November Recorded the Worst Month For ICOs

An unsurprising consequence of Bitcoin and Ether crashing is that ICOs have also significantly suffered in their ability to raise funds.

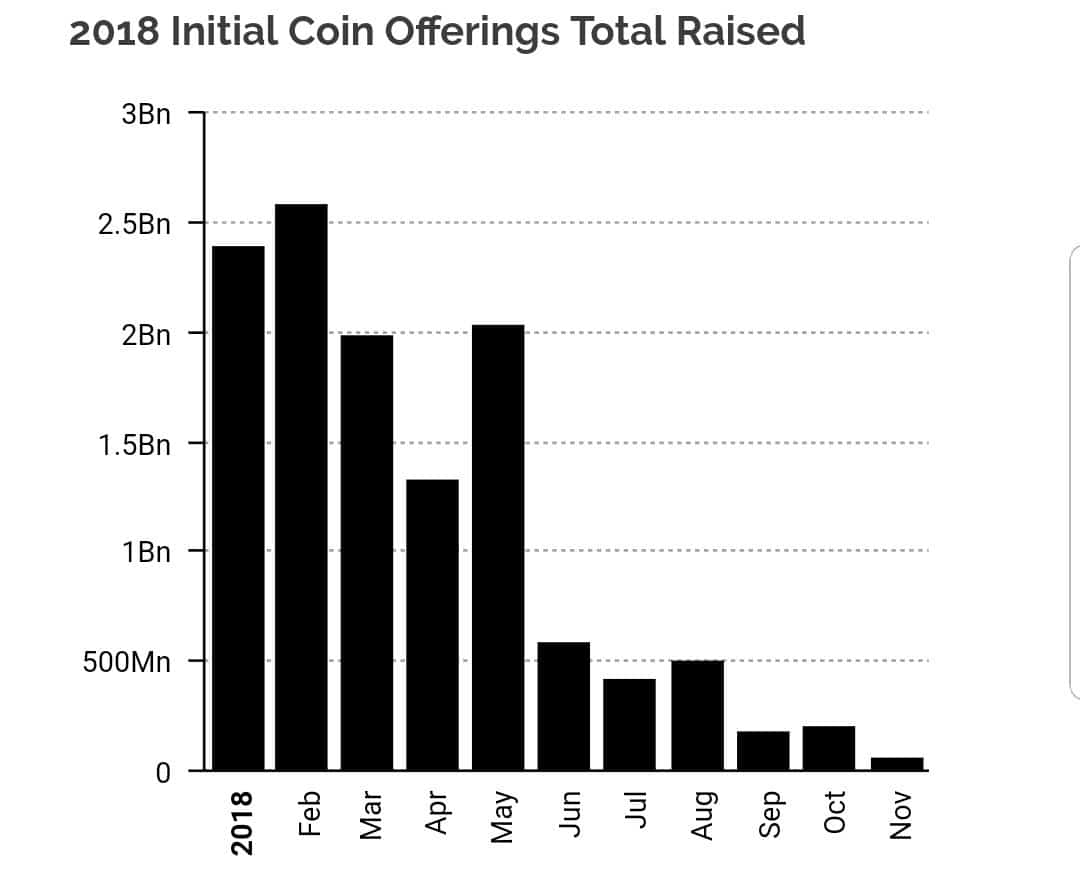

The following chart shows that November recorded the lowest inflows into Initial Coin Offerings (ICOs) in 2018. Only $65 million were raised last month, which is equaled to 2.5% of the amount raised in this year’s best-performing month, February, when $2.6 billion was collected. It is also a tiny fraction of the $12.2 billion that has been raised by ICO’s so far this year.

In a year when Bitcoin has declined by more than 80%, it doesn’t seem like there would be much hope for newer tokens to flourish. The majority of blockchain projects that still seek to raise funds through ICOs have significantly lowered their soft and hard cap expectations.

Without any validation from the traditional project fundraising sources (venture capitals, angel investors, etc.), it is highly unlikely that any project can succeed in this market’s negative sentiment.

SEC Halts The Party

It also hasn’t helped that ICOs have faced significant regulatory scrutiny this year on behalf of the SEC: On November 16, two major blockchain projects, Paragon (PRG) and Air Token (AIR) were ordered by the SEC to refund investors from the money raised through their ICO. The SEC has investigated the projects and concluded that their tokens were, in fact, unregistered securities.

Even ICO Influencers have come under the microscope of the SEC, with Floyd Mayweather and DJ Khaled being fined $300k and $50k respectively by the SEC for failing to disclose that they had accepted money to promote the now fraudulent ICO named Centra.

Add other factors like market saturation and poor business models to the equation and you get an accurate recipe for disaster that leads to only $65 million being raised by ICOs during bloody November.

At this point, it looks like crypto market prices are either going to need to stabilize or go back up before we can see more funding pouring into ICOs.

In the meantime, project founders may be better off going through the traditional funding routes to raise capital for blockchain projects. What is for sure is that this way is a lot harder than raising funds through the ICO model.

The post November Recorded the Worst Month For ICOs appeared first on CryptoPotato.