NYAG Takes Victory Lap as Court Approves Genesis Settlement

-

A New York court has approved a settlement between Genesis and the NYAG

-

The settlement involves a $2 billion fine which wil go towards establishing a victims’ fund.

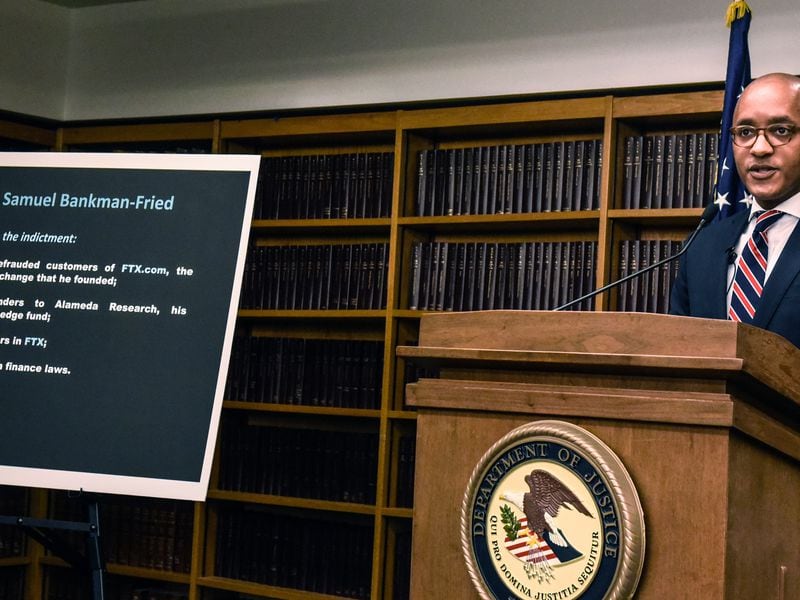

The office of the New York Attorney General announced today that a state court had approved a $2 billion settlement with bankrupt crypto lender Genesis.

In October 2023, the NYAG sued Genesis, Gemini, and Digital Currency Group for allegedly defrauding more than $1 billion from over 230,000 investors, including 29,000 New Yorkers.

The NYAG claimed Gemini knew Genesis’ loans were undersecured and concentrated with Alameda Research but did not disclose this to investors.

“This historic settlement is a major step toward ensuring the victims who invested in Genesis have a semblance of justice,” Attorney General Letitia James said in a statement. “Once again, we see the real-world consequences and detrimental losses that can happen because of a lack of oversight and regulation within the cryptocurrency industry.”

Genesis neither admits nor denies the allegations outlined in the suit. The lender will be blocked from doing business in New York as part of the settlement.

Digital Currency Group (DCG), which was part of the initial suit by the NYAG, but was excluded from the settlement, but had objected to the process earlier.

The company in February objected to Genesis’ proposed settlement with the New York attorney general, arguing that it unlawfully redistributed value to preferred creditors, bypassing the principles of U.S. bankruptcy law.

Earlier this week, Genesis announced that it would return $3 billion worth of customer assets – roughly 77% of the value of customer claims – as part of a bankruptcy liquidation plan approved by courts.

The Victims’ Fund, announced as part of the settlement, will receive up to $2 billion from Genesis’ remaining assets after initial bankruptcy distributions to compensate creditors for their remaining losses.

Edited by Omkar Godbole.