One Million Individual Wallets Now Hold a Whole Bitcoin

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

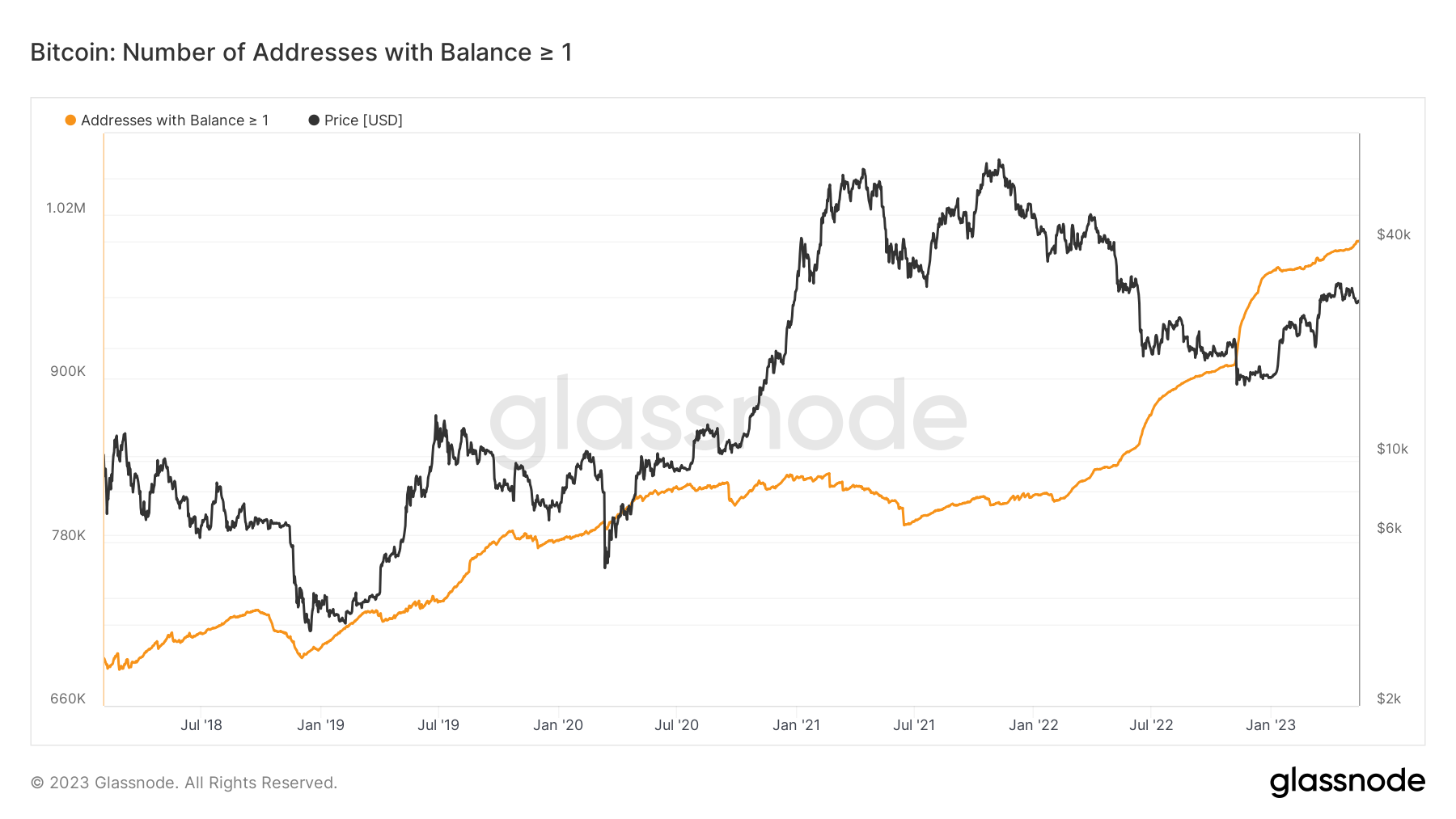

Individual wallets holding at least one bitcoin (BTC) set a milestone figure earlier this week, suggesting long-term sentiment for the tokens remains intact even as broader markets weigh down bitcoin prices.

Data from the on-chain analytics tool Glassnode show bitcoin wallets holding more than one token crossed the millionth mark on Monday. This is a 20% bump since February last year.

Over one million individual wallets now hold bitcoin, data shows. (Glassnode)

The data shows that bitcoin wallets holding one token grew by 79,000 between November and January – amid the collapse of crypto exchange FTX as prices fell from over $22,000 to briefly under $16,000.

The recent rise in ‘Bitcoin Request for Comment’ (BRC-20) tokens has done little to increase the number of wealthy holders, with only 30,000 new wallets holding one bitcoin added since the BRC-20 token standard’s launch in March.

These standards allow developers to issue tokens on the network and build decentralized finance (DeFi) services such as lending and borrowing. It has contributed toward fees on the Bitcoin blockchain surging to two-year highs amid the demand for block space, with altcoins issued on Bitcoin reaching a cumulative market capitalization of as high as $1.6 billion earlier this month.

Meanwhile, despite the large holder figure, some market observers saw that most of the current bitcoin transactions come from smaller wallets.

“During the last peak in 2019, most Bitcoin transactions skewed towards larger transactions, in the range of $1,000 to $10,000,” said Tom Rodgers, Head of Research at ETC Group, in an email to CoinDesk.“This suggests most Bitcoin users were using the blockchain for trading.”

“Compare this to last week. The largest cohort of Bitcoin transactions – 359,560 – came from transactions under $1. This suggests a huge increase in Bitcoin velocity — or the amount of Bitcoin being transacted by users, instead of being locked up in cold wallets and held over the long term,” Rodgers added.

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.