Only a Tiny Amount of ETH Is Poised to Be Withdrawn After Ethereum Shanghai Upgrade, Nansen Says

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

The Ethereum Shanghai upgrade, poised to take place late Wednesday, will allow validators who run the blockchain to unstake and withdraw the ether (ETH) they’ve pledged to run the network.

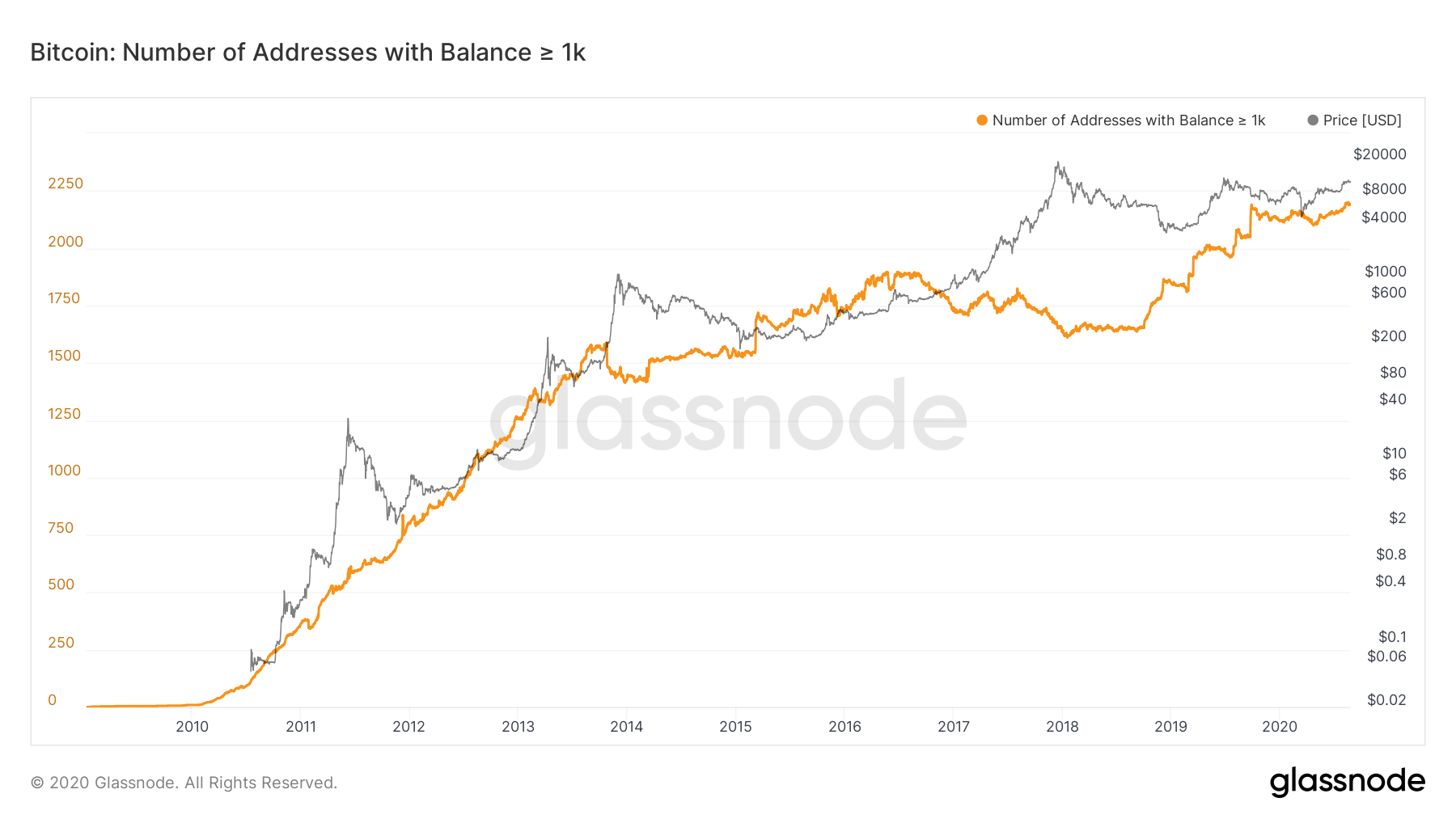

In the runup to the significant event – which is also called Shapella – very little ETH appears poised to be withdrawn, according to data from Nansen.

The blockchain analytics firm says nearly 4,000 validators have already unstaked 141,499 ETH (worth about $270 million) that’s currently waiting to be withdrawn. This represents less than 1% of Ethereum’s total validators and staked ETH, according to Nansen. Crypto exchange Huobi is waiting to remove almost 40,000 ETH, making it the largest entity in the withdrawal queue.

All validators cannot withdraw at once; there’s a daily limit. “Currently, eight validators can exit per epoch which is about 1,800 [validators] per day,” Nansen data engineer Edgar Rootalu told CoinDesk over Telegram.

Ethereum, the second-largest blockchain by market capitalization of its native cryptocurrency, will undergo a hard-fork upgrade around 22:27 UTC Wednesday to change its execution and consensus layer. This will complete Ethereum’s transition to a proof-of-stake (PoS) blockchain, allowing stakers, who secure the network, to withdraw their staked ETH as well as the rewards they’ve accrued.

Walter Teng, vice president of digital asset strategy at Fundstrat Global Advisors, told CoinDesk in a private message on Twitter there’s a few possibilities from unstaking, “1) restake with [liquid staking derivatives] 2) sell tokens 3) use tokens to lever up 4) hold tokens to sell later.” Teng’s “hunch is that 1 will actually be dominant” and that “everyone is overweight 2.”

Edited by Nick Baker.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.