Not Only Bitcoin, These Crypto Stocks Soared After Grayscale’s Victory

The cryptocurrency industry won another major battle against the United States Securities and Exchange Commission (SEC) after the US Court of Appeals for the DC Circuit ruled in favor of Grayscale in its lawsuit against the agency. The magistrates ordered the regulator to “vacate” its decision to reject the conversion of the Grayscale Bitcoin Trust into a spot exchange-traded fund that tracks the performance of BTC.

The decision infused optimism that the launch of a spot BTC ETF in America is just around the corner, which, expectedly, acted as a catalyst for the price of the primary cryptocurrency and many of the altcoins.

The digital assets were not the only ones to benefit from the court’s ruling. Several companies part of the crypto sector or having some connection with it also took advantage, seeing their shares rise. In the following lines, we will take a closer look at which are those entities and the gains they registered.

COIN, MSTR, and SQ

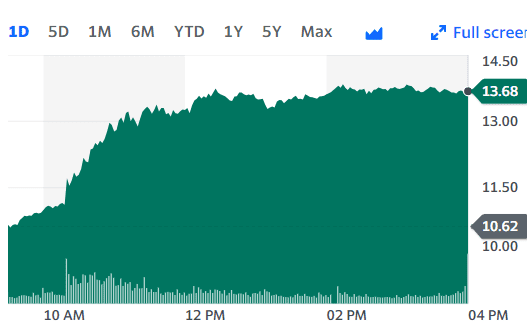

One crypto firm that saw its stocks significantly climb after the news went out on Tuesday was Coinbase (the first publicly traded entity of its kind). COIN soared by almost 15%, currently hovering around $84.70. The development could be considered a breath of fresh air for Coinbase, whose shares have been on a downfall since mid-July.

MicroStrategy – a business intelligence company co-founded by Michael Saylor that is heavily invested in bitcoin – also benefited. MSTR rose 10% in the last 24 hours, surpassing $380 for the first time in two weeks. Still, the shares’ price is far from this year’s peak registered in the middle of July. Back then, MSTR traded at over $460, boosted by bitcoin’s rally above $30,000.

Block (formerly known as Square) should be mentioned, too. The fintech company that offers bitcoin trading services through its Cash App saw its stocks going up by more than 3%.

Miners and Chip Producers

Some of the largest cryptocurrency mining companies, including Marathon Digital, Riot Platforms, and Hut 8 Mining, are also among the winners following Grayscale’s landmark win against the SEC. MARA spiked by a staggering 28%, RIOT gained over 17%, whereas HUT registered a 14% increase.

The tech behemoths, known as leading manufacturers of graphics processing units (which are employed in crypto mining operations) – Nvidia and Advanced Micro Devices (AMD) – are part of the list, too. NVDA climbed more than 4%, while AMD is up 3%.

Tesla and Robinhood

Despite selling most of its bitcoin holdings in 2022, the EV giant led by one of the wealthiest individuals, Elon Musk – Tesla, remains invested in the primary cryptocurrency. This could be one reason the company’s shares spiked by over 7% after the court announcement.

Robinhood – a trading platform that offers users the chance to deal with a variety of digital assets – is also worth mentioning. HOOD is currently worth around $11, 4.5% more than yesterday’s figures.

The post Not Only Bitcoin, These Crypto Stocks Soared After Grayscale’s Victory appeared first on CryptoPotato.