Old Bitcoin Spending Slows, But The Bears Are Lurking

This week’s on-chain insights from analytics provider Glassnode have highlighted a slowdown in the rate at older BTC being spent. This is indicative of a level at which a large number of holders are willing to stop or pause as markets consolidate for a while.

“A period of consolidation is to be expected as the market comes to terms with the dramatic sell-off last week.”

The primary question on the minds of investors is whether a bear market trend is in play or whether the market has returned to a re-accumulation range, it added.

The report continued to state that long-term holders (those with coins older than 155 days) represent almost all profitable coins accumulated prior to 2021. Those having bought BTC in 2021, classified as short-term holders, represent almost all coins that are at an unrealized loss.

The #Bitcoin market consolidates after selling-off last week, as investors demonstrate unique spending behaviours on-chain.

We Assess

– Market pain points

– Spending patterns on-chain

– Analysis of sellers and hodlersRead more in The Week On-chainhttps://t.co/BJhhRNzKKx

— glassnode (@glassnode) May 31, 2021

Return of The Bears?

The research stated that in its assessment, short-term holders had capitulated a large volume of coins, however, they may continue to be a source of selling pressure moving forwards.

Using the Average Spent Output Lifespan metric (ASOL), which provides insight into the average age of all UTXOs spent that day, it added that older coins saw a spike in spending behavior in early May. The metric has fallen back to levels below the accumulation range, it added:

“This indicates LTHs [long-term holders] did not panic sell and capitulate and instead primarily HODLed through the dip.”

Analyst ‘CryptoFibonnaci’ is not so confident that the hodling will continue after taking a detailed look at the monthly chart.

The short-term picture could be bullish with resistance at around $41,500, where the 200-day moving average is. However, a combination of technical signals on the long-term chart, such as the “evening star” candle indicating trend reversal, and the RSI crossover, suggests a lot more pain to come.

The #Bitcoin market consolidates after selling-off last week, as investors demonstrate unique spending behaviours on-chain.

We Assess

– Market pain points

– Spending patterns on-chain

– Analysis of sellers and hodlersRead more in The Week On-chainhttps://t.co/BJhhRNzKKx

— glassnode (@glassnode) May 31, 2021

Bitcoin Price Outlook

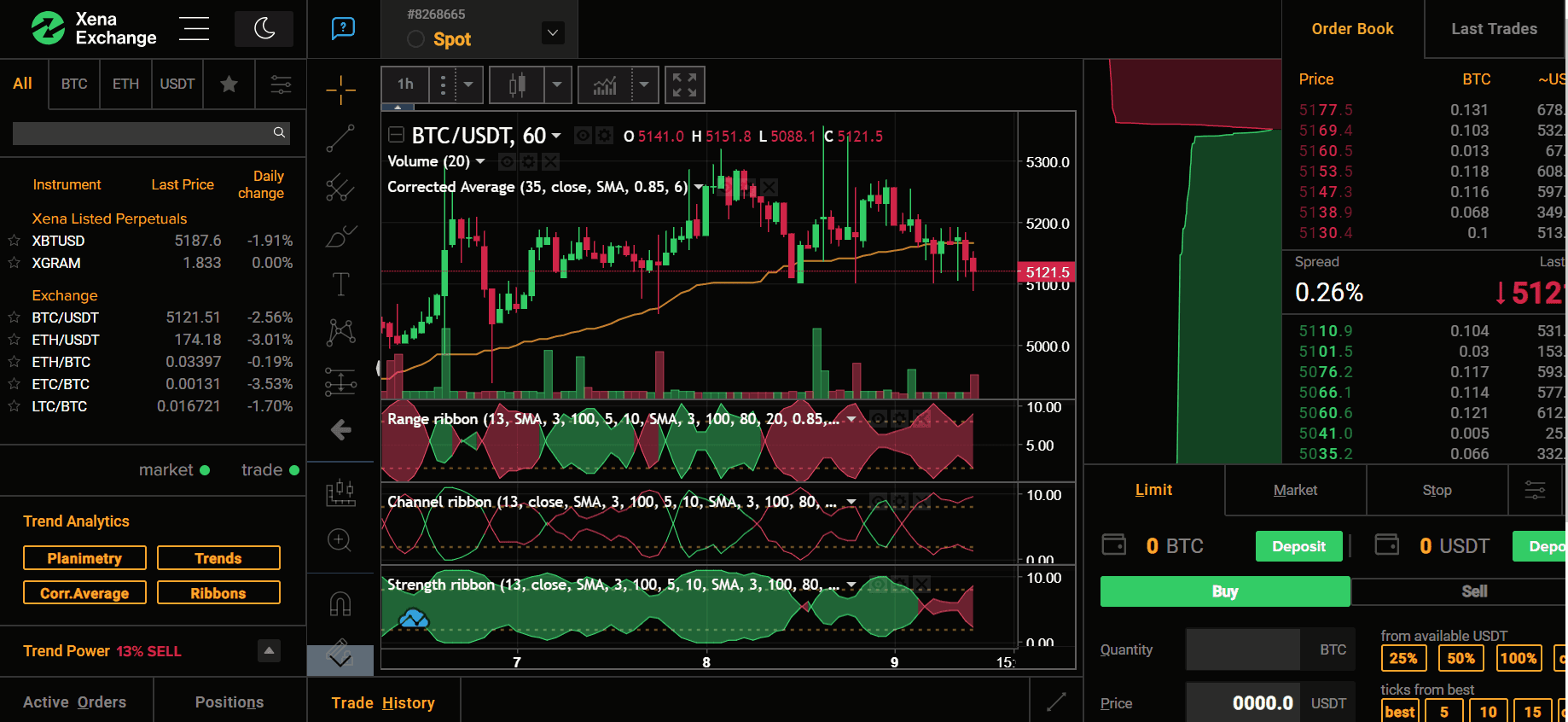

At the time of press, Bitcoin was trading up 8.5% on the day at $37,250, according to CoinGecko. It hit an intraday high of $39K during the morning’s Asian trading session but failed to breach it. Short-term resistance currently lies just above $40K.

On the downside, Bitcoin has found support at $34K over the past few days, so a break below those levels could see the selloff resume.