Notional Launches Out of Stealth to Bring Fixed-Rate Lending to DeFi

Notional Launches Out of Stealth to Bring Fixed-Rate Lending to DeFi

Lending and borrowing rates on all the top decentralized finance (DeFi) platforms are dizzyingly variable.

Enter Notional, a new protocol that lets users lend and borrow crypto at fixed rates. After 10 months in stealth, the platform launches in beta on Ethereum today. The startup also announced Monday a $1.3 million funding round from a total of eight investors, including Coinbase Ventures, 1confirmation and Polychain.

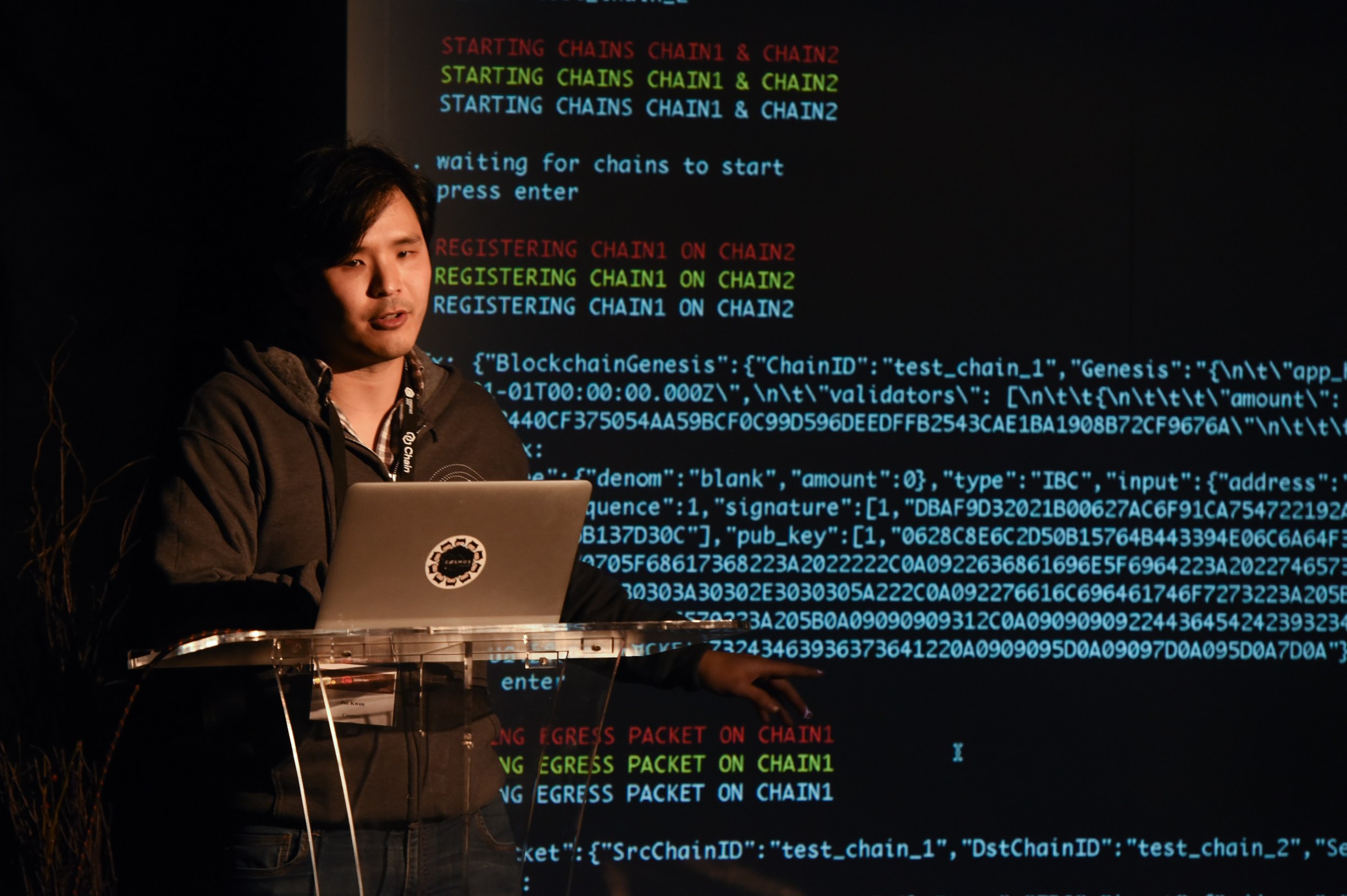

Notional enables fixed-rate debt on Ethereum using a new on-chain automated market maker (AMM) that can be used by DeFi, CeFi and institutional traders, the startup said in a statement.

“Today, DeFi is a jungle full of high net-worth speculators, self-identified degenerates and meme chasers,” said co-founder Teddy Woodward. “With Notional, you can take advantage of volatility instead of getting hurt by it.”

To accomplish that, Notional lets DeFi traders lock in borrowing rates on dai (DAI) to finance yield farming activities for up to six months, all while accessing fixed rates on levered long ether (ETH) trades for the same amount of time using a token called fCash.

How fCash works

“It’s a token like any other but it’s got one specialty,” Woodward told CoinDesk in an interview, “which is that upon a certain date, its maturity date, it can be converted or redeemed for one unit, or even have an associated currency.”

For now, fCash represents DAI at a future date in time. By trading between DAI and fDAI, “the rate at which I exchange DAI today for DAI in the future implies an interest rate that is fixed over the period of time until its maturity date,” he added.

Notional seeks to tap into the established demand for fixed-rate loans in traditional markets.

Investor Nick Tomaino, founder of 1confirmation, told CoinDesk in an email, “We’re excited about bringing fixed-rate loans to people in a current Ethereum lending environment where variable-rate loans dominate.”

“Ultimately, we want to move DeFi forward,” Woodward said, adding:

“The ability to lend and borrow at fixed rates is going to open up a brand new dimension, or financial design space, for DeFi and Ethereum’s ecosystem.”