Ohio Becomes First US State to Allow Taxes to Be Paid in Bitcoin

Ohio has become the first U.S. state to allow taxes to be paid in bitcoin.

According to a report from The Wall Street Journal on Sunday, starting this week, companies in the state will be able to pay a variety of taxes, from tobacco sales tax to employee withholding tax to public utilities tax with the cryptocurrency.

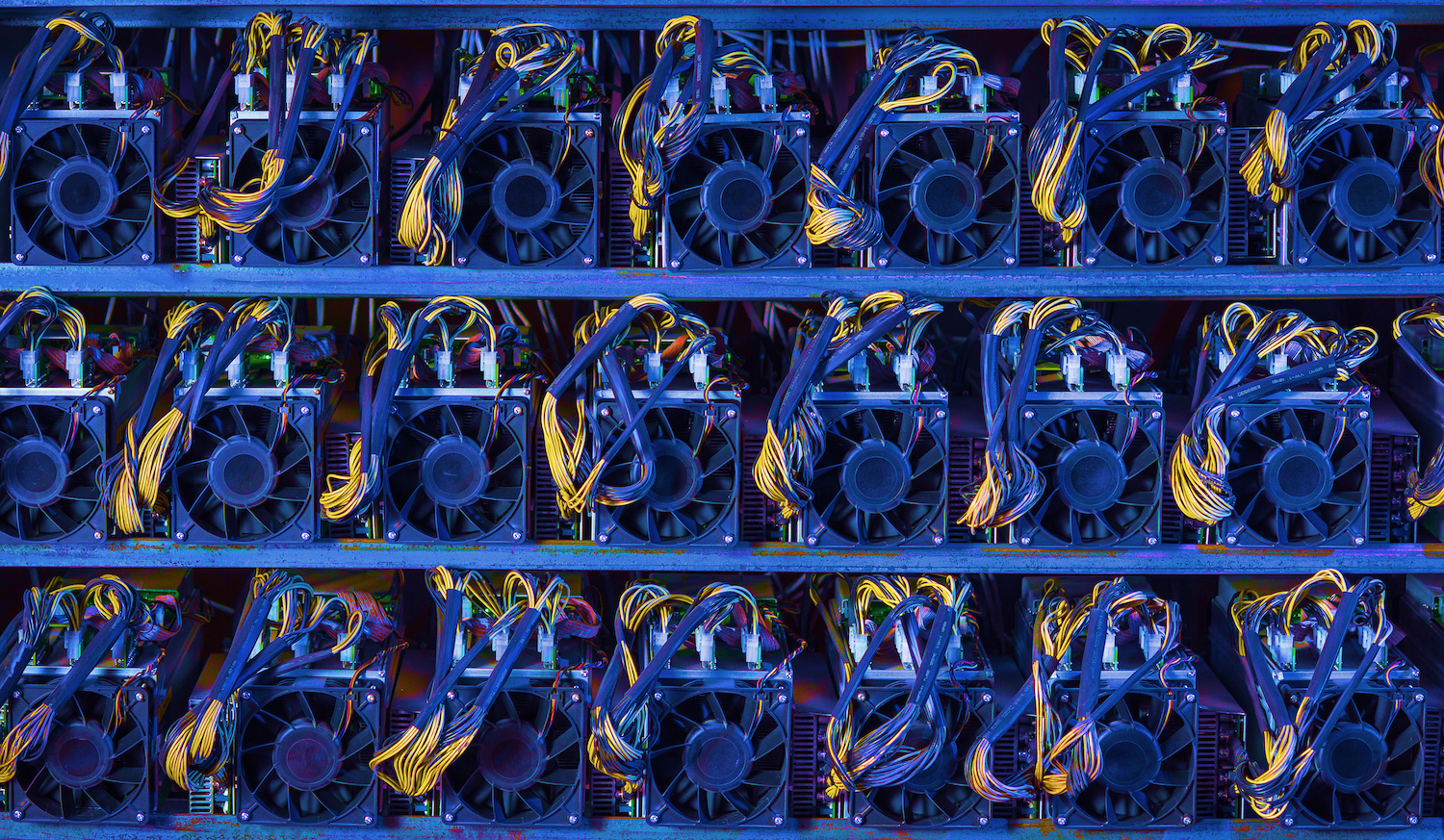

The filing process involves three steps: First, businesses will have to register with the Office of the Ohio Treasurer through a dedicated portal called OhioCrypto.com. They then need to enter tax details such as payment amount and tax period, and, finally, the due amount is paid in bitcoin using a “compatible” crypto wallet, according to the portal.

Compatible wallets include the Bitcoin Core client, Mycelium and breadwallet, and others that are compatible with the Bitcoin Payment Protocol.

All tax payments will be processed by Atlanta-based bitcoin payments processor BitPay, which will convert bitcoins to dollars for the Treasurer’s office.

While, for now, the facility is available only for businesses, it is reportedly expected to be made available to individuals in the future.

Lawmakers in other U.S. states have also considered allowing crypto tax payments in the past. Back in March, Illinois and Arizona were both weighing proposals to allow residents to pay their tax bills in bitcoin. Georgia was also considering the option in February.

However, Arizona’s lawmakers scrapped the plan two months later due to insufficient votes for the proposal. Similarly, Georgia’s proposal also stalled in April, due to a “lack of understanding” about cryptocurrency, said Senator Mike Williams at the time.

Ohio has also been working to bring other aspects of blockchain technology into law. Over the summer, the state legally recognized data stored and transacted on a blockchain, meaning electronic signatures secured through blockchain technology have the same legal standing as any other electronic signatures.

In the same month, Ohio lawmakers also pitched their state as a future hub for blockchain, hoping to both attract companies in the space and blockchain talent to the jurisdiction.

Ohio state flags image via Shutterstock