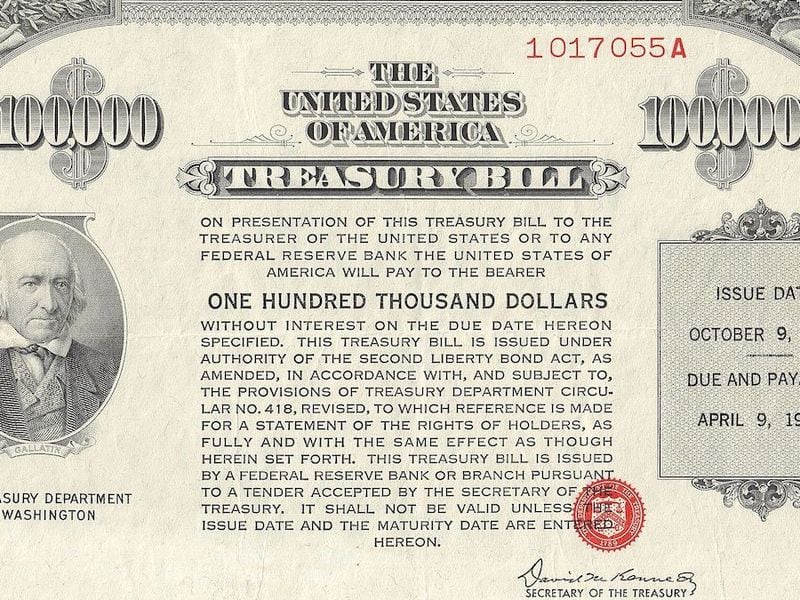

Ondo Finance, a security token start-up, is launching a stablecoin alternative that will pay its holders interest via a tokenized money market fund.

Ondo says its OMMF token will be pegged to US$1 and backed by money market funds that trade on traditional exchanges. Investors will be able to mint and redeem OMMF on business days and collect interest daily in the form of new OMMF tokens, according to the company’s blog post.

Leading stablecoins such as Tether’s USDT and Circle’s USDC currently do not pay out interest to holders, even amid a rising-rate environment, as doing so would strengthen the case that such stablecoins are unregistered securities. Ondo says that’s why they’re only targeting institutional investors designed as both accredited investors and qualified purchasers, a move that exempts Ondo from registering the product with the Securities and Exchange Commission (SEC).

“There is no regulatory gray area with OMMF. We structured it as a security,” Ondo Finance founder and CEO Nathan Allman told CoinDesk in an interview. “Stablecoins were not designed in compliance with securities law. They’re not really able to pay out interest in a compliant way. They’re a zero-interest rate phenomenon.”

According to the project’s website, OMMF lists an APY of 4.5%, in-line with what publicly-traded money market funds are currently yielding.

Stablecoins have also faced heat due to the fragility of their pegs. Terra’s algorithmic stablecoin UST collapsed in dramatic fashion last May, and even Circle’s asset-backed stablecoin USDC depegged amid last month’s Silicon Valley Bank crisis.

“Money market funds have a constant $1 NAV [net asset value],” explained Allman. “We’re also targeting holding a few percent of the fund’s assets in stablecoins. That way, investors can get in and out.”

Allman declined to give a specific launch date for Ondo’s tokenized money market fund, saying it would go live “soon” and that the company was currently “in the process of onboarding clients.”

Security tokens like Ondo’s OMMF have seen a surge in interest as startups and institutional investors alike are exploring ways to migrate traditional financial assets on-chain through tokenization. Crypto enthusiasts say innovations like smart contracts and blockchain technology can modernize outdated financial plumbing and democratize investing, but such innovations have also faced scrutiny by critics, who say such innovations are thinly-veiled attempts at skirting securities laws.

“We designed OMMF in a way that makes it composable with on-chain infrastructure,” says Allman. “Because the token is compostable with DeFi, you can lend against it permissionlessly.”

Enter Flux Finance, a decentralized finance protocol backed by Ondo that functions as a permissionless touchpoint and, crucially, makes it accessible to retail investors. Allman says one way retail investors can access OMMF’s yield without owning the security outright is by lending non-yield stablecoins like USDT and USDC into Flux, a protocol he describes as “similar to Aave and Compound” but without the overcollateralization. Then, whitelisted institutional clients can borrow the stablecoins in the Flux pool and mint OMMF, pocketing a small spread and paying out some yield to the protocol, which is passed onto retail investors.

“It’s really just DeFi,” added Allman. “This is what all of DeFi enables: the creation of financial services that are not operated by financial institutions.”

Edited by Aoyon Ashraf.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Tracy is a deputy managing editor at CoinDesk. She owns BTC, ETH, MINA, ENS, USDC, and some NFTs.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Tracy is a deputy managing editor at CoinDesk. She owns BTC, ETH, MINA, ENS, USDC, and some NFTs.

:format(jpg)/www.coindesk.com/resizer/y5LQa_csFoAsVPqL2XVU2by5Dnk=/arc-photo-coindesk/arc2-prod/public/ONOXEA56LFAZTN55Q52M4MTVSQ.png)