Non-Zero Bitcoin Addresses at ATH, Bitcoin Wholecoiners at 10-Month Peak

On-chain metrics about bitcoin have reversed after the recent bearish signals as the number of non-zero wallets and such holding at least one whole BTC have tapped new peaks.

This comes shortly after whales and other large entities made substantial transfers of their BTC holding amid the ongoing war between Ukraine and Russia.

Bitcoin Address on a Tear

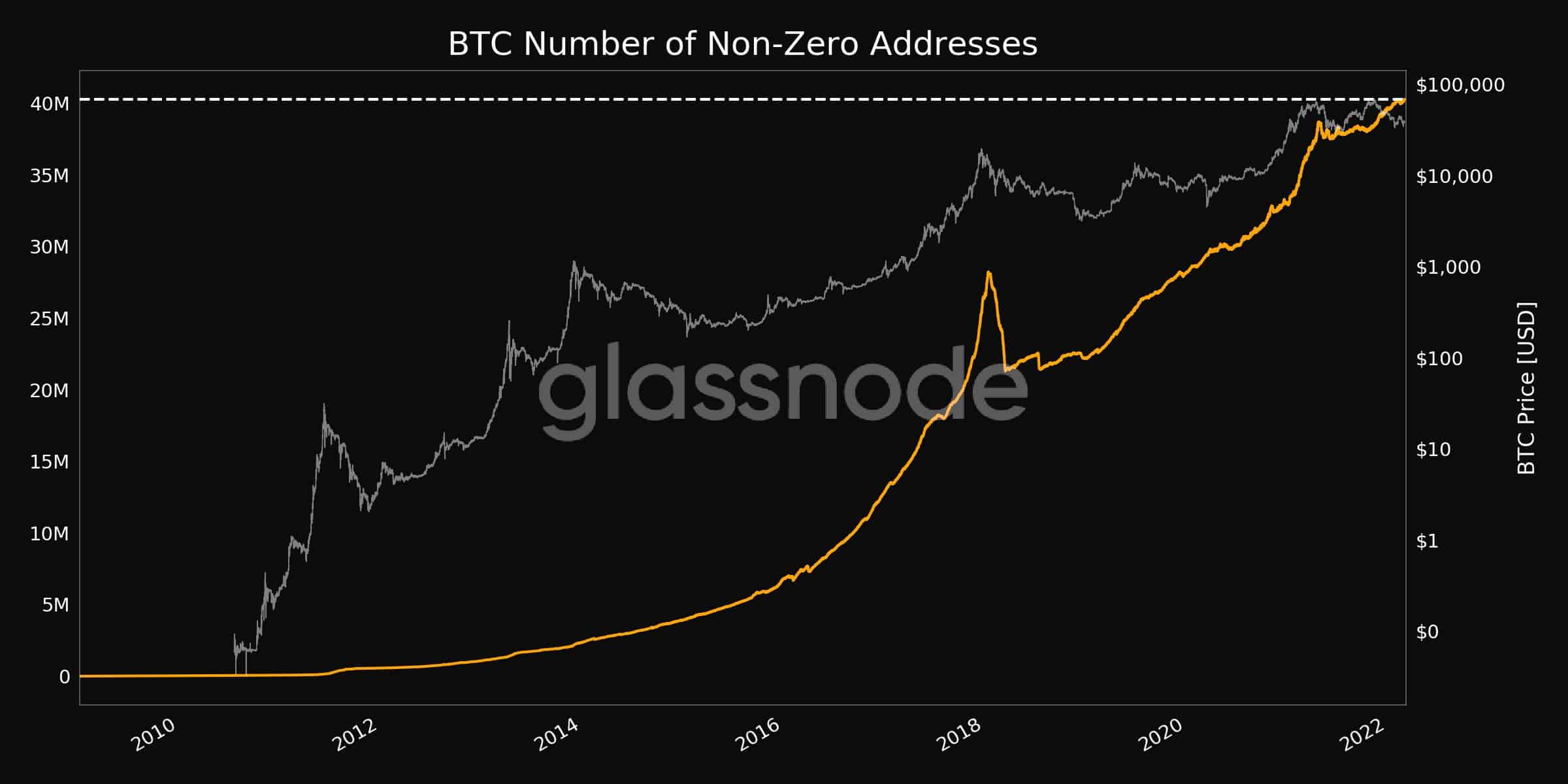

As the name suggests, non-zero addresses are wallets containing even the smallest fraction of bitcoin. A recent chart by the analytics resource Glassnode informed that such entities have begun increasing lately and charted a new all-time high after finally exceeding 40 million.

As the graph below demonstrates, such addresses, which typically demonstrate retail investors’ behavior, spiked in late 2017 amid the previous bull cycle and declined shortly after – as BTC started its retracement.

They picked up in the next year or so before plateauing at around 35 million for a while, but Glassnode said they are 40,276,163 as of early February 28.

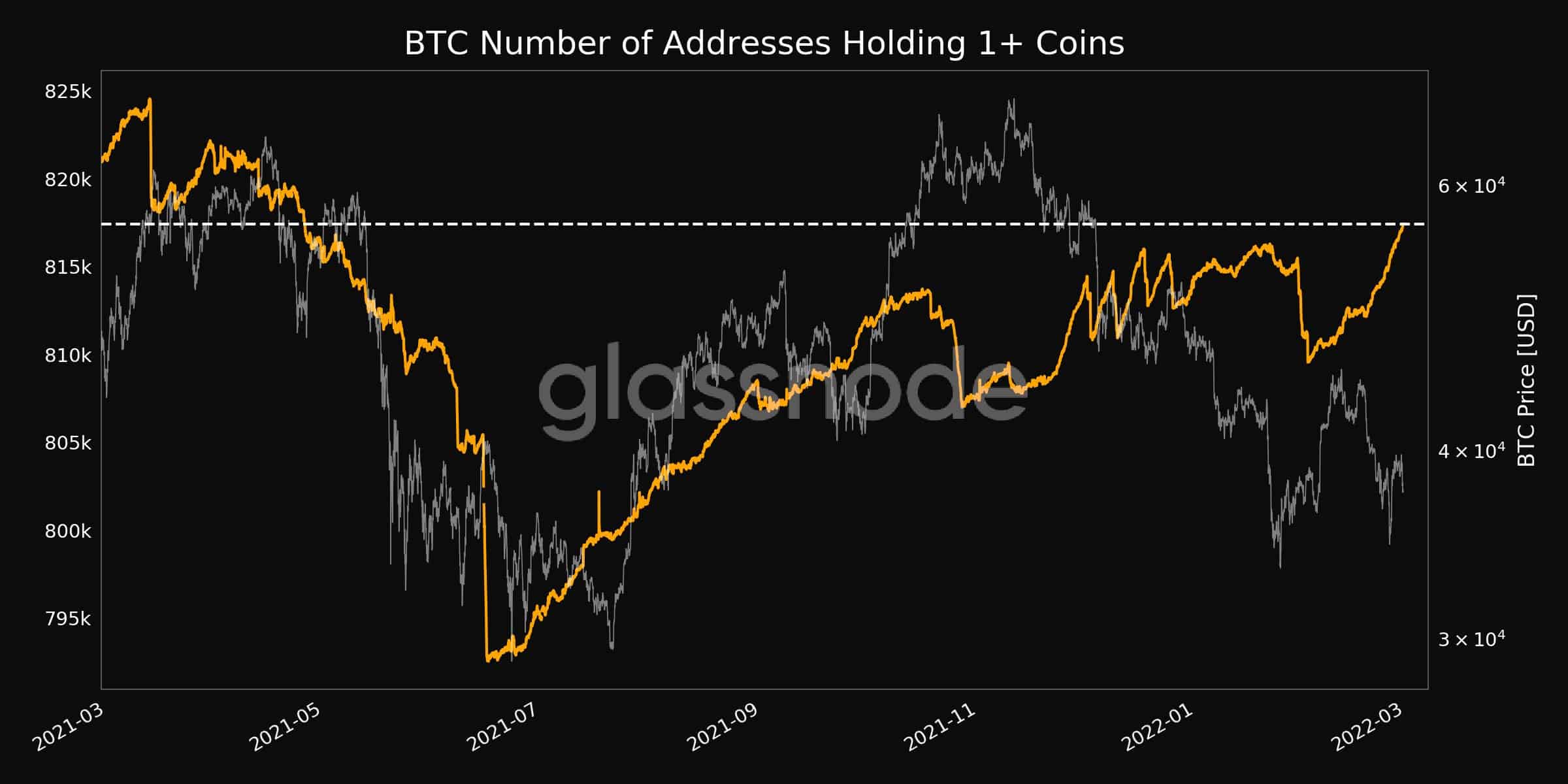

But it’s not only non-zero addresses that have increased lately. The analytics company also informed that wholecoiners (entities owning at least one full bitcoin) have recovered from its recent decline and tapped a 10-month high. As of now, there’re over 800,000 such wallets.

The Calm After the Storm?

Last week, the world shook upon news that Russia had launched a “special military operation” against Ukraine following weeks of escalating tension. Naturally, Europe’s first war in over 70 years sent the financial markets into turmoil. Bitcoin lost about $5,000 in hours, while bearish signals were coming left and right.

This uncertainty prompted many BTC investors to move their holdings. While in similar situations generally retail investors tend to panic, this time, whales made massive transfers, according to data from another blockchain analytics resource – Santiment.

The firm observed the largest amount of BTC transactions worth over $100,000 and $1,000,000 in about a month as BTC dropped below $35,000. Additionally, Santiment said bitcoin’s token circulation hit a 9-month high, “revealing just how polarized traders have become with the war.”

This BTC movement resembled the events of March 2020, when the world was officially introduced to the COVID-19 pandemic. However, the landscape seems to have calmed in the days after the war became evident. Also, BTC quickly recovered most of its USD value losses.

#Bitcoin‘s token circulation hit a 9-month high, revealing just how polarized traders have become with the #war. This circulation spike was similar to #BlackThursday back in Mar, 2020, where #crypto traders sold at the bottom at the beginning of #COVID. https://t.co/1XM82Asf4x pic.twitter.com/Z7gHJ7MY7F

— Santiment (@santimentfeed) February 26, 2022