or expect. The recent failure of Bitcoin ETFs on Wall Street shows that there’s still a conservative bent to many established markets.

In places of volatility and transformation — whether that volatility arises from economic development or political unrest — potential users may be more likely to try new, different — even risky — forms of economic life. What’s mildly intriguing to participants in one market may be absolutely vital to people in another. Although daily bitcoin volumes in Venezuela dwarf those of the new Bakkt futures, Bakkt and projects like it could not emerge without the backing of Wall Street and the tech know-how imported from Silicon Valley.

Each week seems to bring new innovation in the transfer, storage, security or speed of Bitcoin, and each incremental improvement makes mass bitcoin adoption more likely by making it less difficult. The successes of Wall Street and Silicon Valley, and of other tech and financial hubs, make adoption feasible, but it’s the failures of centralization the world over that make it desirable — and necessary.

This is an op ed by Mati Greenspan. Opinions expressed are his own and do not necessarily reflect those of Bitcoin Magazine or BTC Inc.

The post Op Ed: Wall St. May Support Bitcoin Adoption, But Markets of Unrest Are Key appeared first on Bitcoin Magazine.