NovaWulf Plans to Tokenize Equity of Celsius’ New Firm With $2B Assets, After Takeover

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/r4hCNh4zR8o4AxiOYIgV0l2Wigc=/arc-photo-coindesk/arc2-prod/public/QPY362MKDVA77CB4EHZRXW2KZM.jpeg)

Eliza Gkritsi is CoinDesk’s crypto mining reporter based in Asia.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

Digital asset investment firm NovaWulf is poised to take over all assets belonging to bankrupt crypto lender Celsius Network and roll them into a new company, once its creditors have been paid out.

NovaWulf will manage the new company for five years, which will have a new name and a new board of directors, and will be traded through a fairly untested method of putting tokenized equity on blockchain. The five-year management term can be renewed. The board of directors will be chosen by NovaWulf and the official committee of creditors, which represents their interests in the bankruptcy. The plan could take effect as soon as June 30.

NovaWulf has committed $45 million in the transaction, but the Celsius assets it will manage could be worth as much as $2 billion, according to Marc D. Puntus, co-head of Centerview Partners, the investment banker working with Celsius during the bankruptcy case. The assets in question include Celsius’s mining unit, its loan portfolio, staked cryptocurrency, and other alternative investments, according to court filings.

However, the team will have a big task ahead of it – turning around one of the most spectacular collapses in crypto history. The leadership sees the bankruptcy process as a way to turn over a new leaf, and then some.

“What I’m really most excited about is the flexibility to be in a position to play offense, when you have an entire industry that’s playing defense,” given that major crypto firms are either in bankruptcy or facing regulatory scrutiny, said NovaWulf co-founder and managing partner Jason New.

Celsius contacted 130 interested parties and signed non-disclosure agreements with 40, before choosing NovaWulf, according to filings.

NovaWulf is related to TeraWulf (WULF), a publicly traded mining company. The two firms share their two co-founders, who don’t have any formal executive roles at NovaWuf, only in the miner – Nazar Khan, who is also the miner’s chief operating officer and chief technology officer, and CEO Paul Prager. NovaWulf’s team has had experience with complicated bankruptcies such as Lehman Brothers.

The tokenized equity of the new company will be traded on-chain and outside of stock exchanges. It will however have to follow Securities and Exchange Commission disclosure rules, which should make its workings more transparent. Just a month before Celsius filed for Chapter 11, industry commentators were disapproving of its opacity.

The equity tokens will be sold on the Provenance Blockchain, according to a presentation filed with the bankruptcy court. Figure Technologies will also provide infrastructure for the tokenized securities.

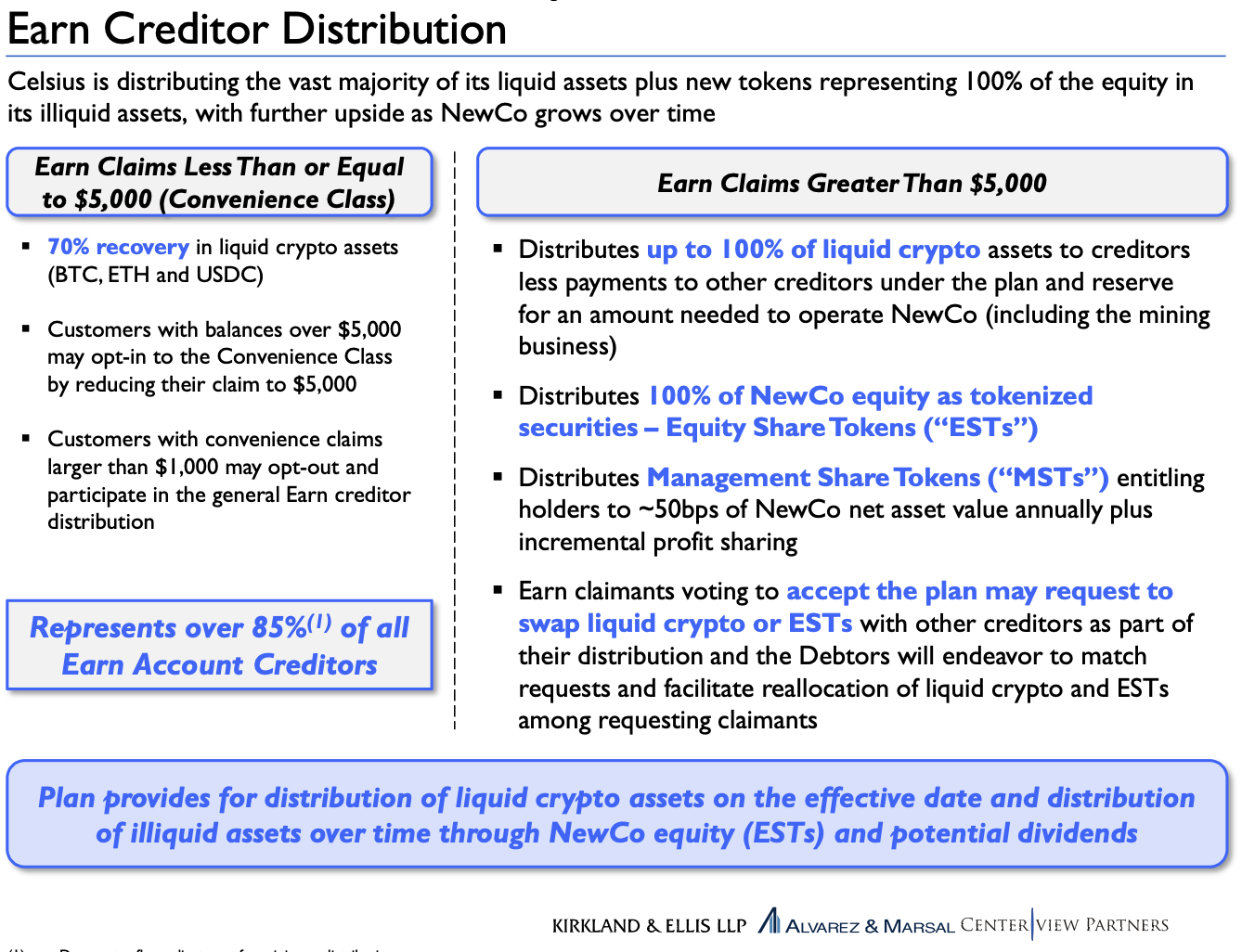

General earn creditors, with claims below $5,000, will see 70% recovery of their claims in liquidity cryptos, the presentation said. Up to 100% of the rest of the assets, minus what is needed to run the new company, will be dispersed to earn creditors with claims over $5,000, who will also receive tokenized securities of the new company.

How Celsius creditors’ claims will be treated in the current bankruptcy plan, excerpt from presentation filed with the court on March 1. (Kirkland & Ellis)

Taking on Celsius’ new chapter requires a certain amount of house cleaning: The new firm will have a new name and none of the pre-bankruptcy leaders will be involved, said NovaWulf’s New.

Celsius’s leadership has been slammed for its risky management online and offline, including in a report from a court-appointed examiner after the bankruptcy.

The mining business was, in former CEO and founder Alex Mashinsky’s view, a way to increase yield on customer deposits, according to the report. By June 2022, Celsius had lent out $579 million in Celsius Mining, its wholly owned subsidiary that was established in 2020, and forwarded another $70 million loan shortly before the bankruptcy, the report said.

Celsius was also using stablecoins bought with user funds as collateral to fund “the entire mining asset,” said CEO Chris Ferraro in a Slack message, according to the examiners’ report. The company was doing the same to prop up other parts of its business.

By spring of 2022, some of the company’s senior management thought that an initial public offering (IPO) of the mining business could be used to plug a $1.1 billion hole in its balance sheet, along with the sale of other “non-balance sheet assets.”

But the value of the mining unit dropped from $2 billion to $2.9 billion in August of 2021, to $500 to $700 million at the time of the bankruptcy, meaning even if an IPO or sale had gone through, it likely wouldn’t have sufficed to plug in the balance sheet hole.

Risk management and an overreliance on third parties, known as hosting firms, formed Celsius Mining’s Achilles heel.

The new management will look to vertically integrate the mining business, which now counts about 120,000 machines. At least initially, they will be looking for hosting agreements, but a focus will be to set up their own hosting capacity down the line to better control risks and costs.

Asked whether the new firm will be working with TeraWulf for hosting, New said it wouldn’t.

Edited by Nikhilesh De and Aoyon Ashraf.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/r4hCNh4zR8o4AxiOYIgV0l2Wigc=/arc-photo-coindesk/arc2-prod/public/QPY362MKDVA77CB4EHZRXW2KZM.jpeg)

Eliza Gkritsi is CoinDesk’s crypto mining reporter based in Asia.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/r4hCNh4zR8o4AxiOYIgV0l2Wigc=/arc-photo-coindesk/arc2-prod/public/QPY362MKDVA77CB4EHZRXW2KZM.jpeg)

Eliza Gkritsi is CoinDesk’s crypto mining reporter based in Asia.