On-Chain Update: Bullish Indicators Despite Price Dips

Despite the recent bitcoin sell off, there are several very bullish on-chain indicators showing HODLers are accumulating through this dip.

At the time of this writing, bitcoin’s price is in the midst of a consolidation that has lasted almost two weeks, currently sitting at $47,200.

One of the most important data points that can be used to generally call bottoms of corrections is the spent output profit ratio (SOPR) metric. This measures profit-taking, with 1.00 essentially marking the break-even point. In bitcoin bull markets, SOPR rarely dips below 1.00 and if it does, this can indicate a very attractive opportunity for buyers. Most recently, SOPR bottomed out above 1.00. This indicates that recent buyers aren’t panic selling and are viewing this consolidation as just another higher low in the parabolic price run that bitcoin has been on; a very bullish indication.

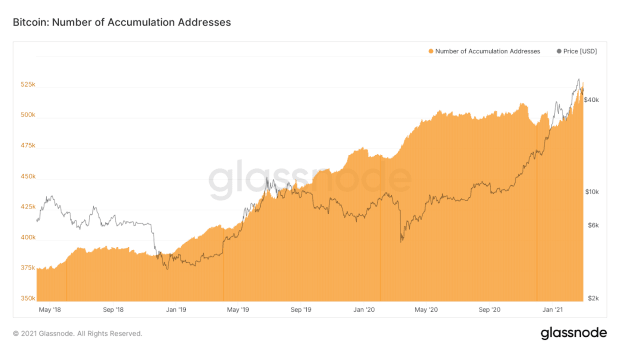

This same concept can be illustrated by looking at the number of accumulation addresses on-chain. Despite the recent price decrease, there has been a massive run-up in new accumulation addresses.

Another bullish indication of accumulation: There has been a massive increase in illiquid supply. This indicates HODLers have been adding to their positions despite the recent sell-off.

Similarly, this can be illustrated by looking at liquid supply as well. Looking at the chart below, you can clearly see a massive decline in liquid supply:

Other Interesting Data Points

One of the most intriguing on-chain metrics that I have an eye on measures the net position of Bitcoin miners. For the first time in months, we have begun to see miners net-long bitcoin, indicating that they are no longer selling, but rather accumulating. Even the Marathon CEO stated in a recent tweet: “Marathon has held Bitcoin we mine and will continue to do so, barring any unforeseen consequences. We also purchased $150m of Bitcoin on 1/25/2021 that is now worth $277m.” On-chain data suggests that it is far from the only mining operation that is thinking this way.

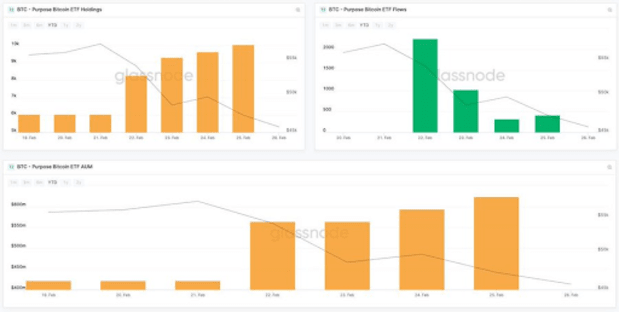

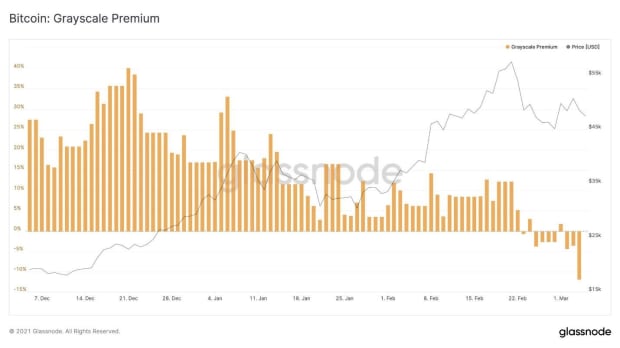

A final interesting chart to look at is from the Grayscale Bitcoin Trust Premium. For the first time throughout this entire bull run, the premium has dipped negative, now -11.92 percent, compared to spot bitcoin. Why has the premium turned negative? It’s impossible to say for sure, but it may have something to do with the availability or exchange-traded funds (ETFs) such as Canada’s Purpose Bitcoin ETF. This ETF now holds over 10,000 BTC.

In addition, this could possibly suggest institutional buyers/high-net-worth individuals are understanding the importance of taking possession of their own private keys.

This is a guest post by William Clemente III. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.