NYSE Plans Bitcoin Options, Bringing Another TradFi Giant Into Crypto

The New York Stock Exchange plans to list index options tracking the price of bitcoin (BTC), bringing another traditional finance giant into the cryptocurrency space.

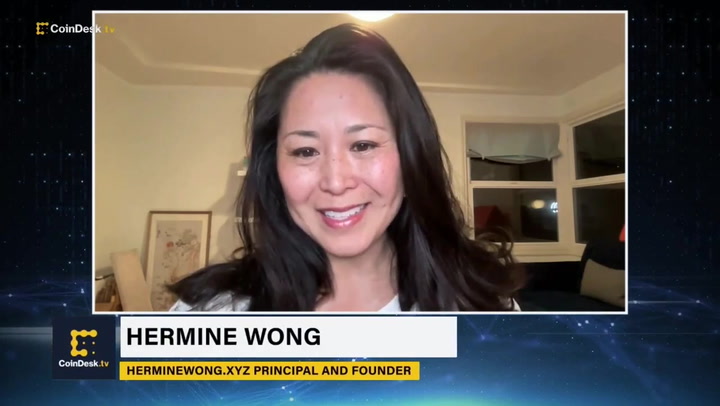

The cash-settled derivatives will track the CoinDesk Bitcoin Price Index (XBX), a 10-year-old benchmark operated by this news organization’s corporate sibling, CoinDesk Indices. The XBX is currently the benchmark for $20 billion in exchange-traded fund assets under management, according to the Wednesday press release announcing the partnership.

01:10

Bitcoin Extends Rally as $1B in BTC Withdrawals Suggests Bullish Mood

1:02:43

Why Financial Advisors Are So Excited About a Spot Bitcoin ETF

02:21

When Could Traders See the Arrival of a Spot Bitcoin ETF?

02:16

‘Santa Rally’ Could Spark Bitcoin to $56K by Year-End; PayPal Faces SEC Inquiry

“As traditional institutions and everyday investors are demonstrating their wide-ranging enthusiasm for the recent approval of spot bitcoin ETFs, the New York Stock Exchange is excited to announce its collaboration with CoinDesk Indices,” NYSE Chief Product Officer Jon Herrick said in the statement. “Upon regulatory approval, these options contracts will offer investors access to an important liquid and transparent risk-management tool.”

Bitcoin derivatives helped pave the way for this year’s introduction of spot bitcoin ETFs, which turned into one of the most successful ETF launches in history. NYSE is owned by Intercontinental Exchange, which competes with CME Group – whose bitcoin futures are widely held in the industry. NYSE’s entrance into the game provides another TradFi-friendly onramp to crypto.

In 2023, Intercontinental Exchange’s ICE Futures Singapore collaborated with CoinDesk Indices to use XBX for its monthly contract settlement for CoinDesk Bitcoin Futures in that country.

Edited by Nick Baker.