No, SpaceX Isn’t the Cause of This Multi-Billion Dollar Bitcoin Bloodbath

This was the first thought that crossed the mind of Reetika, a Dubai-based bitcoin (BTC) and crypto trader, during her usual routine of checking prices after waking up.

An unexpected and major sell-off in the crypto markets jolted what was an otherwise boring few weeks for crypto and the sentiment was likely shared worldwide among traders and crypto hopefuls, Reetika told CoinDesk in a message.

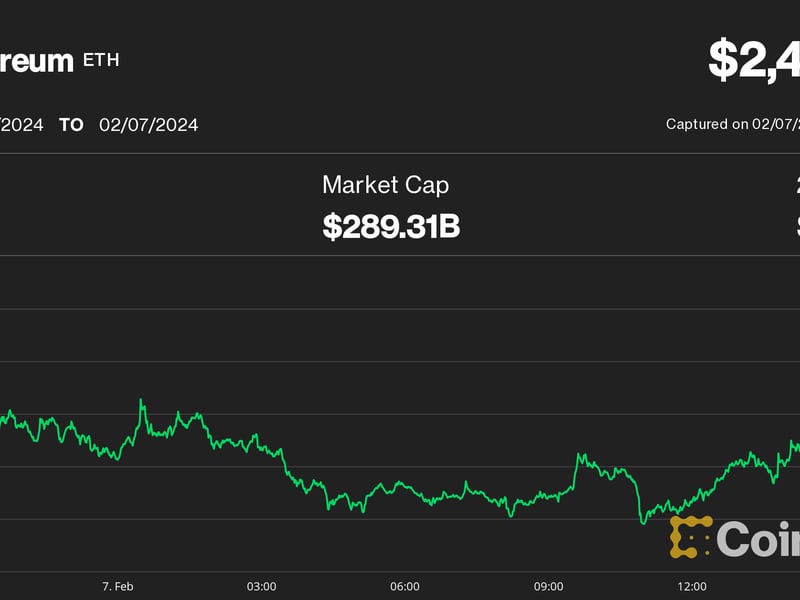

Bitcoin plunged on Thursday as traders sold the tokens en masse based on several unrelated catalysts, causing the crypto markets to lose 6.7% in overall capitalization in what marked one of the biggest drops in recent months.

In the past 24 hours, Bitcoin fell as much as 9% to $25,000 from $28,500 on Binance, leading to a market-wide fall that sent major tokens like litecoin (LTC) tumbling by 14%. This caused more than $1 billion in crypto futures to be liquidated, a 14-month high.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/BIOEWTEDIFCSZM6VUJXF3DIDYQ.png)

Some pointed to space exploration company SpaceX’s supposed bitcoin sales – an unsubstantiated claim – while others said the bankruptcy of China Evergreen’s may have had something to do with the fall. However, neither of these events may have impacted prices.

SpaceX merely wrote down the value of its bitcoin holdings, as per a WSJ report. Among accountants, that is the reduction in the book value of an asset when its fair market value has fallen below the book value.

Asset write-downs are common among businesses – as it reduces the value of any holdings for tax purposes. As of Asian morning hours on Friday, SpaceX did not confirm, or report, any sales of its bitcoin holdings. As such, it remains unknown how much bitcoin or crypto the Elon Musk-owned company holds.

Long squeeze and what really happened

Professional traders say market structure and liquidations were a likely reason for the sudden drop instead of a singular fundamental catalyst. The market has also been relatively illiquid and flat – creating conditions ripe for sudden movements.

“Potential Grayscale decision tomorrow. We’ve seen BTC OI ramp up in position, with a bias to shorts,” said Decentral Park Capital trader Lewis Harland, in a message to CoinDesk. “The break below $28,500 led to material volumes of longs being liquidated. This has been combined with spot selling ahead of the date (likely anticipating further delays).”

Open interest refers to the number of unsettled futures contracts for any financial asset. In a flat market, the rapid building up of a significant amount of futures positions sometimes causes prices to fall quickly in the event of a large sell-off by an influential player.

That is because as prices fall lower, long traders have to sell their positions to avoid getting liquidated – adding to increased selling pressure, but, at the same time, creating an endless loop of falling prices and long position covering.

Data shows most long liquidations took place on crypto exchange OKX, accounting for nearly 40% of the entire market.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/I5TG3LBMG5CNNDTVP4EYPS5FKI.png)

Some fundamental catalysts, however, are the rising interest rates in the U.S., as previously reported.

“U.S. interest rates are rising to multi-year highs. The 10-year yield has pushed to 15-year highs. This is bearish risk assets in general,” Harland added. “If this sell-off in bonds continues we could see continued negative price action in risk assets into the weekend.”

Elsewhere, analysts at on-chain data platform CryptoQuant told CoinDesk they expect sentiment to remain bearish in the days ahead – citing increased funding rates from short traders, or those who bet against prices.

Funding rates are periodic payments made by traders based on the difference between prices in the futures and spot markets. Depending on their open positions, traders will either pay or receive funding. The payments ensure there are always participants on both sides of the trade.

High rates can lead to price volatility, as traders are incentivized to be on one side of the market – thus increasing both futures and spot market movements.

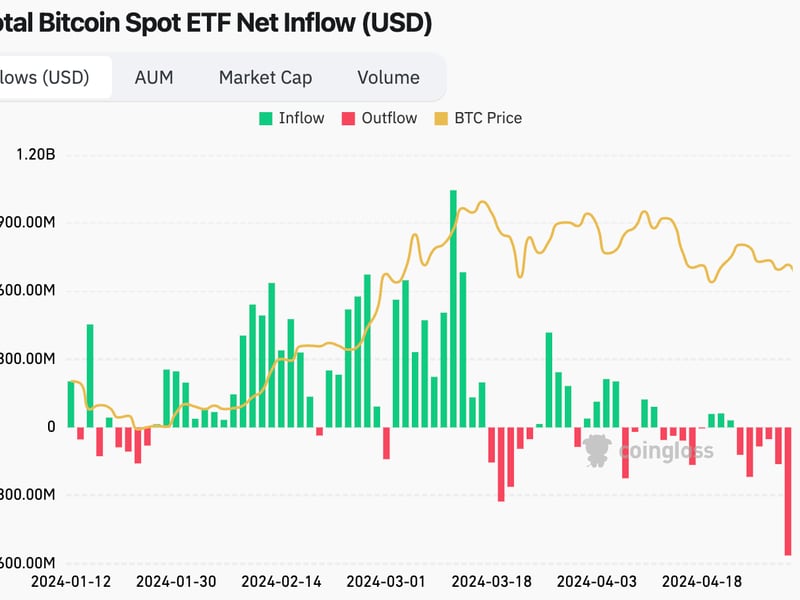

Meanwhile, traders seem to be waiting on a Grayscale court ruling about the issuance of an exchange-traded fund (ETF), a ruling widely expected to be announced on Friday.

A federal appeals court will publish its ruling on the ongoing Grayscale V. SEC case that would determine if the U.S. Securities and Exchange Commission (SEC) was unreasonable in its repeated denial of Grayscale’s proposed bitcoin ETF. The ruling, in Grayscale’s favor, is expected to create a marketwide surge, while the opposite could jolt markets further.

Omkar Godbole contributed reporting.

Edited by Parikshit Mishra.